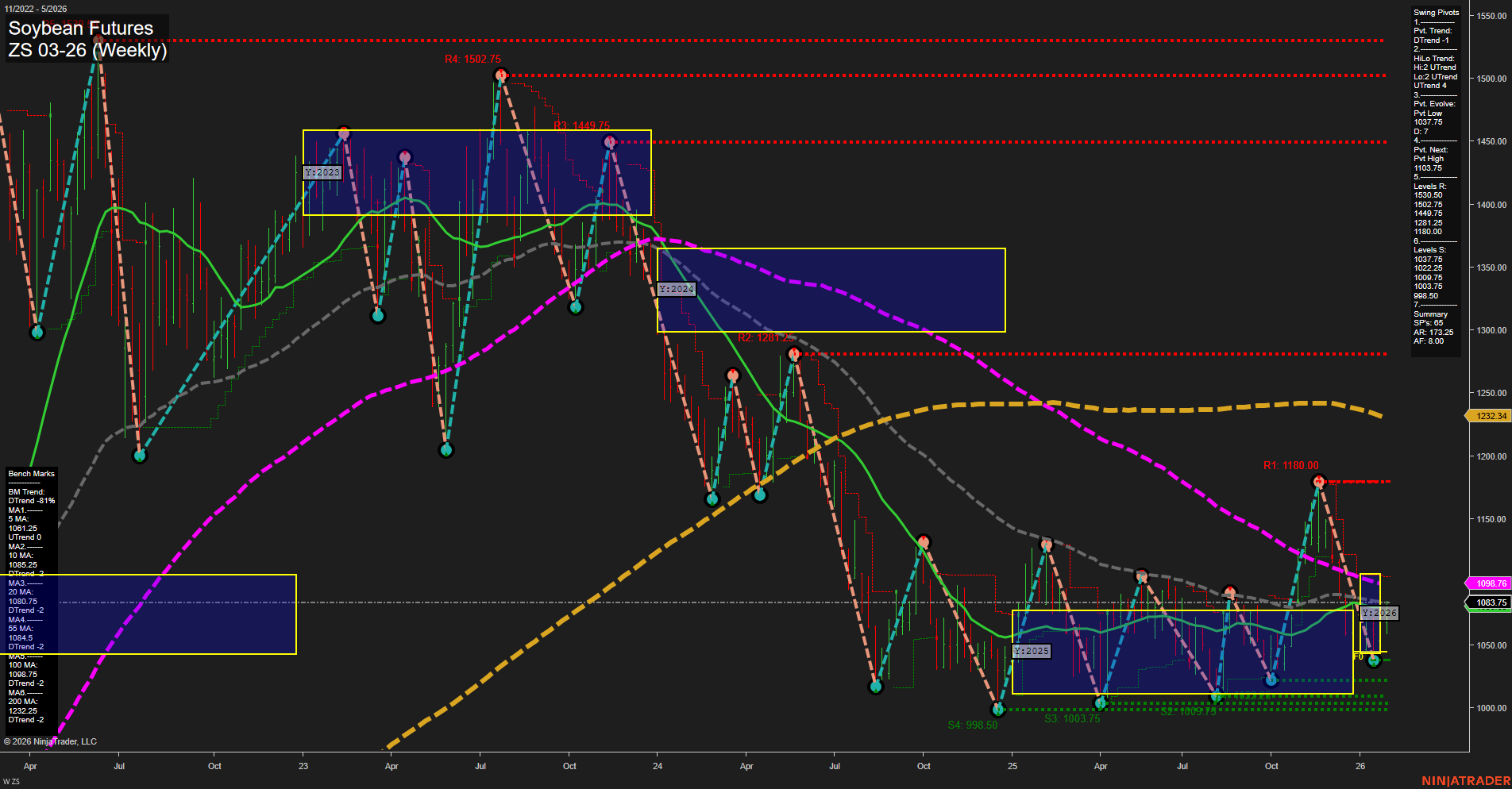

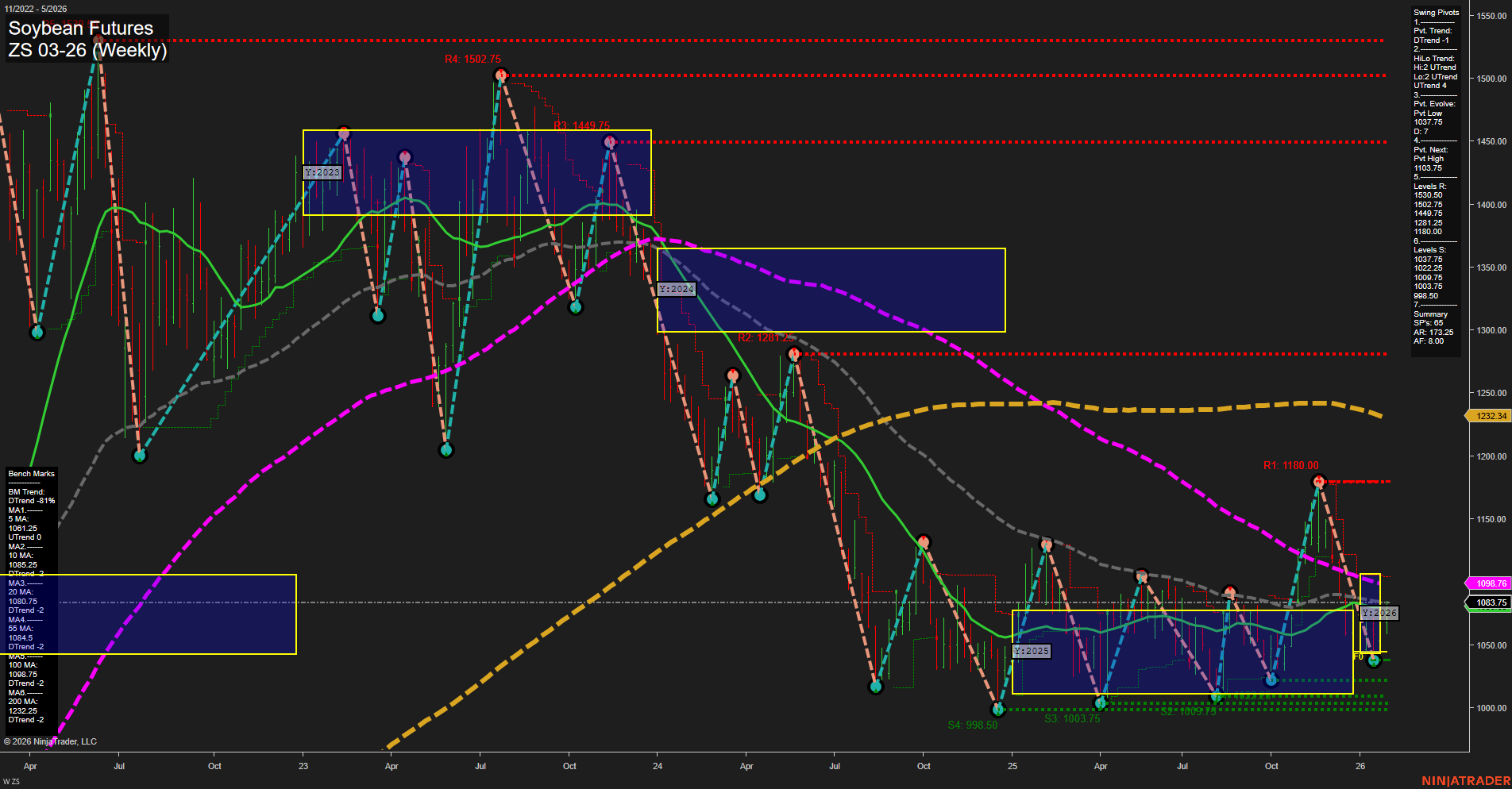

ZS Soybean Futures Weekly Chart Analysis: 2026-Jan-29 07:24 CT

Price Action

- Last: 1083.75,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 54%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: 28%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: 2%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 5. Levels R: 1180.00, 1201.25, 1247.75, 1449.75, 1502.75,

- 6. Levels S: 1037.25, 1003.75, 1002.75, 998.50, 985.50.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1081.25 Up Trend,

- (Intermediate-Term) 10 Week: 1085.25 Up Trend,

- (Long-Term) 20 Week: 1098.75 Down Trend,

- (Long-Term) 55 Week: 1085.5 Down Trend,

- (Long-Term) 100 Week: 1086.75 Down Trend,

- (Long-Term) 200 Week: 1232.34 Down Trend.

Recent Trade Signals

- 28 Jan 2026: Long ZS 03-26 @ 1074.25 Signals.USAR-WSFG

- 26 Jan 2026: Short ZS 03-26 @ 1061.25 Signals.USAR.TR120

- 23 Jan 2026: Long ZS 03-26 @ 1069.75 Signals.USAR.TR720

- 23 Jan 2026: Long ZS 03-26 @ 1061.75 Signals.USAR-MSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

Soybean futures are currently trading in a consolidation phase, with price action showing medium-sized bars and slow momentum. The short-term trend, as indicated by the swing pivot, is down, but both the weekly and monthly session fib grids (WSFG and MSFG) are trending up, with price holding above their respective NTZ center lines. Intermediate-term HiLo trend is up, and recent trade signals show a mix of long and short entries, reflecting choppy, range-bound conditions. Key resistance levels are clustered above 1180, while support is firm around 1000–1037. Weekly benchmarks show short-term moving averages trending up, but longer-term averages remain in a downtrend, suggesting the market is attempting a base but has not yet confirmed a sustained reversal. Overall, the market is in a transition zone, with potential for further upside if resistance levels are broken, but still facing overhead pressure from longer-term trends. Volatility remains moderate, and the market is likely to continue oscillating within established support and resistance until a decisive breakout occurs.

Chart Analysis ATS AI Generated: 2026-01-29 07:25 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.