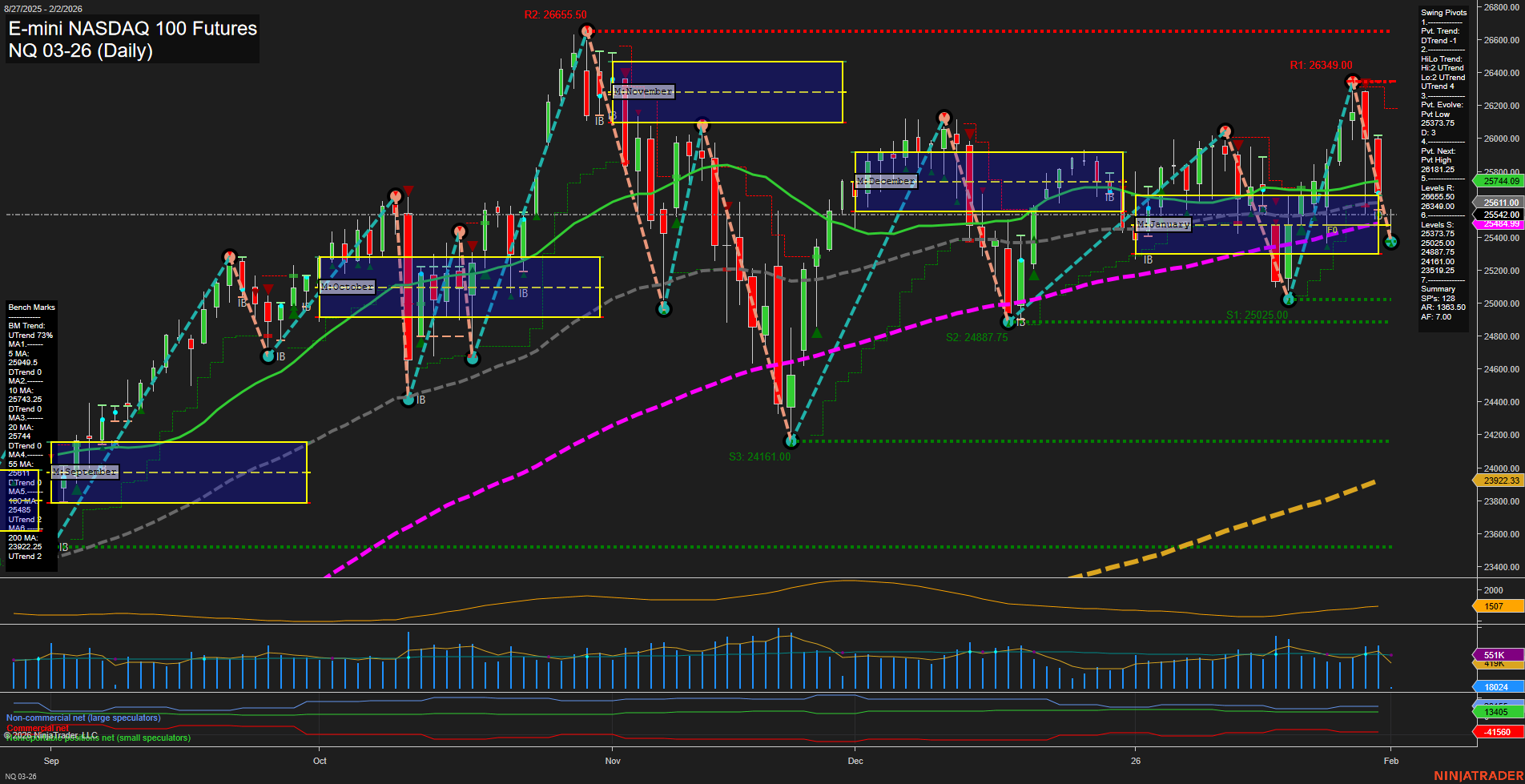

The NQ E-mini NASDAQ 100 Futures daily chart currently reflects a market in transition. Price action has been volatile, with large bars and fast momentum, indicating heightened activity and potential for sharp moves. Short-term signals and moving averages have shifted to a bearish stance, with the 5, 10, and 20-day MAs all trending down and a recent short signal confirming this direction. However, intermediate-term structure remains bullish, as seen in the uptrend of the 55 and 100-day MAs and the HiLo swing pivot trend, suggesting that the broader move is still upward despite the recent pullback. Long-term metrics, including the yearly session fib grid and 200-day MA, are bearish, highlighting a larger corrective phase or consolidation within the broader uptrend. Swing pivots show the market recently put in a pivot low at 25373.75, with resistance levels above at 26181.25, 26349.00, and 26655.50, and support below at 25373.75 and 25125.00. The ATR and volume metrics confirm increased volatility and participation. The market is currently above both the weekly and monthly session fib grid NTZs, supporting the intermediate-term bullish case, but remains below the yearly NTZ, reinforcing the long-term caution. Overall, the market is experiencing a short-term correction within an intermediate-term uptrend, set against a backdrop of long-term consolidation or retracement. This environment is typical of a market digesting gains after a strong rally, with potential for both sharp reversals and trend continuation moves as new information and positioning drive price action.