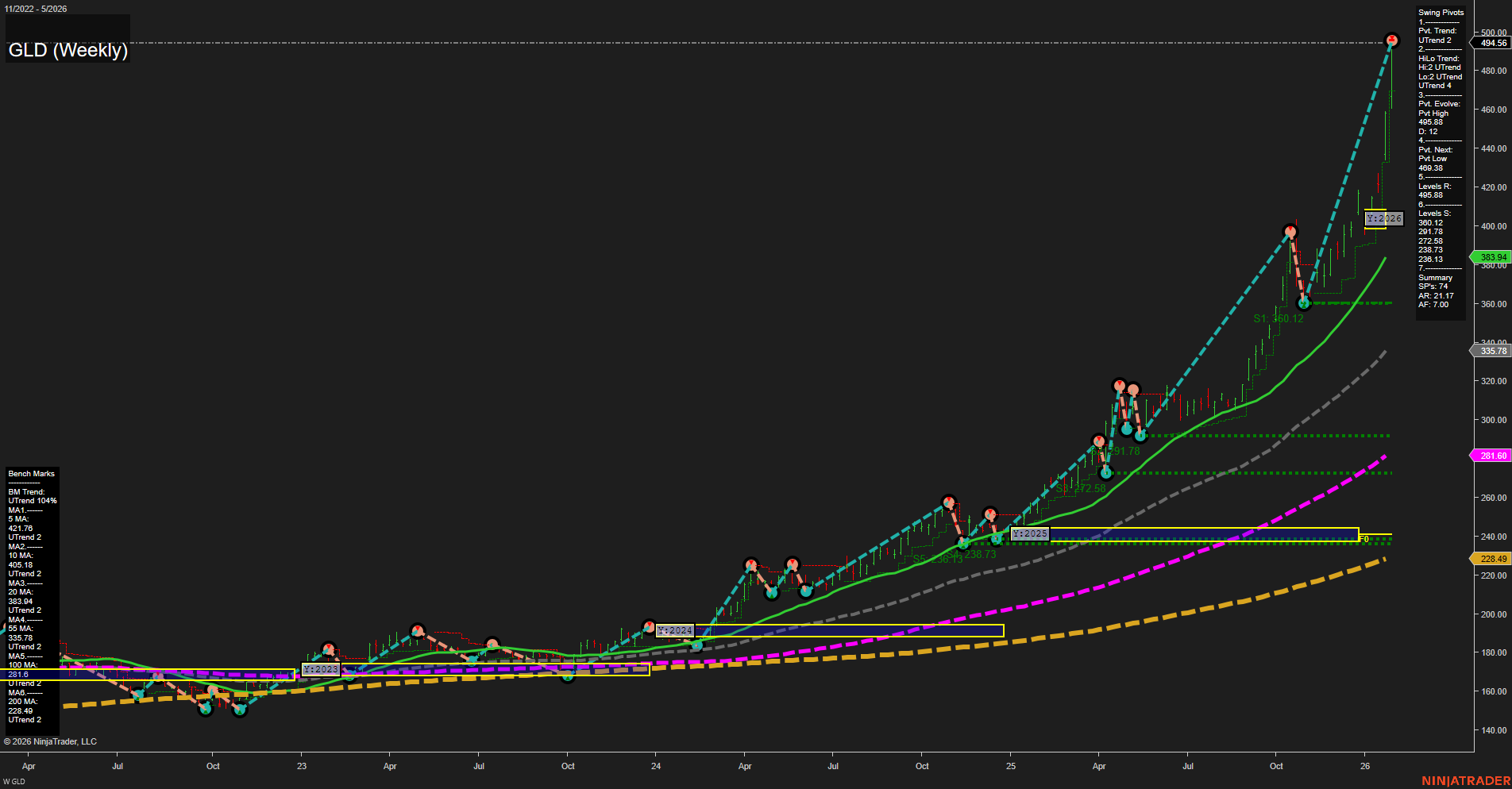

GLD is exhibiting a powerful, sustained uptrend across all timeframes, with price action accelerating sharply in recent weeks. The most recent weekly bars are large and momentum is fast, indicating strong buying interest and a possible parabolic move. All benchmark moving averages are trending upward and well below current price, confirming broad-based strength and trend alignment. Swing pivot analysis shows the current pivot high at 494.56, with the next significant support at 360.12, highlighting a wide gap and limited nearby support, typical of strong trend extensions. Resistance is at the current high, with multiple support levels far below, suggesting any pullback could be sharp but would still be within a broader bullish context. The neutral bias on the session fib grids reflects the price being well above key grid levels, with no immediate reversal signals. From a futures swing trader’s perspective, the market is in a mature, extended rally phase, with trend continuation dominating and no technical evidence of reversal or exhaustion yet. However, the distance from support and the size of recent moves may increase volatility and the potential for sharp retracements if sentiment shifts.