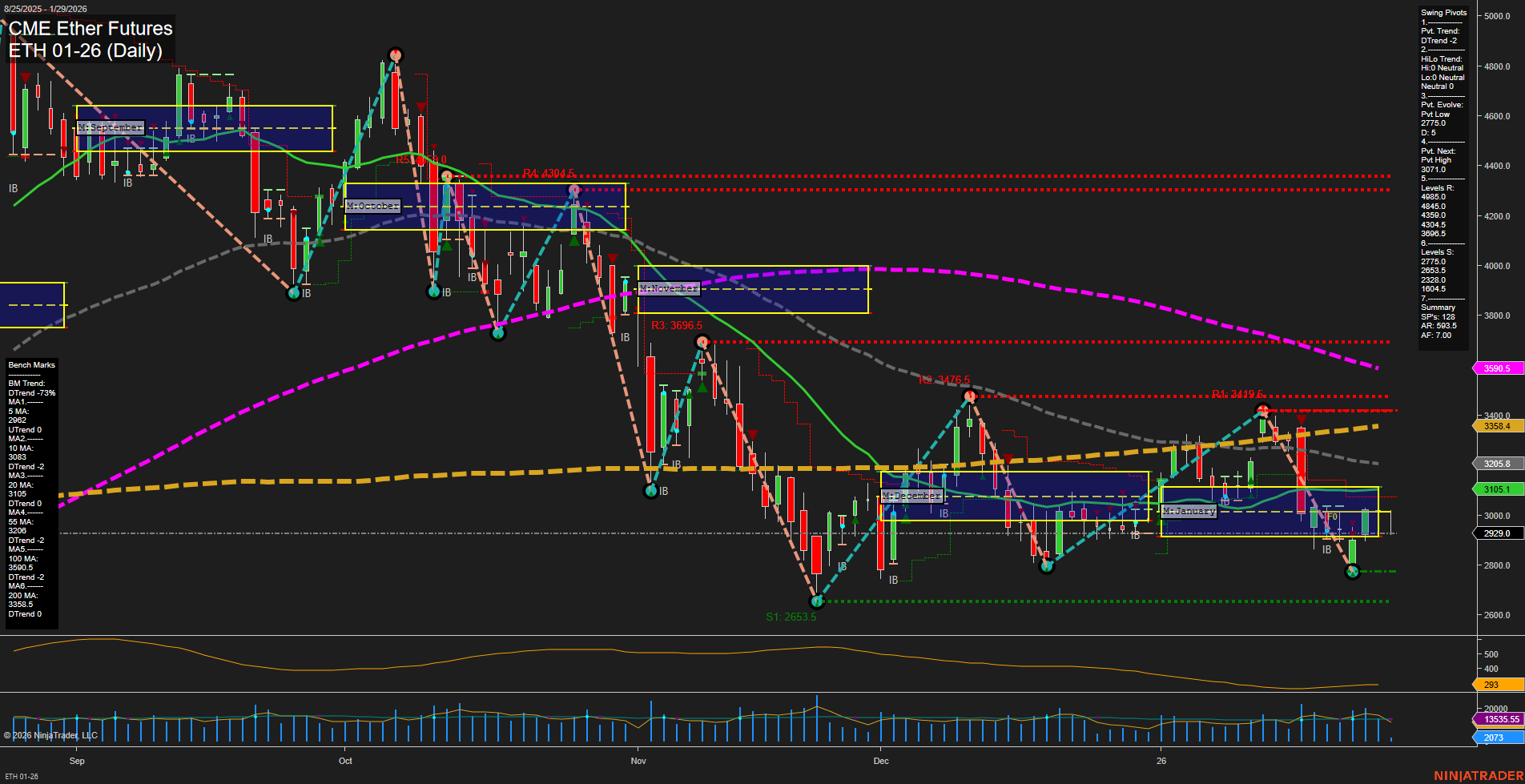

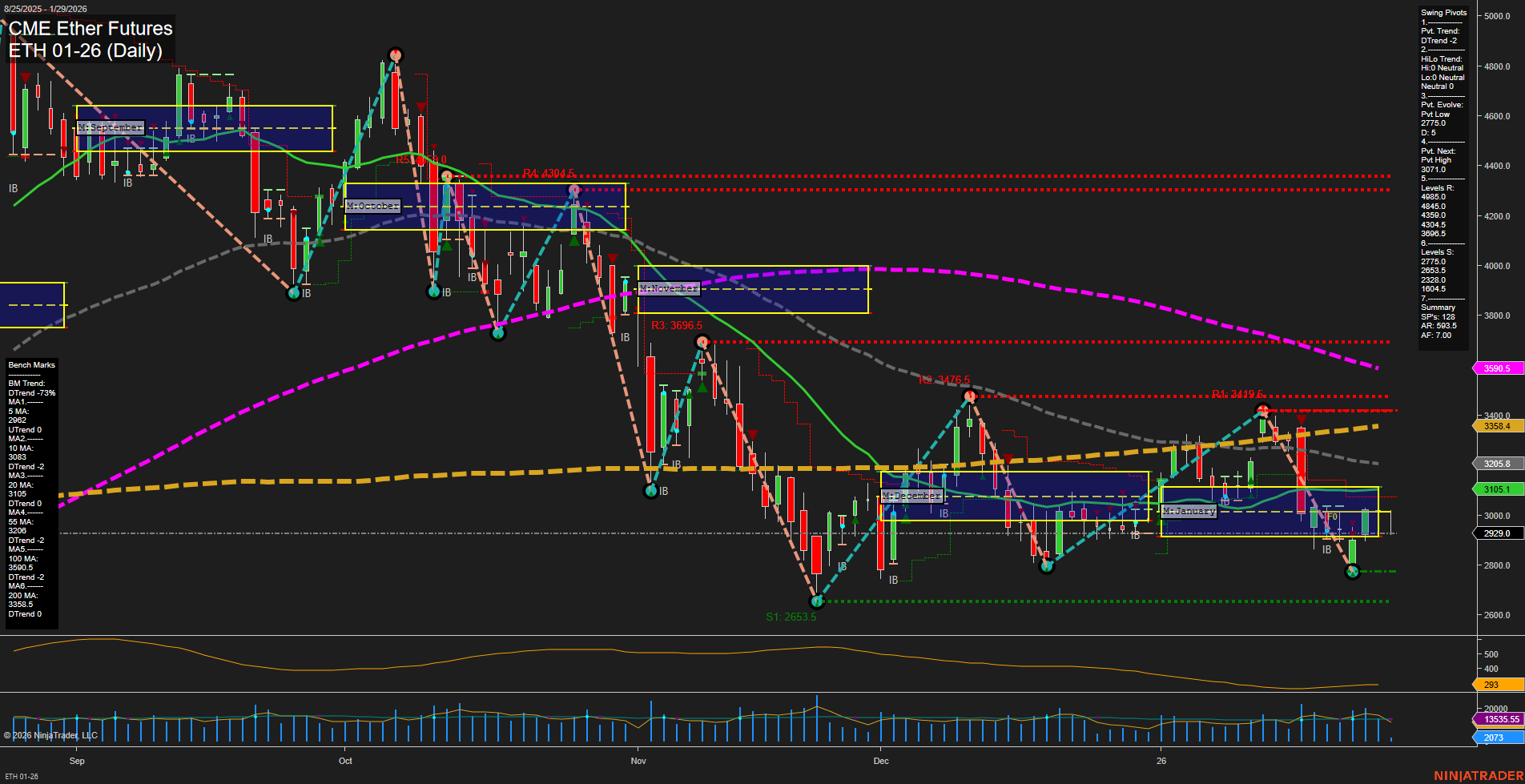

ETH CME Ether Futures Daily Chart Analysis: 2026-Jan-29 07:09 CT

Price Action

- Last: 2929.0,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 38%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: -6%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2026

- Long-Term

- YSFG Current: -1%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: Neutral,

- 3. Pvt. Evolve: Pvt Low 2705,

- 4. Pvt. Next: Pvt High 3071,

- 5. Levels R: 3419.5, 3475.5, 3696.5, 4304.5, 4845.0,

- 6. Levels S: 2779.5, 2653.5, 2303.5, 1204.5.

Daily Benchmarks

- (Short-Term) 5 Day: 2944 Down Trend,

- (Short-Term) 10 Day: 3038 Down Trend,

- (Intermediate-Term) 20 Day: 3105 Down Trend,

- (Intermediate-Term) 55 Day: 3205.5 Down Trend,

- (Long-Term) 100 Day: 3590.5 Down Trend,

- (Long-Term) 200 Day: 3358.4 Down Trend.

Additional Metrics

Recent Trade Signals

- 27 Jan 2026: Long ETH 01-26 @ 3021 Signals.USAR.TR120

- 26 Jan 2026: Short ETH 01-26 @ 2896.5 Signals.USAR-MSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

The ETH CME Ether Futures daily chart shows a market under pressure, with price action currently below most key moving averages and the monthly and yearly session fib grids. The short-term trend has shifted to the downside, confirmed by a recent swing pivot low and a series of lower highs and lower lows. Intermediate and long-term trends remain bearish, as indicated by the persistent downtrend in all major moving averages and the MSFG/YSFG trends. The market recently attempted a bounce but failed to sustain above resistance, leading to renewed selling pressure. Volatility remains elevated (ATR 431), and volume is steady but not signaling a major reversal. The recent trade signals reflect a choppy environment with both long and short entries, but the prevailing structure favors the bears. Key support levels are being tested, and unless a strong reversal emerges above 3071 (next swing high), the path of least resistance remains to the downside. The overall environment is characterized by trend continuation to the downside, with potential for further tests of lower support if selling persists.

Chart Analysis ATS AI Generated: 2026-01-29 07:09 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.