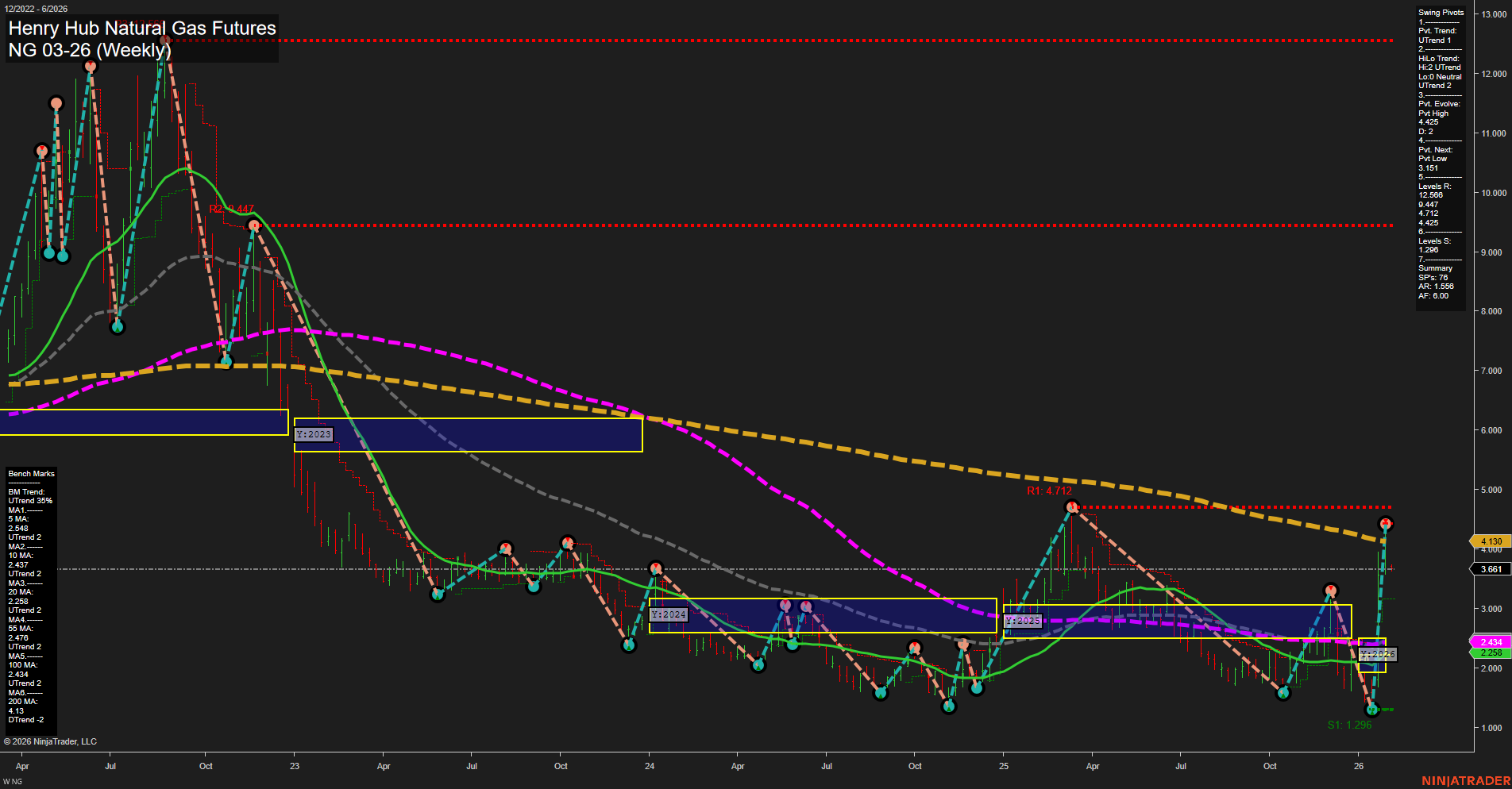

Natural Gas futures have experienced a sharp rally, as indicated by large weekly bars and fast momentum, pushing price above several key moving averages and into a new upswing. Short- and intermediate-term swing pivot trends have shifted to uptrends, with the most recent pivot high at 4.429 and the next potential support at 3.151. Despite the strong short-term move, both the weekly and monthly session fib grids (WSFG, MSFG) still show price below their respective NTZ centers, suggesting the move is a countertrend rally within a broader downtrend context. However, the yearly session fib grid (YSFG) has turned up, with price now above its NTZ center, hinting at a possible longer-term trend reversal or at least a significant retracement. Most benchmark moving averages (5, 10, 20, 55 week) are now in uptrends, but the 100 and 200 week MAs remain in downtrends, indicating overhead resistance and a need for further confirmation before a sustained long-term bull trend is established. Resistance levels cluster in the 4.4–4.7 range, while major support is far below at 1.296, highlighting the volatility and potential for wide price swings. The recent long trade signal aligns with the current bullish momentum, but the overall long-term picture remains neutral until higher time frame resistance is decisively broken.