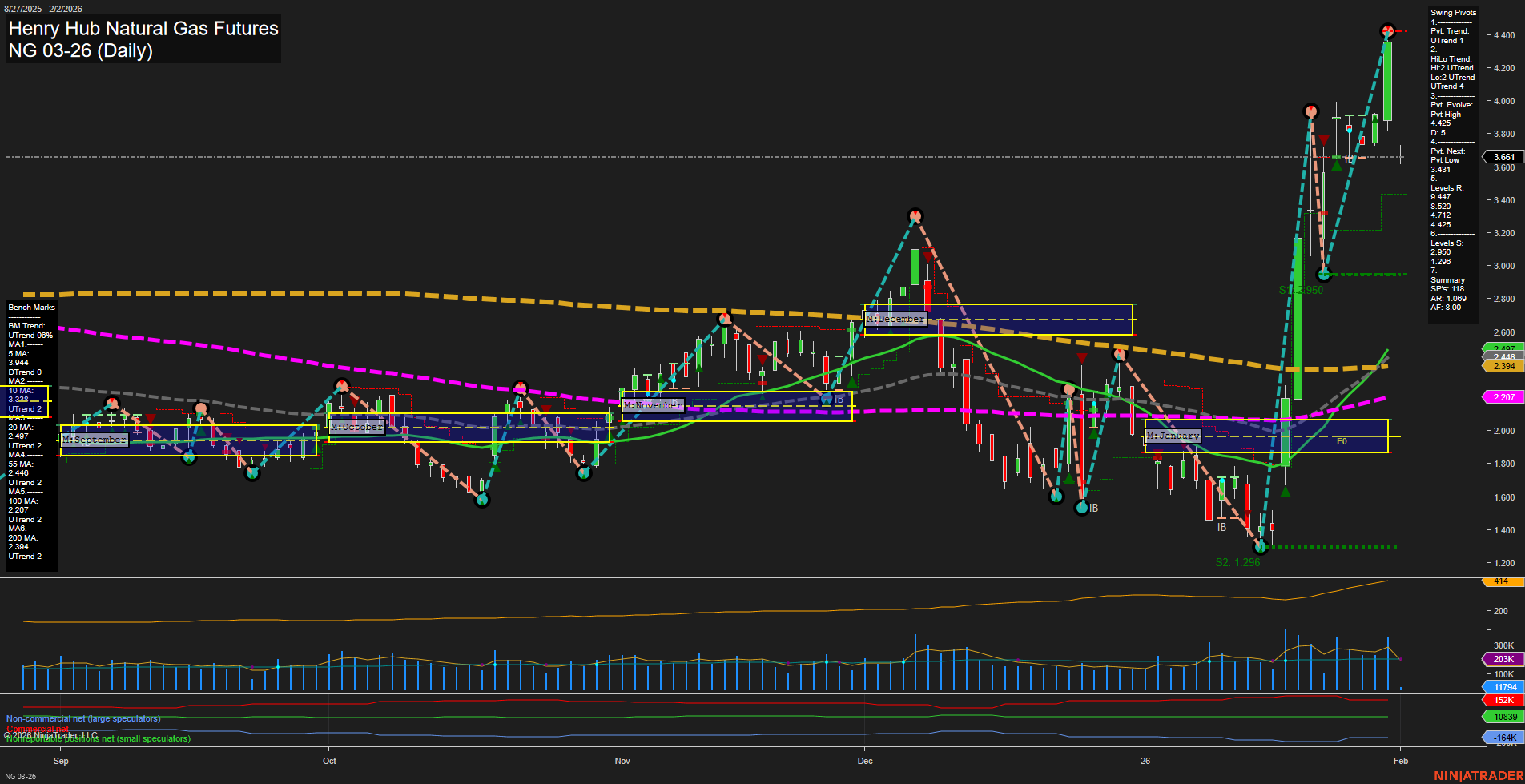

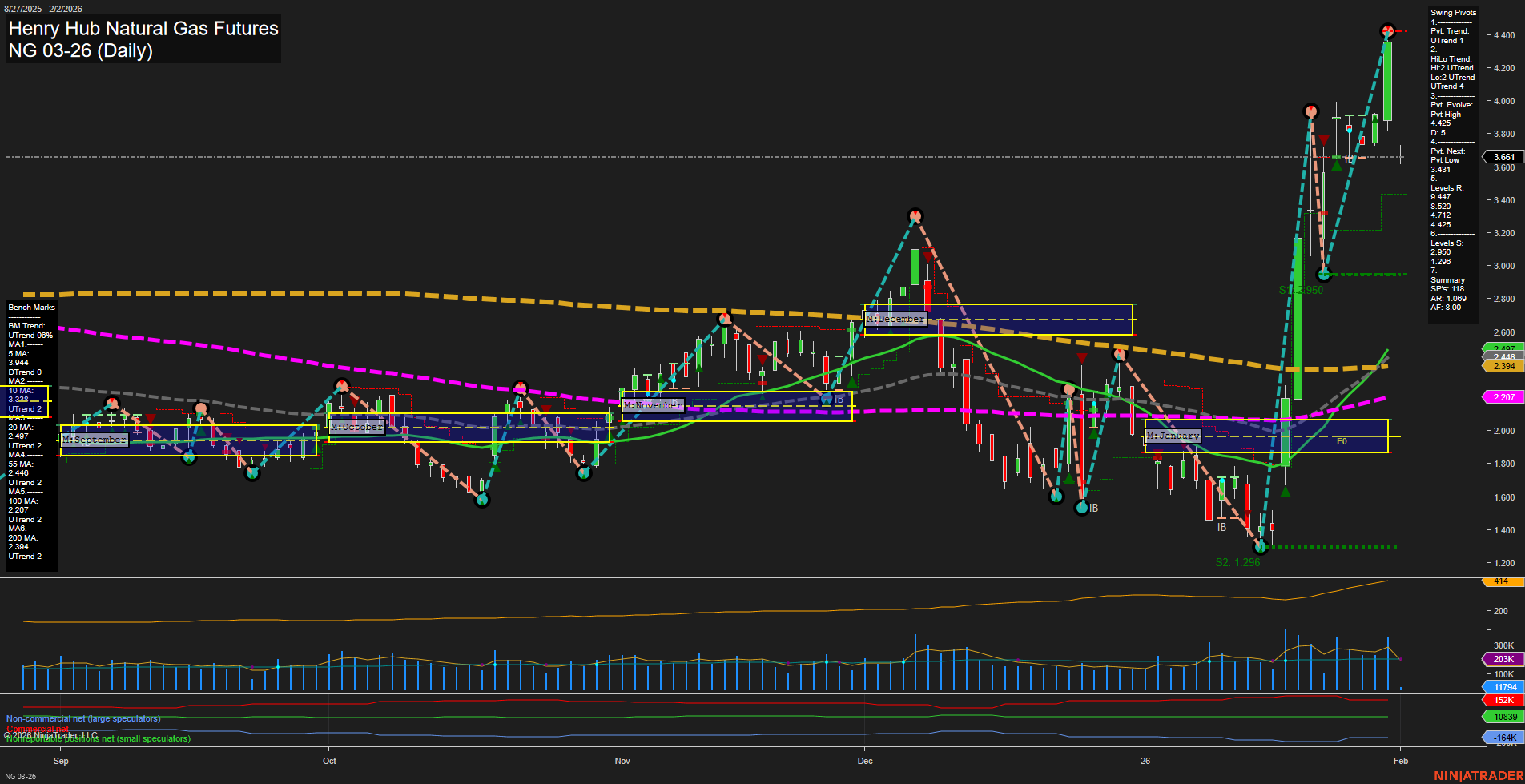

NG Henry Hub Natural Gas Futures Daily Chart Analysis: 2026-Feb-01 18:11 CT

Price Action

- Last: 3.861,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: -86%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: -37%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2026

- Long-Term

- YSFG Current: 50%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 4.425,

- 4. Pvt. Next: Pvt low 3.431,

- 5. Levels R: 4.425, 3.861, 3.647, 3.520,

- 6. Levels S: 2.950, 1.296.

Daily Benchmarks

- (Short-Term) 5 Day: 3.944 Up Trend,

- (Short-Term) 10 Day: 3.333 Up Trend,

- (Intermediate-Term) 20 Day: 2.977 Up Trend,

- (Intermediate-Term) 55 Day: 2.446 Up Trend,

- (Long-Term) 100 Day: 2.207 Up Trend,

- (Long-Term) 200 Day: 2.394 Up Trend.

Additional Metrics

Recent Trade Signals

- 30 Jan 2026: Long NG 03-26 @ 4.188 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

Natural Gas futures have experienced a dramatic surge, with price action showing large, fast momentum bars breaking decisively above all key moving averages. The short-term and intermediate-term swing pivot trends have flipped to uptrends, and the most recent pivot evolution is a new swing high at 4.425, with the next potential reversal level at 3.431. Resistance levels are stacking above, but the nearest support is far below at 2.950, highlighting the strength and verticality of the recent move. All benchmark moving averages across timeframes are now in uptrends, confirming a broad-based bullish shift. Despite the weekly and monthly session fib grids still showing price below their respective NTZ centers and trends technically down, the yearly grid is positive and price is above its NTZ, suggesting a longer-term bullish cycle is underway. Volatility is elevated (ATR 285), and volume is robust, supporting the breakout. The recent long signal aligns with this momentum. The overall structure points to a strong bullish environment across all timeframes, with the market in a potential trend continuation phase after a major breakout from consolidation and prior lows.

Chart Analysis ATS AI Generated: 2026-02-01 18:11 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.