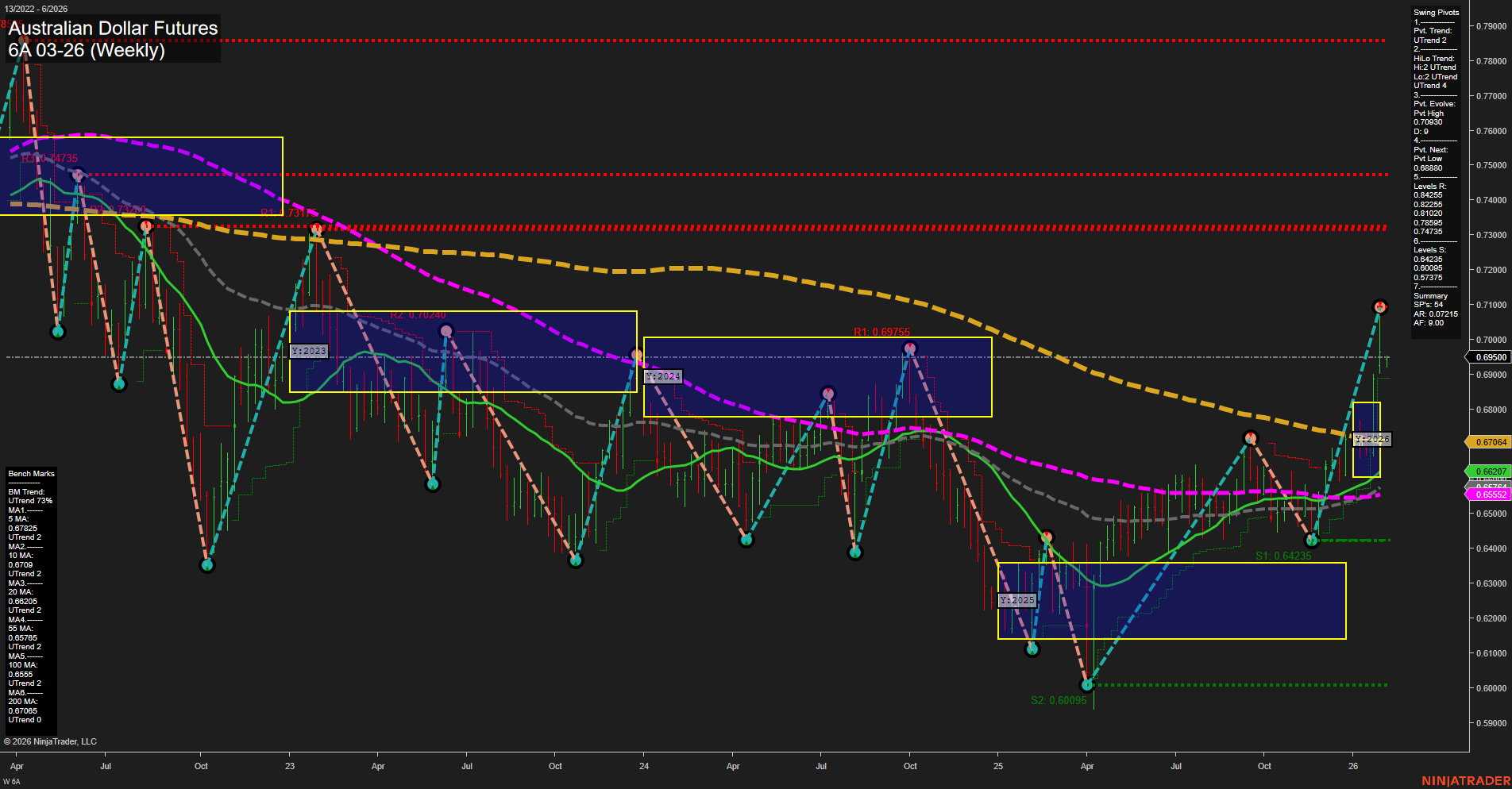

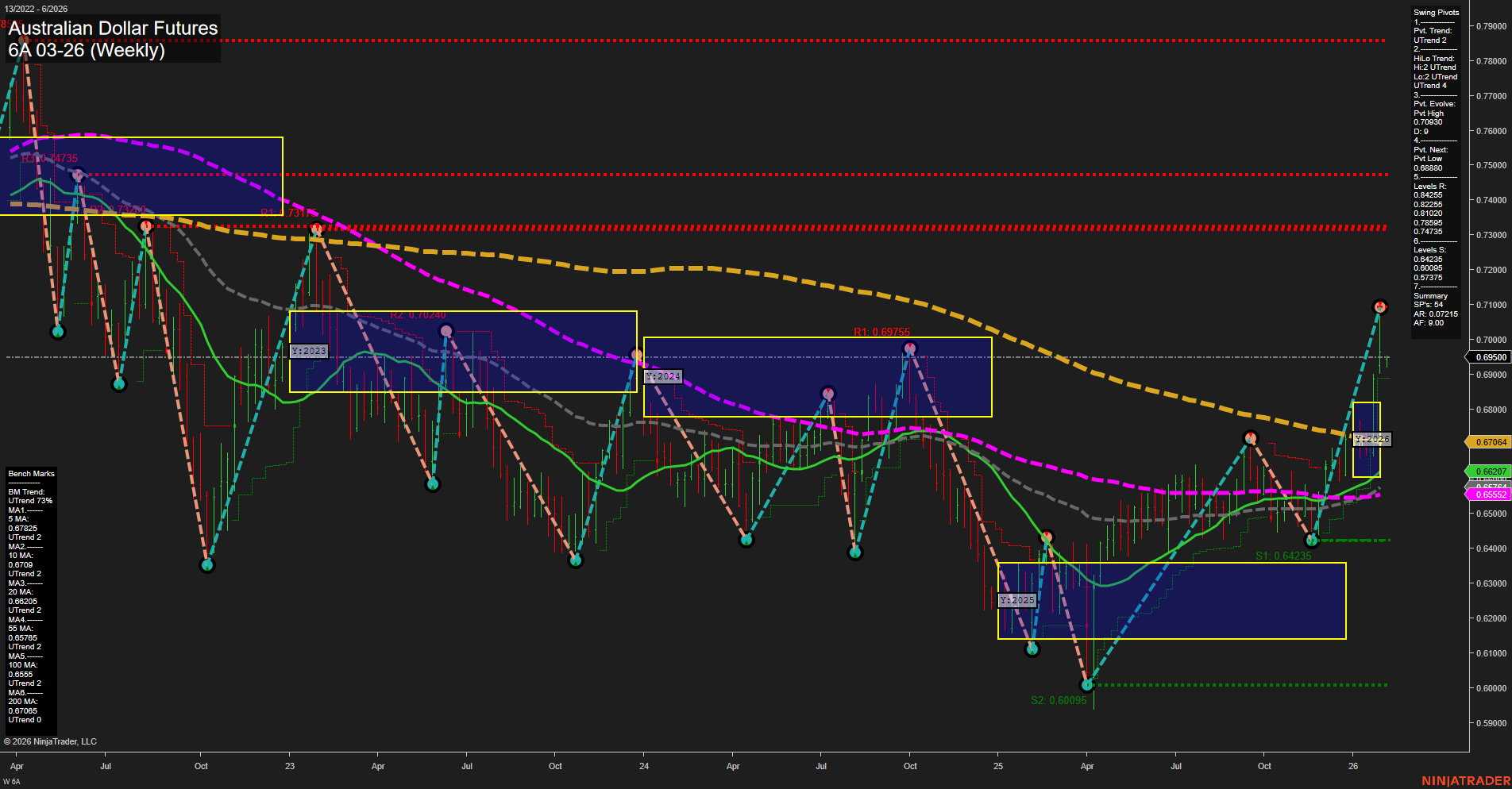

6A Australian Dollar Futures Weekly Chart Analysis: 2026-Feb-01 18:00 CT

Price Action

- Last: 0.70030,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Feb

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2026

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 0.70030,

- 4. Pvt. Next: Pvt low 0.64235,

- 5. Levels R: 0.69755, 0.74735, 0.78255, 0.82255, 0.88880,

- 6. Levels S: 0.64235, 0.60095, 0.57375.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 0.67825 Up Trend,

- (Intermediate-Term) 10 Week: 0.67090 Up Trend,

- (Long-Term) 20 Week: 0.66207 Up Trend,

- (Long-Term) 55 Week: 0.65552 Up Trend,

- (Long-Term) 100 Week: 0.65065 Up Trend,

- (Long-Term) 200 Week: 0.67064 Down Trend.

Recent Trade Signals

- 30 Jan 2026: Short 6A 03-26 @ 0.70025 Signals.USAR.TR120

- 27 Jan 2026: Long 6A 03-26 @ 0.6946 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

The Australian Dollar Futures (6A) weekly chart shows a strong upward momentum with large bars and fast price action, indicating a recent surge. Both short-term and intermediate-term swing pivot trends are in an uptrend, supported by a series of higher highs and higher lows. The price has just reached a new swing high at 0.70030, with the next significant swing low support at 0.64235. Multiple resistance levels are overhead, with the nearest at 0.69755, which has just been surpassed, suggesting a potential breakout scenario. All key moving averages from 5 to 100 weeks are trending upward, reinforcing the bullish structure, though the 200-week MA remains in a downtrend, tempering the long-term outlook to neutral. Recent trade signals show both long and short entries in quick succession, reflecting heightened volatility and possible profit-taking after a strong rally. The overall environment is characterized by a bullish bias in the short and intermediate term, with the long-term trend still in transition. The market appears to be in a recovery phase, possibly following a V-shaped reversal, with price action testing and breaking through previous resistance zones. Consolidation or pullbacks may occur as the market digests recent gains, but the prevailing trend remains upward for now.

Chart Analysis ATS AI Generated: 2026-02-01 18:00 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.