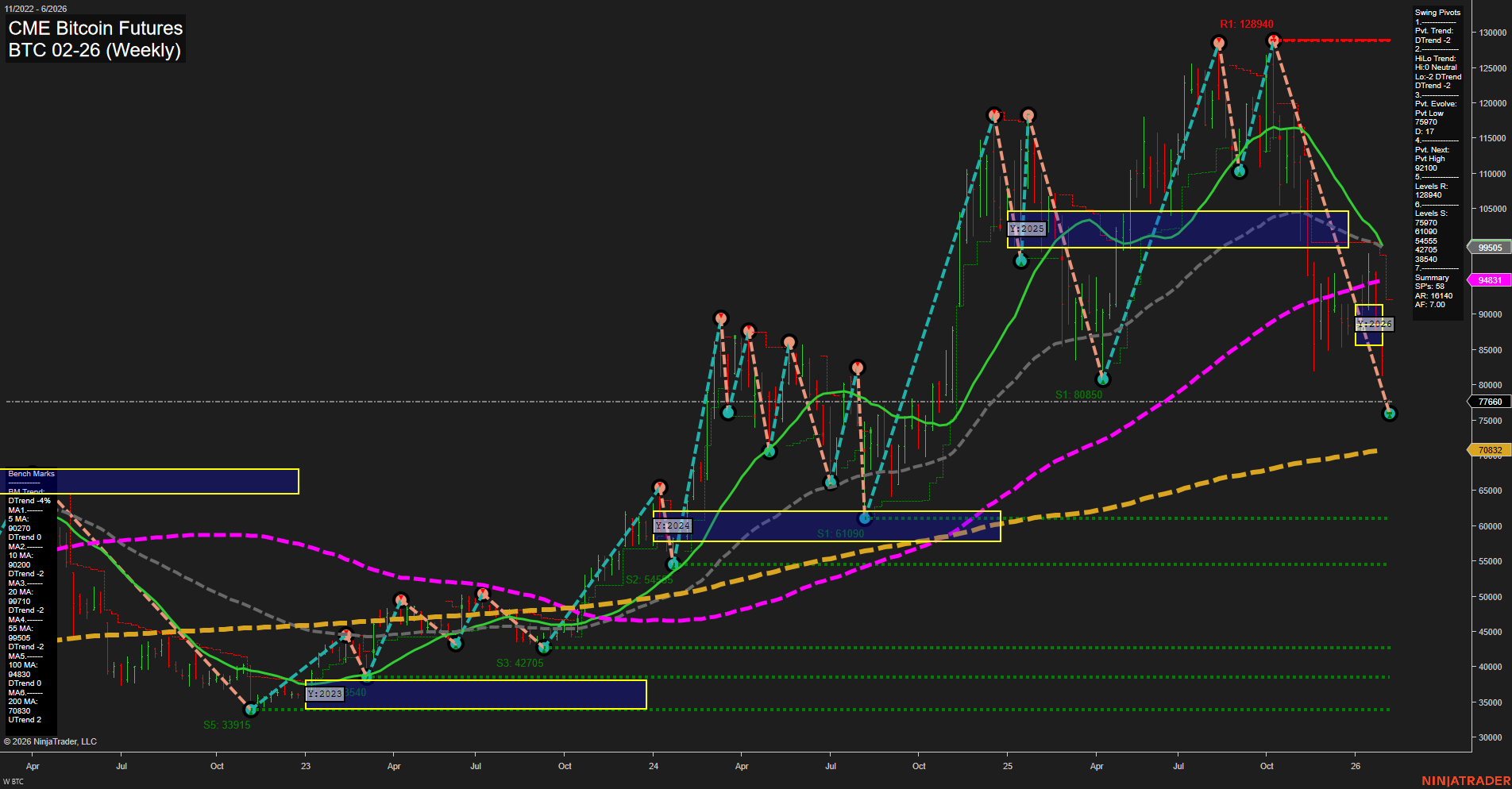

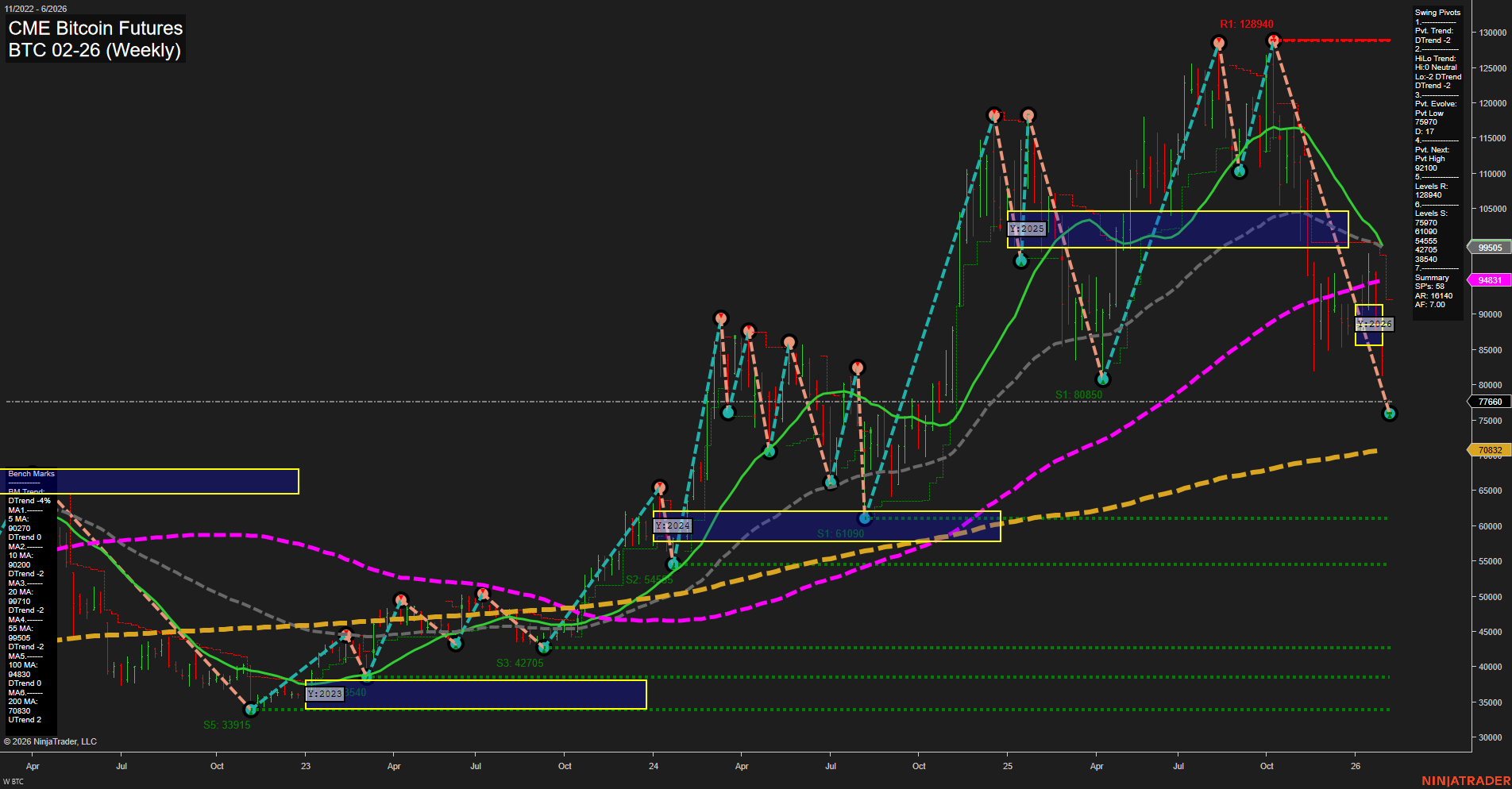

BTC CME Bitcoin Futures Weekly Chart Analysis: 2026-Feb-01 18:03 CT

Price Action

- Last: 84,140,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: -156%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: -41%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2026

- Long-Term

- YSFG Current: -39%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 77,660,

- 4. Pvt. Next: Pvt low 77,660,

- 5. Levels R: 128,940, 120,900, 95,905, 84,505,

- 6. Levels S: 77,660, 61,090, 54,545, 42,705, 33,915.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 95,905 Down Trend,

- (Intermediate-Term) 10 Week: 94,931 Down Trend,

- (Long-Term) 20 Week: 99,505 Down Trend,

- (Long-Term) 55 Week: 84,931 Down Trend,

- (Long-Term) 100 Week: 76,332 Up Trend,

- (Long-Term) 200 Week: 70,830 Up Trend.

Recent Trade Signals

- 30 Jan 2026: Short BTC 02-26 @ 84140 Signals.USAR-MSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

The BTC CME Bitcoin Futures weekly chart is showing pronounced bearish momentum across all timeframes. Price has broken decisively below the NTZ (neutral trading zone) on the yearly, monthly, and weekly session fib grids, with all three trends pointing down. The most recent swing pivots confirm a dominant downtrend, with the next key support at 77,660 and resistance levels well above current price, indicating a significant retracement from recent highs. All major weekly moving averages (5, 10, 20, 55) are trending down, reinforcing the prevailing bearish sentiment, while only the 100 and 200 week MAs remain in uptrend but are well below current price. The recent short signal at 84,140 aligns with the overall technical structure. The market is in a corrective phase after a strong prior rally, with large bars and fast momentum suggesting heightened volatility and potential for further downside moves. The structure points to a trend continuation lower, with the next major test at the 77,660 support zone. No signs of reversal or consolidation are present at this stage, and the chart reflects a classic swing high rejection and lower high/lower low sequence.

Chart Analysis ATS AI Generated: 2026-02-01 18:04 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.