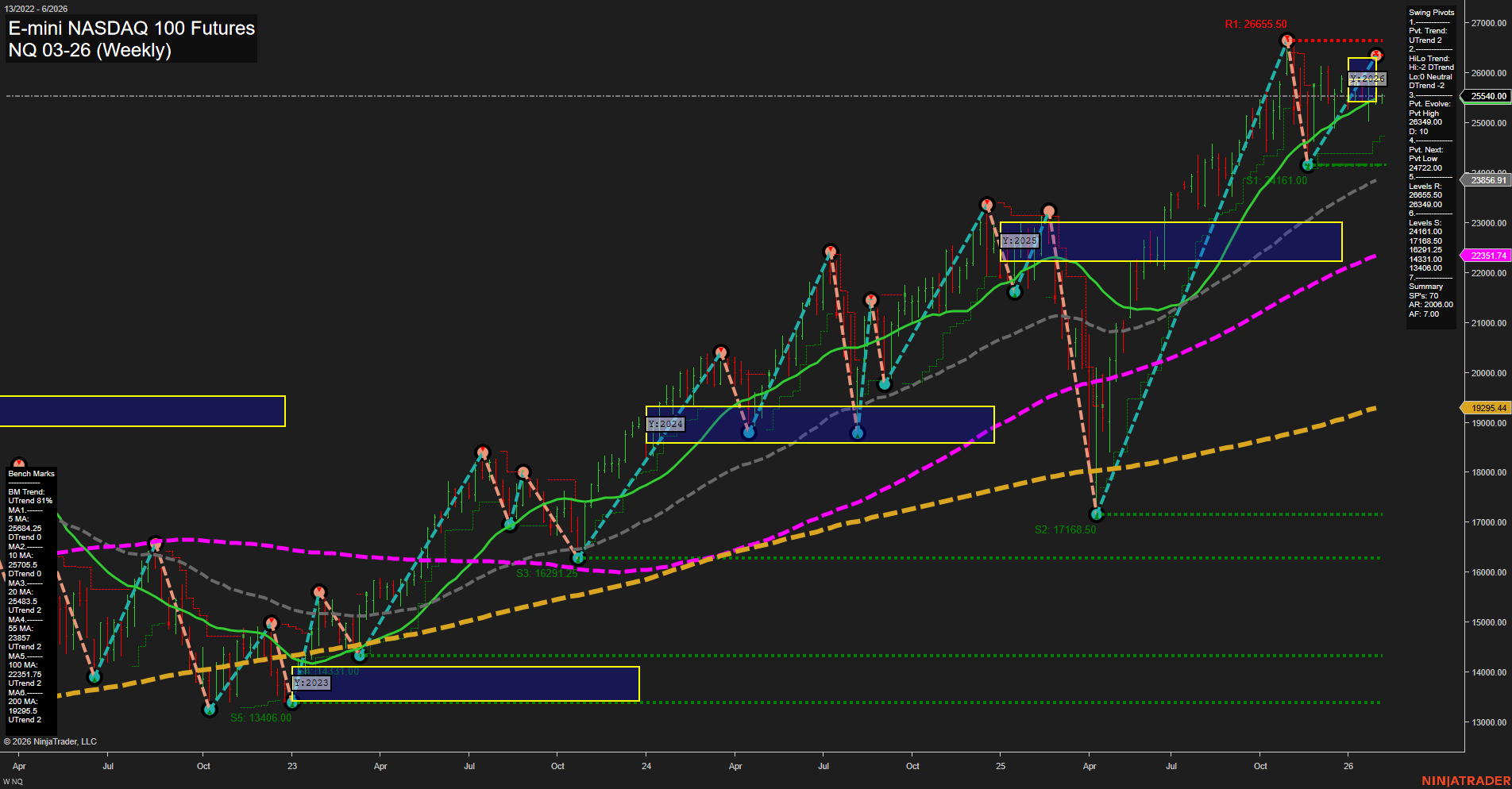

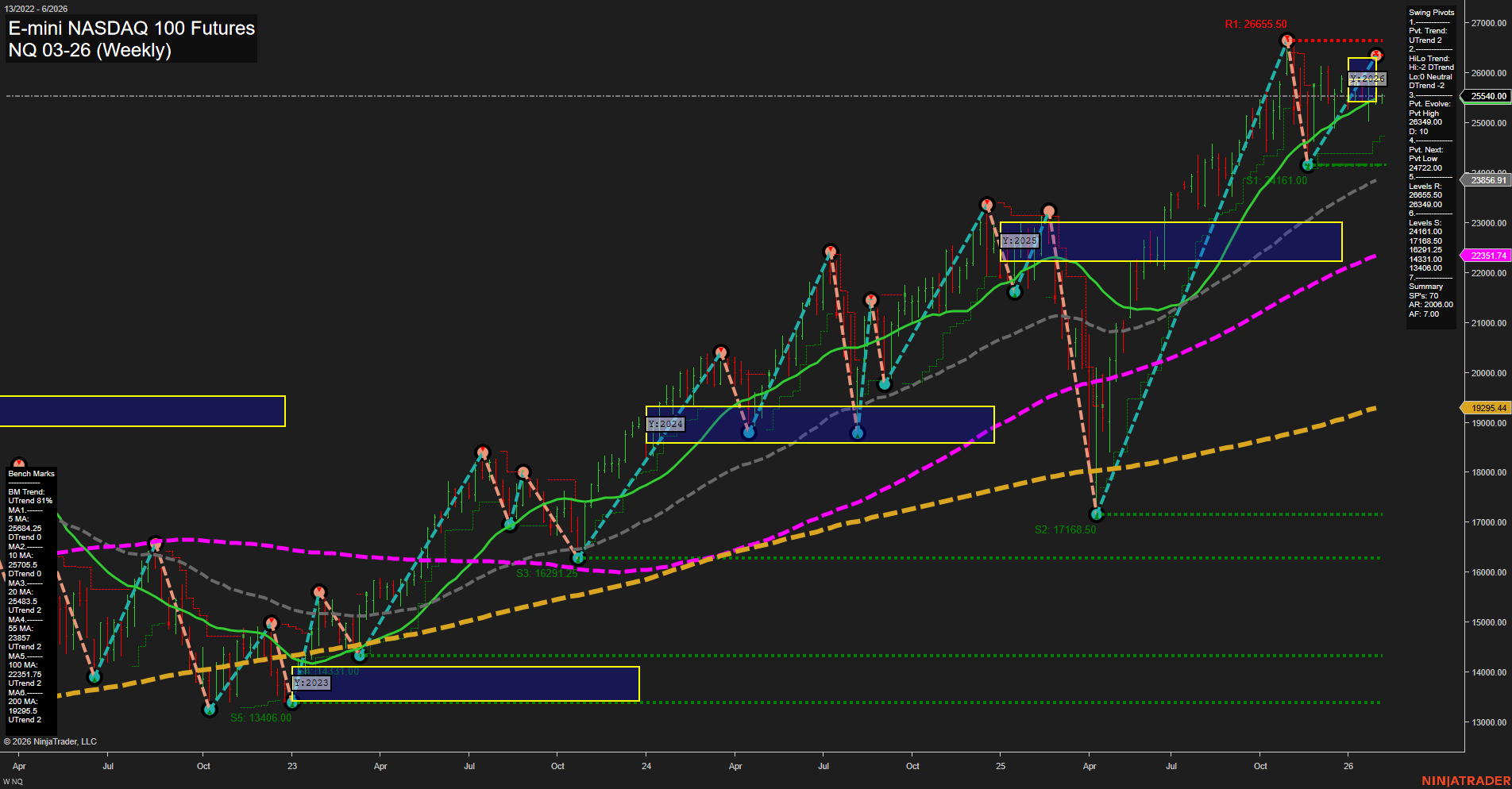

NQ E-mini NASDAQ 100 Futures Weekly Chart Analysis: 2026-Feb-01 18:13 CT

Price Action

- Last: 25624.25,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 1%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: 3%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: -7%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 26655.50,

- 4. Pvt. Next: Pvt low 24722.00,

- 5. Levels R: 26655.50,

- 6. Levels S: 24722.00, 23866.91, 17168.50, 16291.25, 13406.00.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 25624.25 Up Trend,

- (Intermediate-Term) 10 Week: 25483.3 Up Trend,

- (Long-Term) 20 Week: 24343.3 Up Trend,

- (Long-Term) 55 Week: 22351.74 Up Trend,

- (Long-Term) 100 Week: 20806.00 Up Trend,

- (Long-Term) 200 Week: 19255.44 Up Trend.

Recent Trade Signals

- 29 Jan 2026: Short NQ 03-26 @ 25711.75 Signals.USAR.TR120

- 27 Jan 2026: Long NQ 03-26 @ 26080 Signals.USAR.TR720

- 26 Jan 2026: Long NQ 03-26 @ 25716.25 Signals.USAR-WSFG

- 26 Jan 2026: Long NQ 03-26 @ 25688.5 Signals.USAR-MSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

The NQ E-mini NASDAQ 100 Futures weekly chart shows a market in a strong uptrend on both short- and intermediate-term timeframes, as indicated by the upward momentum in the WSFG and MSFG grids, as well as the swing pivot trends. Price is currently above the key short- and intermediate-term Fibonacci grid levels, and all benchmark moving averages from 5 to 200 weeks are trending upward, confirming broad-based strength. The most recent swing high at 26655.50 acts as resistance, while the next significant support levels are at 24722.00 and 23866.91. Despite the long-term YSFG grid showing a downward trend and price below the yearly NTZ, the overall structure remains constructive, with higher lows and higher highs dominating the chart. Recent trade signals reflect active participation in both directions, but the prevailing bias remains bullish in the short and intermediate term, with the long-term outlook more neutral as the market consolidates gains from the recent rally. The chart suggests a market in a healthy uptrend, with periodic pullbacks and consolidations providing structure within the broader move.

Chart Analysis ATS AI Generated: 2026-02-01 18:13 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.