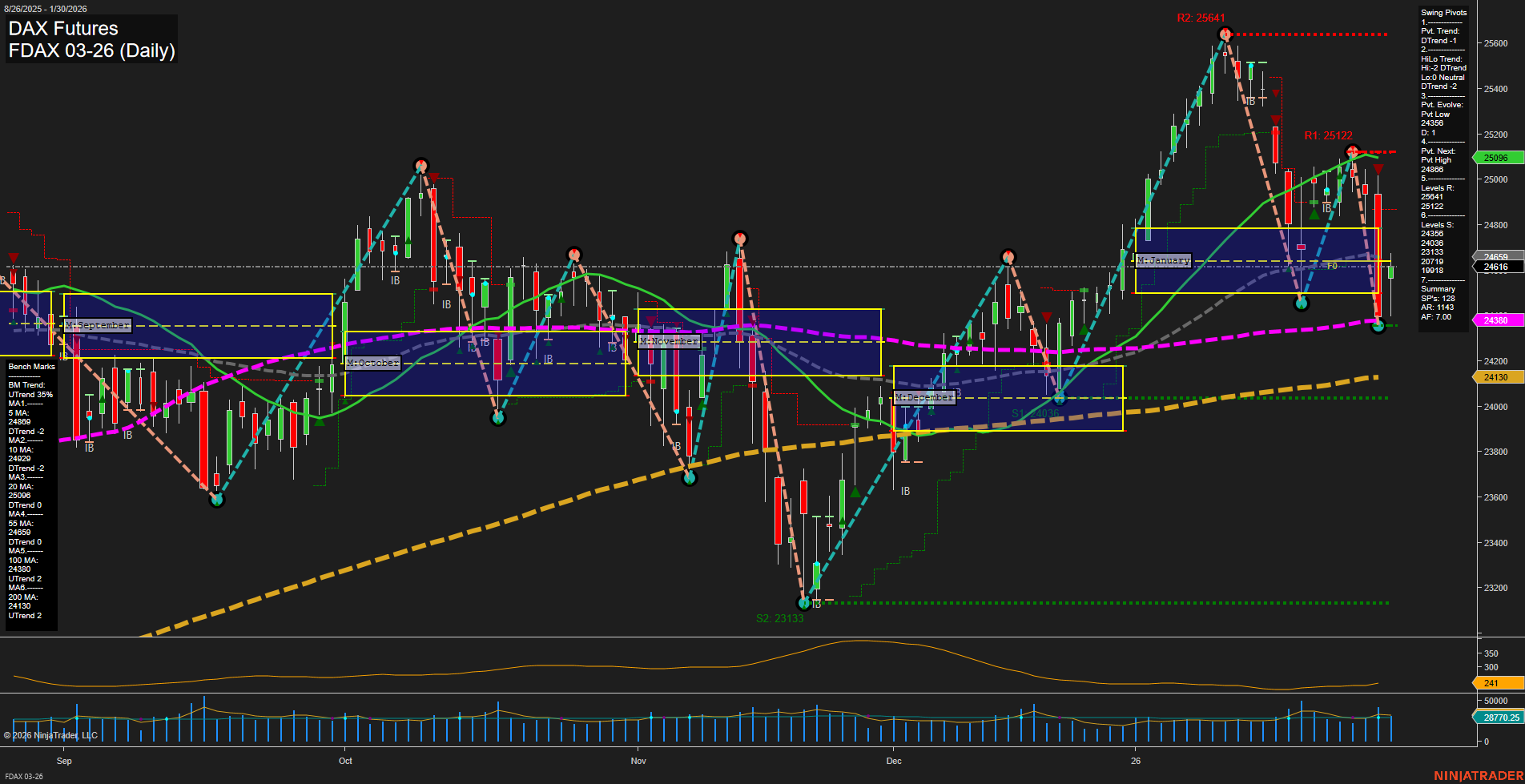

The FDAX daily chart currently reflects a strong short-term and intermediate-term bearish environment, with price action showing large, fast-moving bars to the downside. Both the weekly and monthly session fib grids (WSFG and MSFG) indicate price is below their respective NTZ/F0% levels, confirming a downward trend. Swing pivot analysis supports this, with both short-term and intermediate-term trends in a downtrend, and the most recent pivot evolving at a low (24616), with the next potential reversal at the 25122 high. Resistance levels are stacked above, while support is found at 24380, 24130, and 23133. Short-term and intermediate-term moving averages (5, 10, 20 Day) are all trending down, reinforcing the bearish bias, while longer-term averages (55, 100, 200 Day) remain in uptrends, suggesting the broader trend is still intact to the upside. Volatility is elevated (ATR 230), and volume remains robust (VOLMA 35696), indicating active participation and potential for continued price swings. Recent trade signals have all triggered shorts, aligning with the prevailing short-term and intermediate-term bearish momentum. Overall, the market is experiencing a corrective phase within a longer-term uptrend, with the potential for further downside until key support levels are tested or a reversal pivot is established. The environment is characterized by volatility, strong momentum, and active trend-following signals.