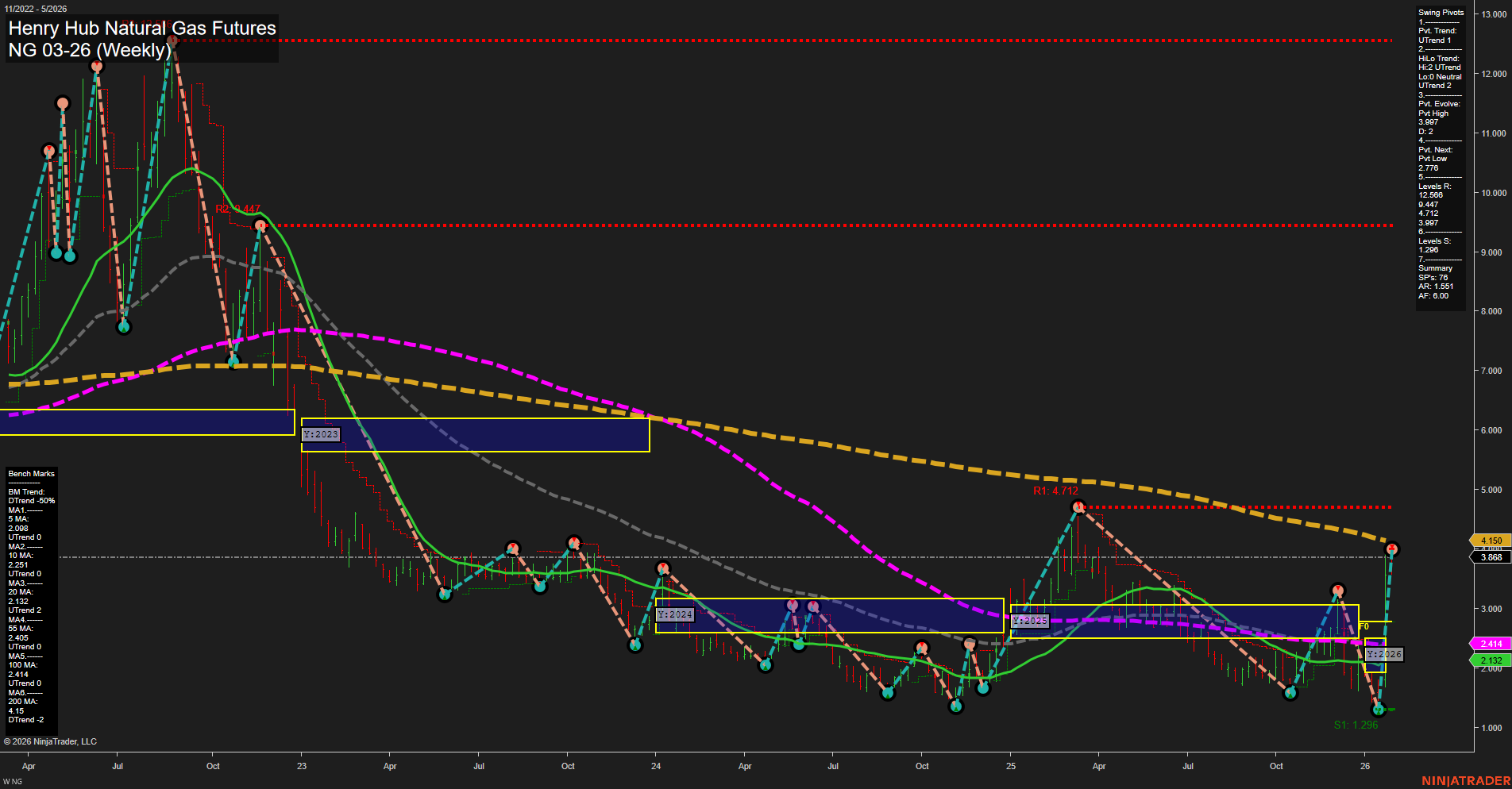

The weekly chart for NG Henry Hub Natural Gas Futures shows a strong and rapid price surge, with the last price at 3.868 and large, fast-moving bars indicating heightened volatility and momentum. Short-term WSFG trend remains down, with price still below the NTZ center, but both the intermediate (MSFG) and long-term (YSFG) session fib grids are trending up, with price above their respective NTZ centers. Swing pivot analysis confirms an uptrend in both short- and intermediate-term, with the most recent pivot evolving to a high at 3.987 and the next key support at 2.775. Resistance levels are stacked above, with major resistance at 4.147 and 3.987, while support is much lower at 1.296, highlighting a wide trading range. Benchmark moving averages show a clear uptrend in the short- and intermediate-term (5, 10, and 20 week MAs), but the longer-term 55, 100, and 200 week MAs remain in a downtrend, suggesting the market is in a transitional phase. Overall, the short- and intermediate-term outlook is bullish, supported by strong upward momentum and trend reversals, while the long-term remains neutral as price approaches key resistance and longer-term averages. The chart reflects a possible shift from a prolonged downtrend to a recovery phase, with potential for further upside if resistance levels are breached, but with volatility and wide ranges likely to persist.