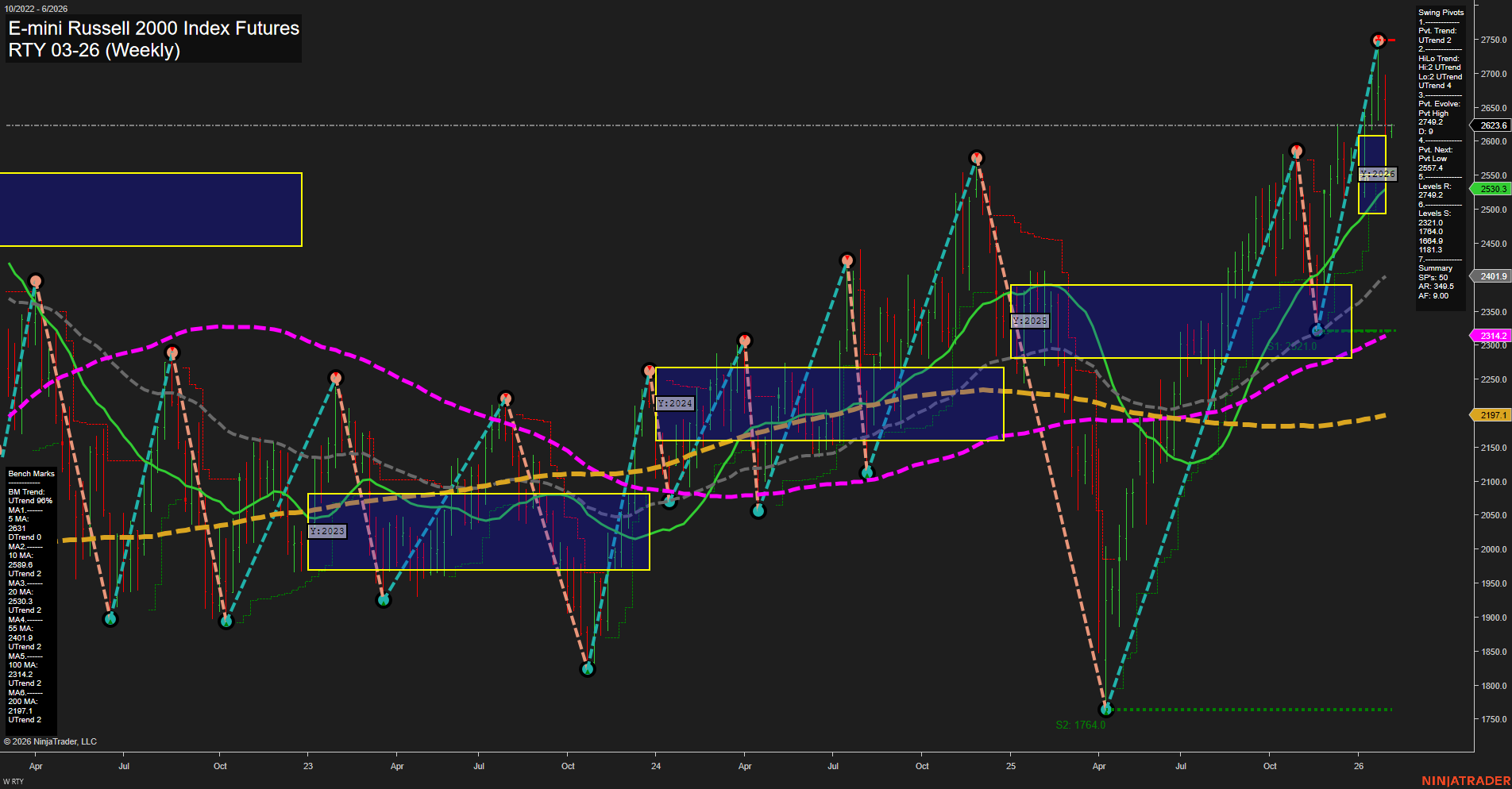

The RTY E-mini Russell 2000 Index Futures weekly chart shows a strong bullish structure across all timeframes. Price action is characterized by large bars and fast momentum, indicating robust buying interest and volatility. The market is trading above all key Fibonacci grid levels (weekly, monthly, yearly), with each grid showing an upward trend and price holding above the NTZ (neutral zone) center lines, reinforcing the bullish bias. Swing pivot analysis confirms an uptrend in both short- and intermediate-term trends, with the most recent pivot high at 2623.6 acting as immediate resistance and the next significant support at 2401.9. Additional support levels are well below, suggesting a wide buffer for potential pullbacks. All benchmark moving averages from 5-week to 200-week are trending upward, further validating the strength of the current uptrend and the market's resilience. Recent short trade signals suggest some tactical countertrend activity, possibly in response to overextended price action or profit-taking near resistance, but the dominant trend remains upward. The overall technical landscape points to a market in a strong uptrend, with higher highs and higher lows, and no immediate signs of reversal. The environment is supportive of trend continuation, though volatility and sharp retracements may occur as the market tests resistance levels.