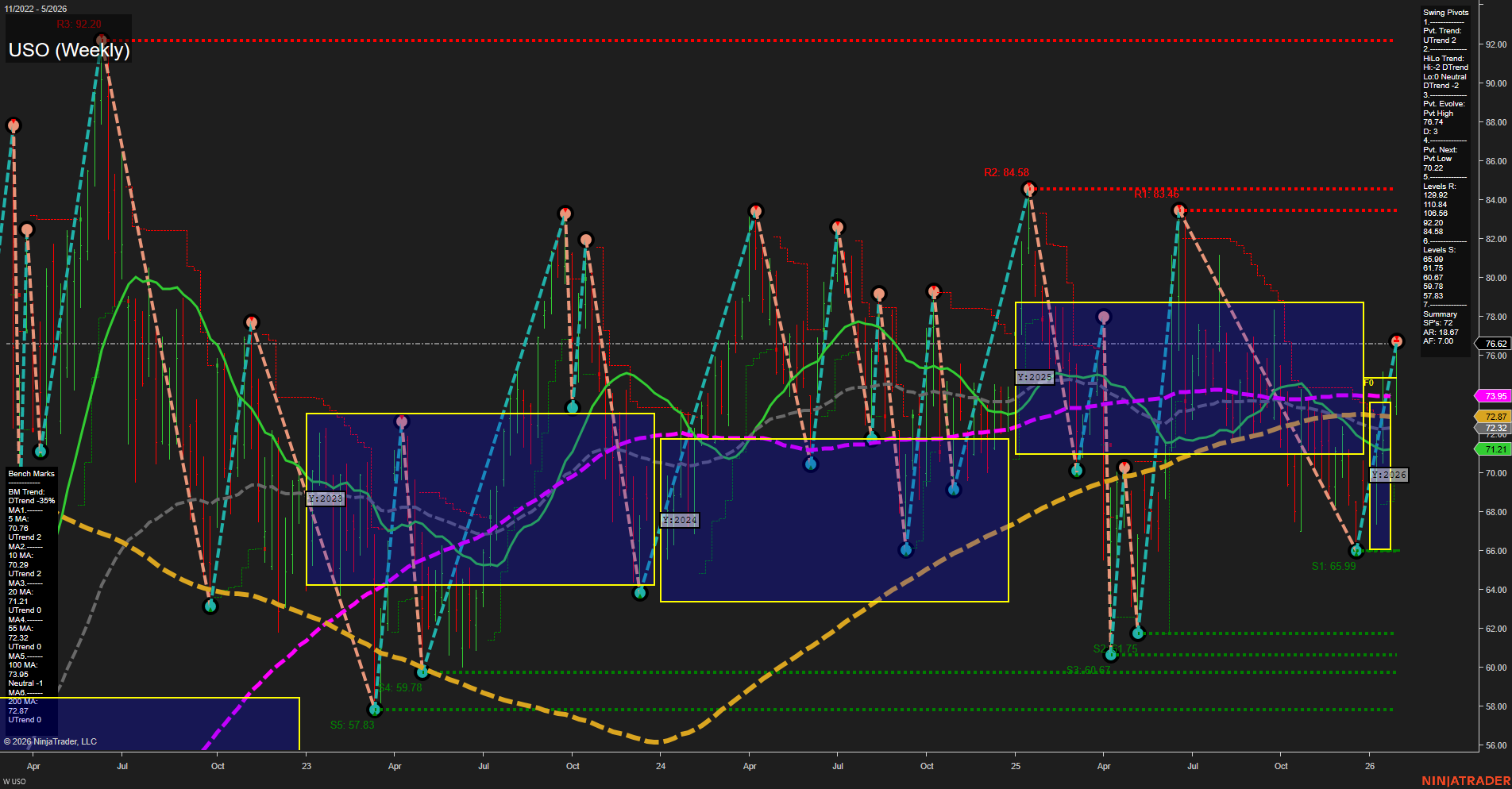

USO is currently trading at 76.62, with medium-sized weekly bars and average momentum, reflecting a market in balance after recent volatility. The short-term swing pivot trend is up, but the intermediate-term HiLo trend remains down, indicating a mixed environment with no clear directional conviction. Price is situated near the upper boundary of the NTZ (neutral zone) on the yearly session fib grid, and all session fib grid trends (weekly, monthly, yearly) are neutral, suggesting a lack of strong bias in either direction. Resistance levels are stacked above at 76.62, 78.88, 80.85, 83.26, 84.58, and 92.20, while support is found at 72.32, 71.21, 65.99, and lower. The 5-week moving average is trending down, but the 10, 20, 55, and 200-week averages are all trending up, with the 100-week MA still in a downtrend, highlighting a transition phase where longer-term bullish structure is being tested by recent pullbacks. The chart shows a broad consolidation range over the past year, with price oscillating between support and resistance, and no decisive breakout or breakdown. This environment is typical of a market awaiting a catalyst, with swing pivots and moving averages providing key reference points for potential reversals or continuations. The overall rating across all timeframes is neutral, reflecting the current indecisiveness and the need for confirmation before a new trend emerges. For swing traders, this suggests a focus on mean reversion and range-bound strategies until a clear directional move develops.