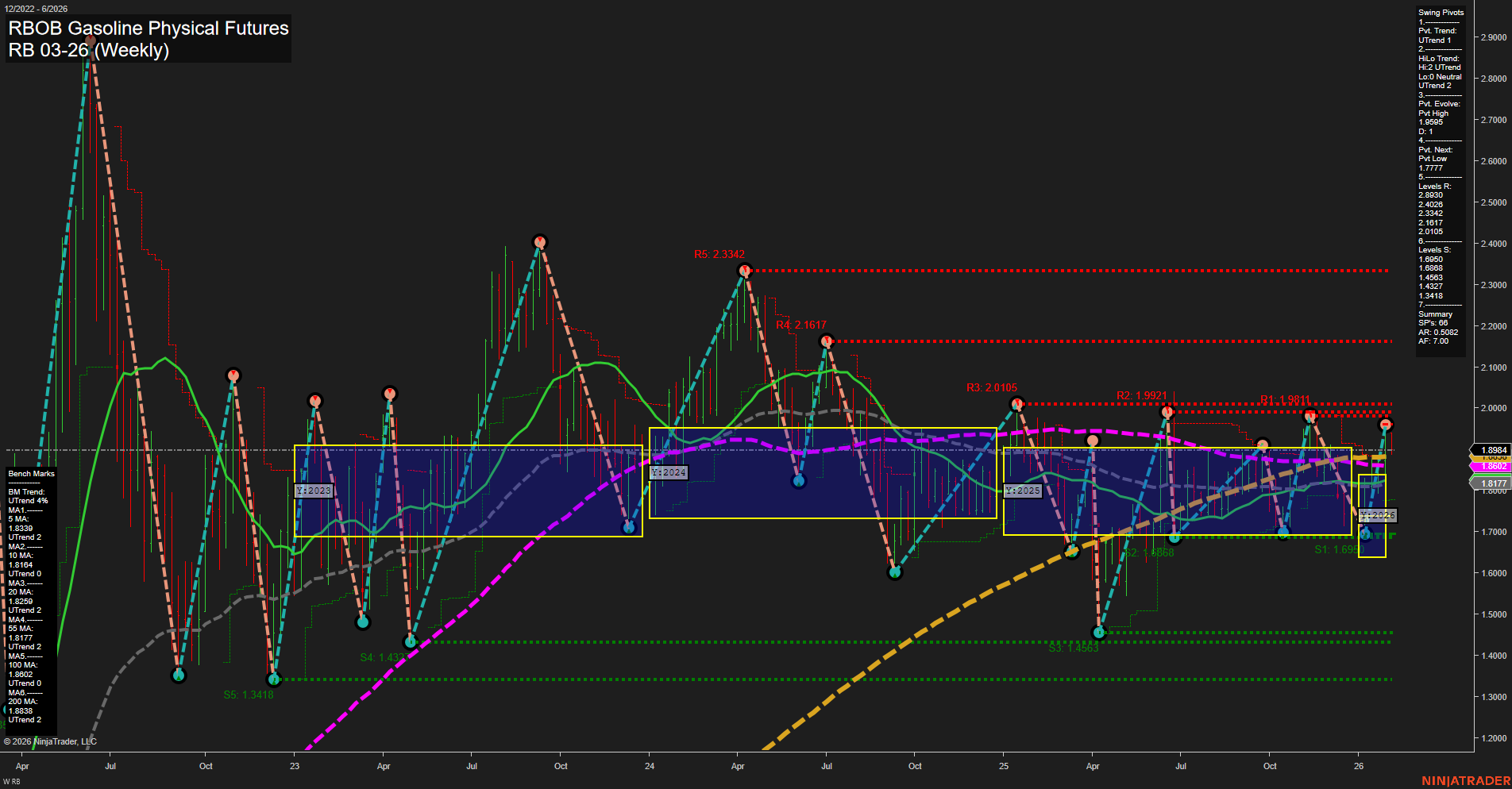

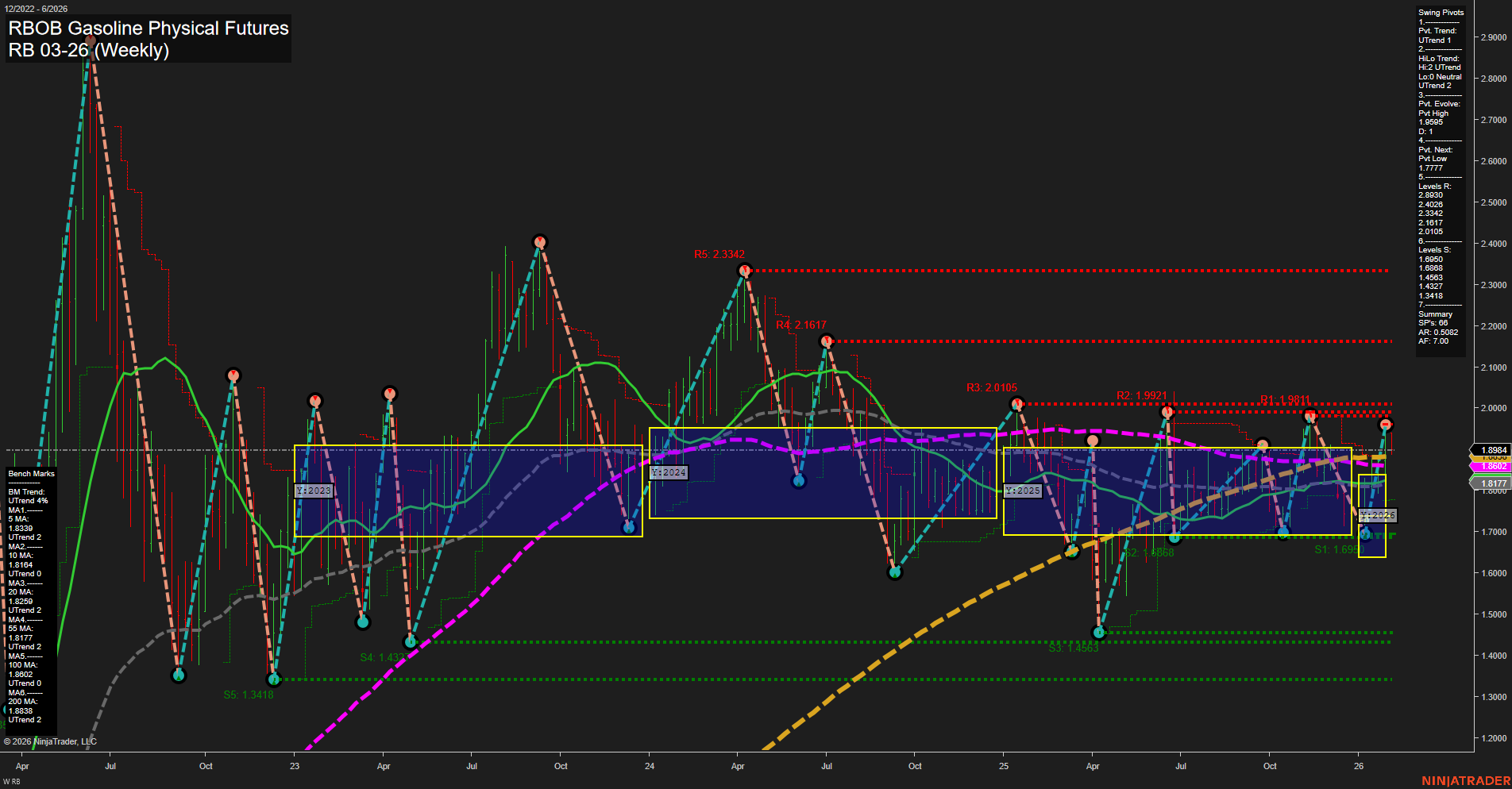

RB RBOB Gasoline Physical Futures Weekly Chart Analysis: 2026-Feb-01 18:14 CT

Price Action

- Last: 1.8894,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: -44%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: 66%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: 16%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 1.9495,

- 4. Pvt. Next: Pvt low 1.5777,

- 5. Levels R: 2.3342, 2.1617, 2.1015, 1.9921, 1.9811,

- 6. Levels S: 1.6998, 1.6483, 1.4631, 1.3418.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1.8834 Up Trend,

- (Intermediate-Term) 10 Week: 1.8492 Up Trend,

- (Long-Term) 20 Week: 1.8177 Up Trend,

- (Long-Term) 55 Week: 1.7496 Up Trend,

- (Long-Term) 100 Week: 1.7662 Up Trend,

- (Long-Term) 200 Week: 1.6838 Up Trend.

Recent Trade Signals

- 28 Jan 2026: Long RB 03-26 @ 1.8906 Signals.USAR-WSFG

- 27 Jan 2026: Long RB 03-26 @ 1.874 Signals.USAR.TR120

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The weekly chart for RBOB Gasoline Physical Futures shows a market transitioning from a recent period of consolidation to a more constructive stance, especially in the intermediate and long-term outlooks. Price action is currently near the upper end of the recent range, with medium-sized bars and average momentum, suggesting a balanced but watchful market. The short-term WSFG trend is down, with price below the NTZ center, indicating some near-term resistance and a neutral short-term bias despite recent long signals. However, both the intermediate and long-term MSFG and YSFG trends are up, with price above their respective NTZ centers, reflecting strengthening bullish sentiment as confirmed by the upward trends in all benchmark moving averages. Swing pivots highlight an uptrend in both short and intermediate terms, with resistance levels overhead and a series of higher support levels, suggesting the market is building a base. Recent trade signals have triggered new long entries, aligning with the broader uptrend. Overall, the market is showing signs of emerging strength, with the potential for further upside if resistance levels are overcome, while the underlying structure remains supportive on pullbacks.

Chart Analysis ATS AI Generated: 2026-02-01 18:15 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.