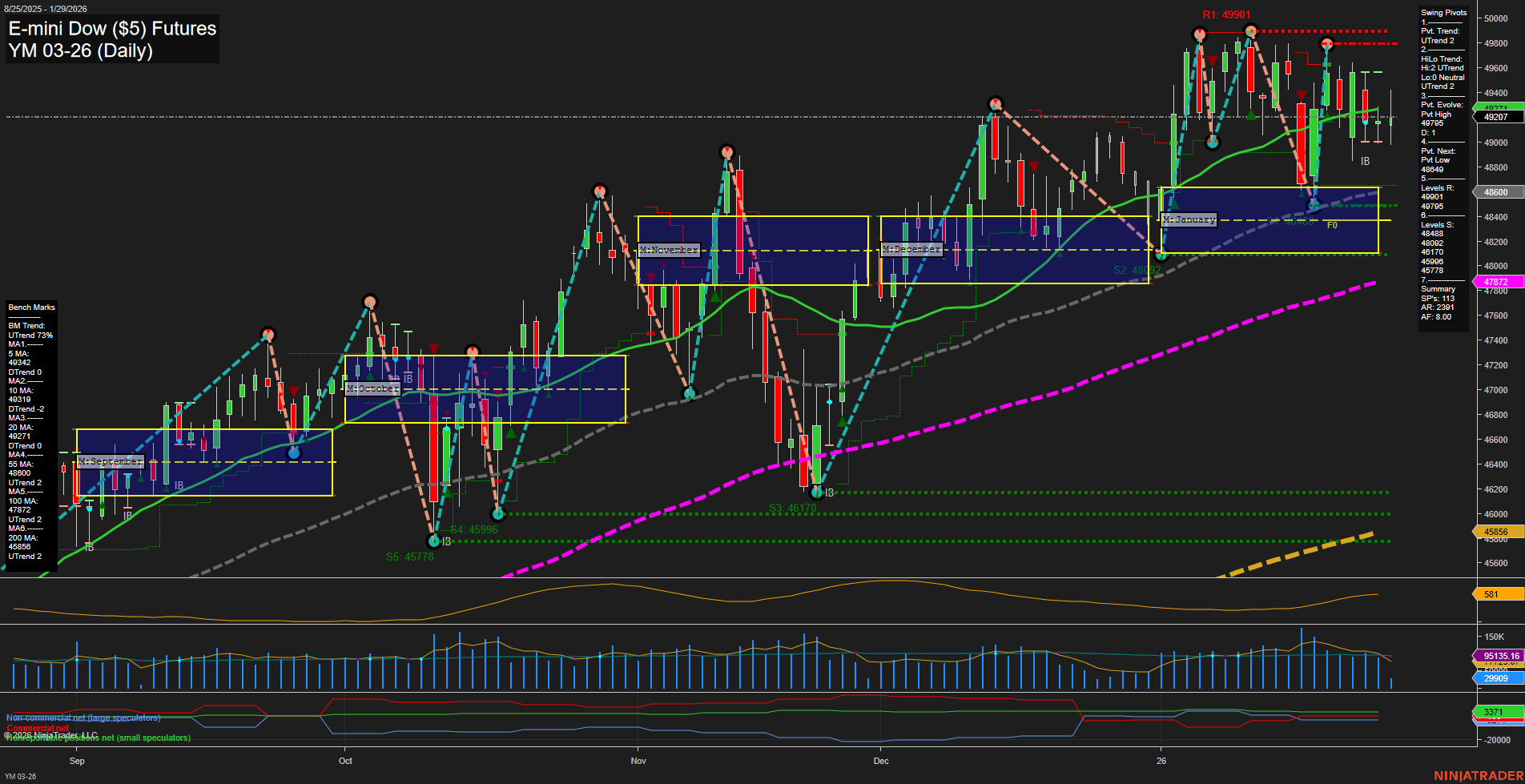

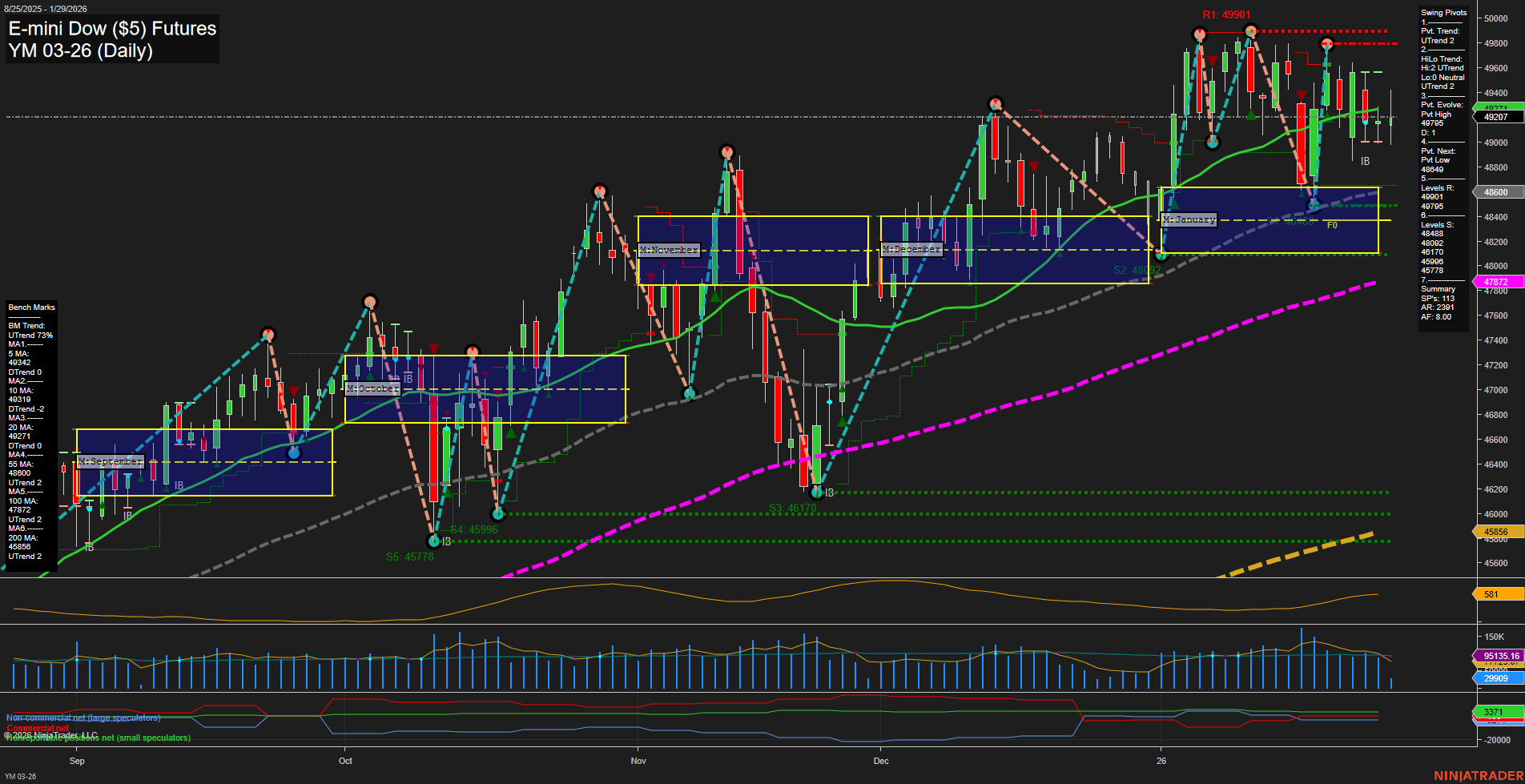

YM E-mini Dow ($5) Futures Daily Chart Analysis: 2026-Jan-29 07:22 CT

Price Action

- Last: 49207,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 15%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: 34%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: 3%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt High 49901,

- 4. Pvt. Next: Pvt Low 48848,

- 5. Levels R: 49901, 49705, 49406,

- 6. Levels S: 48848, 48462, 48002, 46778, 45778.

Daily Benchmarks

- (Short-Term) 5 Day: 49324 Up Trend,

- (Short-Term) 10 Day: 49136 Up Trend,

- (Intermediate-Term) 20 Day: 48771 Up Trend,

- (Intermediate-Term) 55 Day: 48002 Up Trend,

- (Long-Term) 100 Day: 47827 Up Trend,

- (Long-Term) 200 Day: 45856 Up Trend.

Additional Metrics

Recent Trade Signals

- 27 Jan 2026: Short YM 03-26 @ 49117 Signals.USAR.TR120

- 23 Jan 2026: Short YM 03-26 @ 49148 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The YM E-mini Dow futures daily chart shows a market in a broad uptrend across all major timeframes, with price holding above key moving averages and the monthly/weekly session fib grid centers. The short-term swing pivot trend is up, but recent trade signals have triggered short entries, suggesting some near-term consolidation or a possible pullback after testing resistance at 49901. Intermediate and long-term trends remain firmly bullish, supported by higher lows and strong moving average alignment. Volatility is moderate (ATR 512), and volume is healthy. The market is currently trading within a range defined by recent swing highs and lows, with support levels layered below. The overall structure suggests a pause or digestion phase within a larger uptrend, with the potential for either a continuation higher on a breakout or a deeper retracement if support levels are breached.

Chart Analysis ATS AI Generated: 2026-01-29 07:22 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.