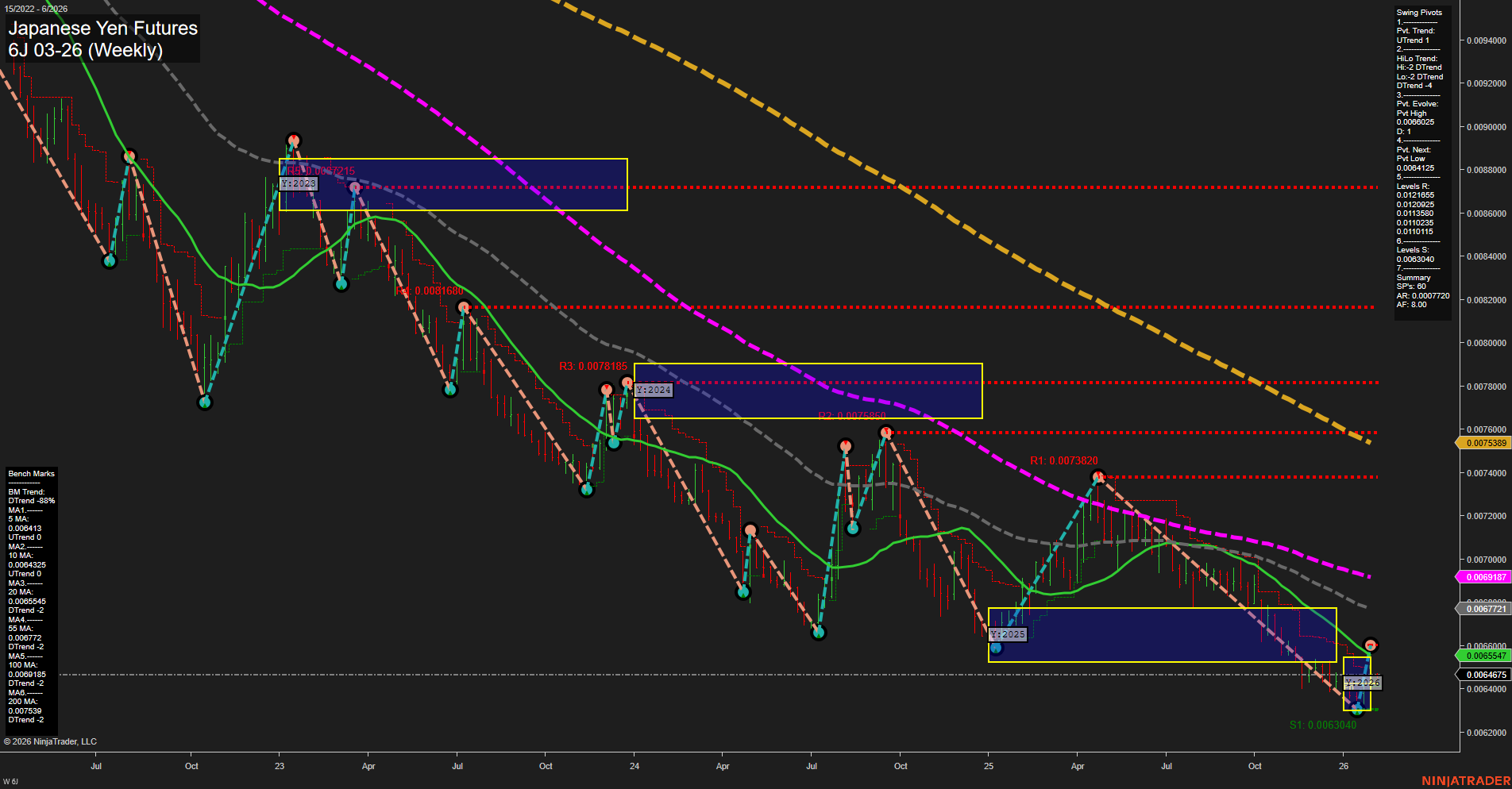

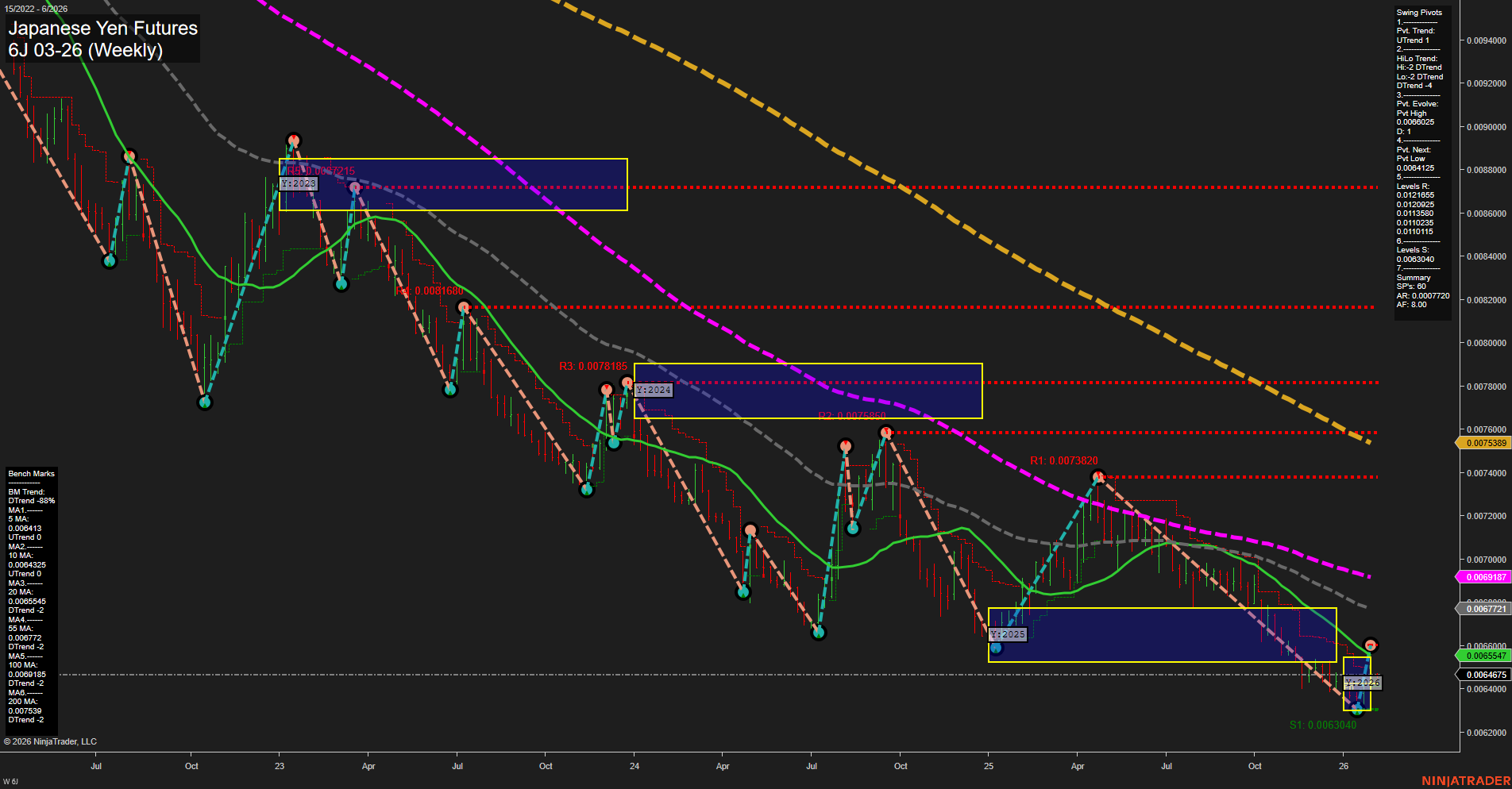

6J Japanese Yen Futures Weekly Chart Analysis: 2026-Feb-01 18:02 CT

Price Action

- Last: 0.0064675,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -1%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: 16%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: 3%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt High 0.0068025,

- 4. Pvt. Next: Pvt Low 0.0063040,

- 5. Levels R: 0.0081680, 0.0078185, 0.0077560, 0.0073820, 0.0072150, 0.0070325, 0.0068025, 0.0065115,

- 6. Levels S: 0.0063040.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 0.0064133 Down Trend,

- (Intermediate-Term) 10 Week: 0.0064325 Down Trend,

- (Long-Term) 20 Week: 0.0065547 Down Trend,

- (Long-Term) 55 Week: 0.0072722 Down Trend,

- (Long-Term) 100 Week: 0.0081685 Down Trend,

- (Long-Term) 200 Week: 0.0075389 Down Trend.

Recent Trade Signals

- 30 Jan 2026: Short 6J 03-26 @ 0.006485 Signals.USAR-WSFG

- 30 Jan 2026: Short 6J 03-26 @ 0.006525 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

The Japanese Yen futures (6J) weekly chart continues to reflect a dominant bearish environment across all timeframes. Price action remains below key short-term and long-term moving averages, with the most recent bars showing medium size and slow momentum, indicating a persistent but not accelerating downtrend. The WSFG (Weekly Session Fib Grid) trend is down, with price below the NTZ center, confirming short-term weakness. Both swing pivot and HiLo trends are in a downtrend, with the next significant support at 0.0063040 and multiple resistance levels overhead, suggesting rallies are likely to face selling pressure. All benchmark moving averages are trending down, reinforcing the prevailing bearish structure. Recent trade signals have triggered new short entries, aligning with the overall trend. Despite some intermediate and long-term Fib grid readings showing price above their respective NTZ centers, the technical structure remains weak, with no clear signs of reversal or strong buying interest. The market is in a sustained downtrend, with lower highs and lower lows dominating the chart, and any countertrend moves have so far failed to break the broader bearish momentum.

Chart Analysis ATS AI Generated: 2026-02-01 18:03 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.