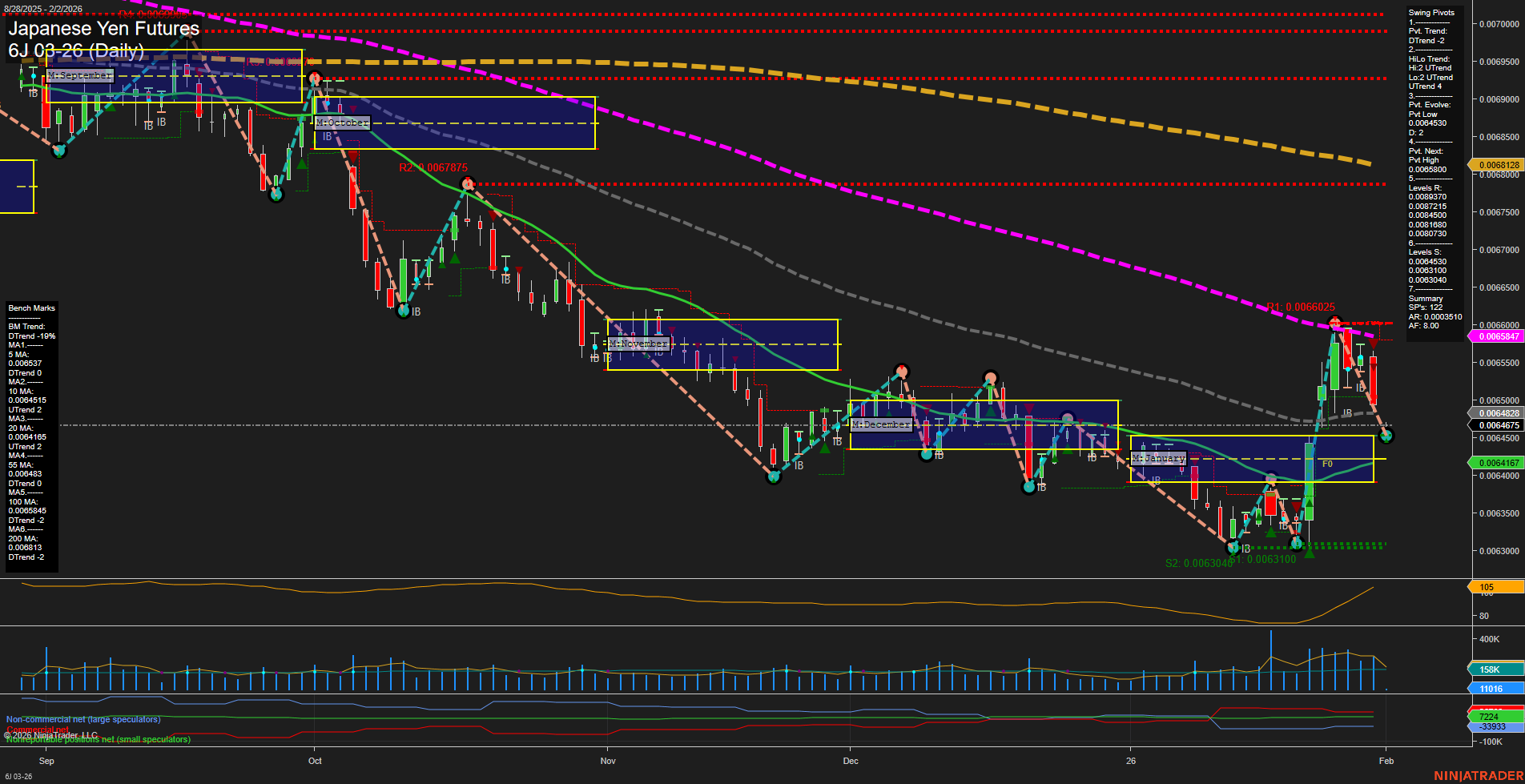

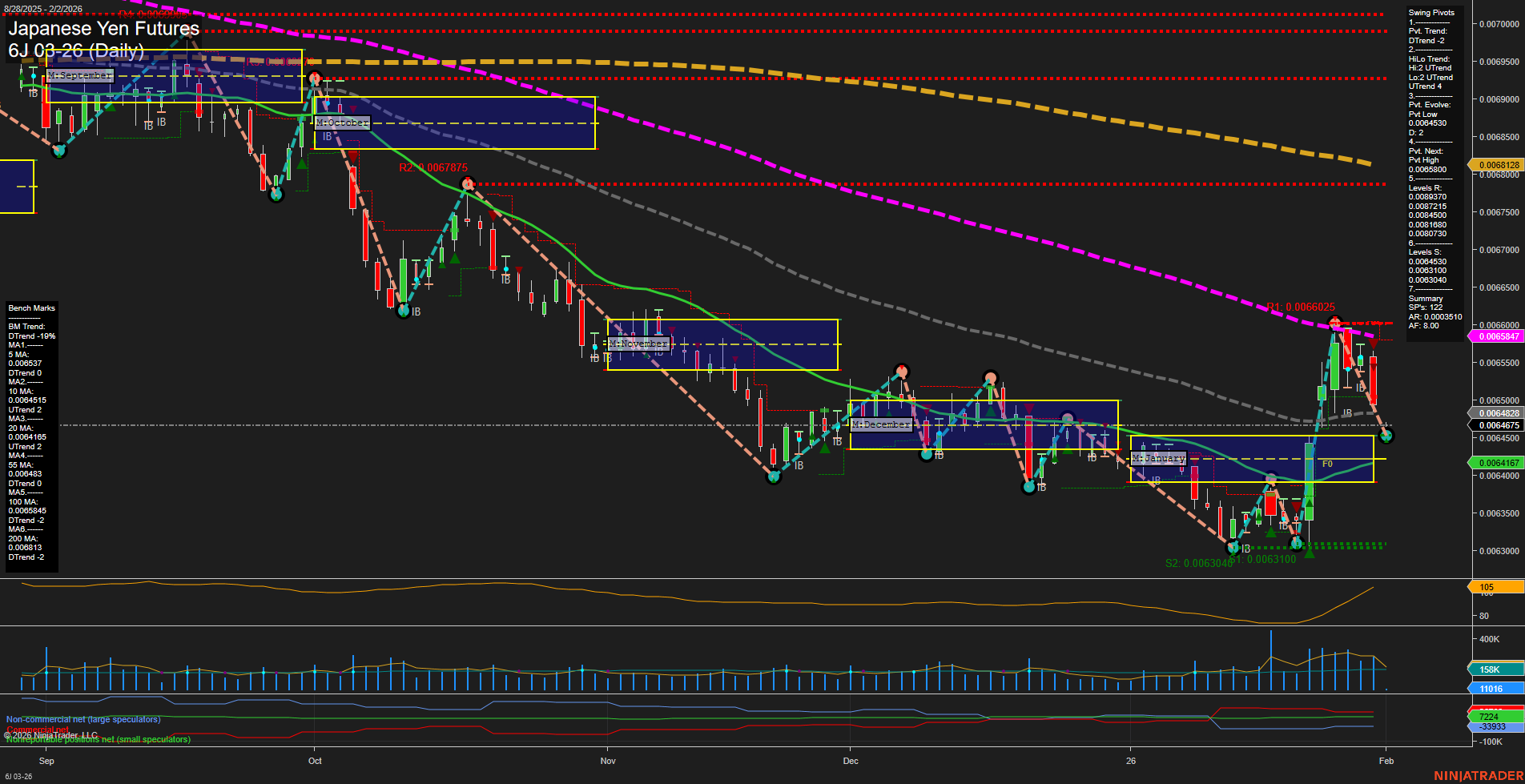

6J Japanese Yen Futures Daily Chart Analysis: 2026-Feb-01 18:02 CT

Price Action

- Last: 0.0064547,

- Bars: Large,

- Mom: Fast.

WSFG Weekly

- Short-Term

- WSFG Current: -1%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: 16%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: 3%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 0.0064547,

- 4. Pvt. Next: Pvt high 0.0065800,

- 5. Levels R: 0.0066025, 0.0065800, 0.0065310, 0.0064875, 0.0064370, 0.0063730, 0.0063440,

- 6. Levels S: 0.0063100, 0.0063040.

Daily Benchmarks

- (Short-Term) 5 Day: 0.006537 Down Trend,

- (Short-Term) 10 Day: 0.0064765 Down Trend,

- (Intermediate-Term) 20 Day: 0.0064167 Up Trend,

- (Intermediate-Term) 55 Day: 0.0064083 Up Trend,

- (Long-Term) 100 Day: 0.0063840 Down Trend,

- (Long-Term) 200 Day: 0.0063813 Down Trend.

Additional Metrics

Recent Trade Signals

- 30 Jan 2026: Short 6J 03-26 @ 0.006485 Signals.USAR-WSFG

- 30 Jan 2026: Short 6J 03-26 @ 0.006525 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

The 6J Japanese Yen Futures daily chart shows a market in transition. Short-term momentum is fast and recent bars are large, reflecting heightened volatility and a sharp move lower after a strong rally. The short-term trend has turned bearish, as confirmed by the WSFG (Weekly Session Fib Grid) and both the 5-day and 10-day moving averages, which are trending down. However, the intermediate-term picture is more constructive: the MSFG (Monthly Session Fib Grid) and 20/55-day moving averages are trending up, and the HiLo swing pivot trend remains upward, suggesting the recent pullback may be corrective within a broader recovery attempt. Long-term benchmarks (100/200-day MAs) are still in a downtrend, indicating the larger trend has yet to fully reverse. Key resistance levels cluster above 0.00648–0.00660, while support is found near 0.00631. Recent trade signals have triggered short entries, aligning with the short-term bearish bias. Overall, the market is experiencing a short-term correction within an intermediate-term uptrend, with volatility elevated and price action testing key support and resistance zones. Swing traders should note the potential for further choppy price action as the market digests recent gains and tests the durability of the emerging uptrend.

Chart Analysis ATS AI Generated: 2026-02-01 18:02 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.