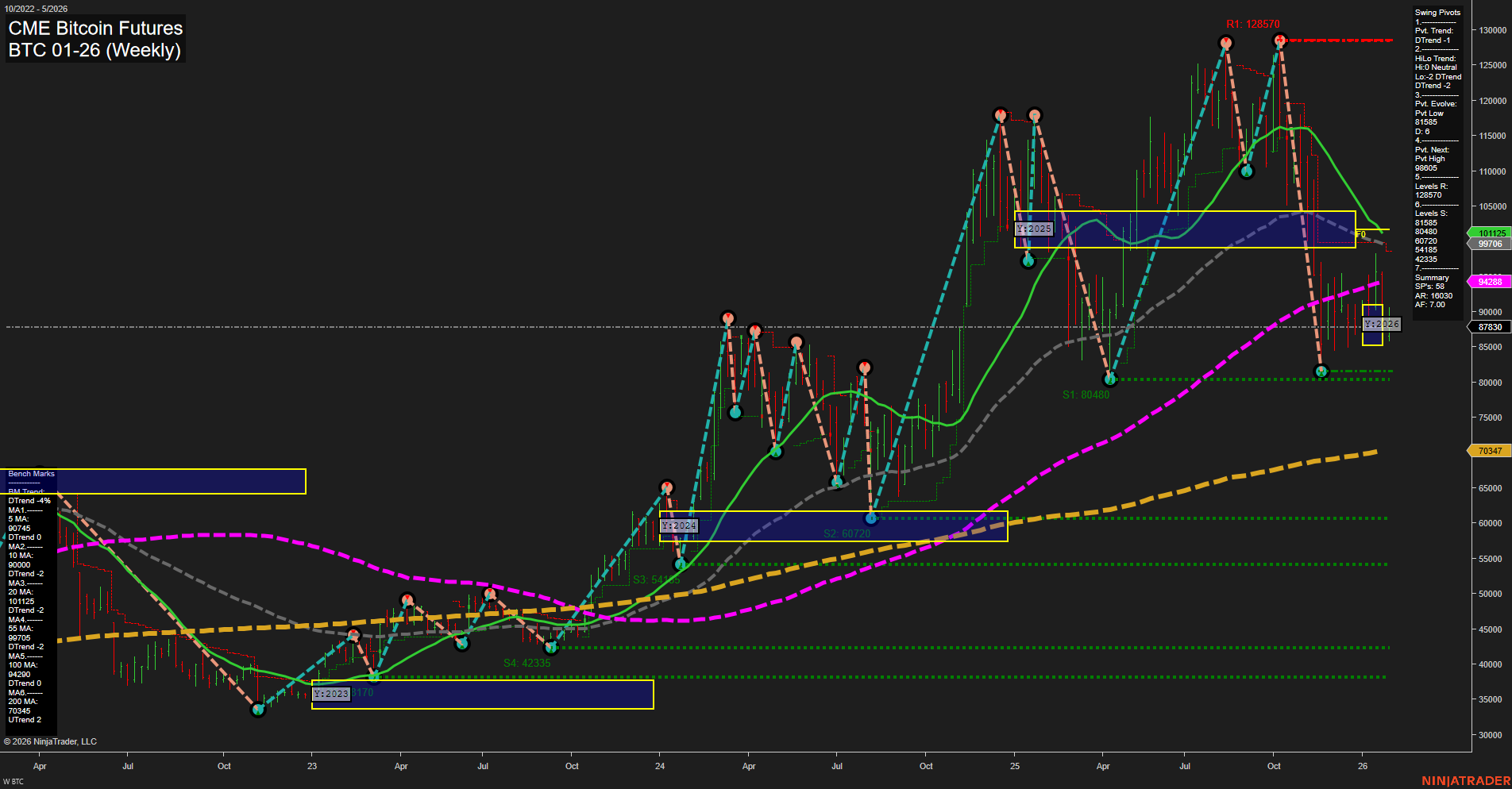

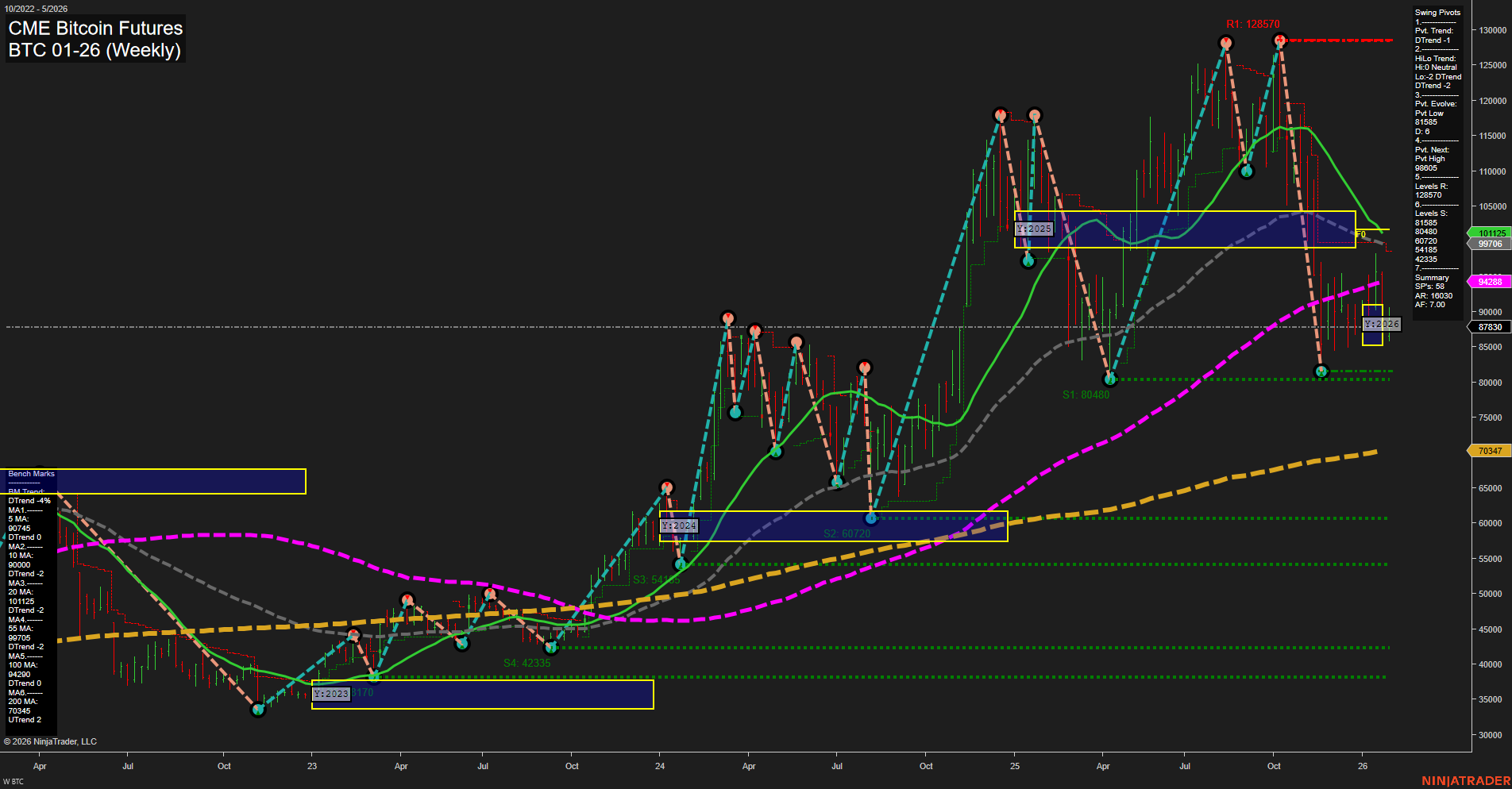

BTC CME Bitcoin Futures Weekly Chart Analysis: 2026-Jan-29 07:04 CT

Price Action

- Last: 101715,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: 21%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: -3%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2026

- Long-Term

- YSFG Current: -1%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 80480,

- 4. Pvt. Next: Pvt high 128570,

- 5. Levels R: 128570, 117425, 105000, 101715,

- 6. Levels S: 80480, 60720, 54945, 42335, 3170.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 101715 Down Trend,

- (Intermediate-Term) 10 Week: 99776 Down Trend,

- (Long-Term) 20 Week: 101115 Down Trend,

- (Long-Term) 55 Week: 94288 Up Trend,

- (Long-Term) 100 Week: 87036 Up Trend,

- (Long-Term) 200 Week: 70347 Up Trend.

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Neutral.

Key Insights Summary

The current weekly chart for CME Bitcoin Futures shows a pronounced shift in momentum, with large bars and fast price action indicating heightened volatility. Short-term price action is bearish, as confirmed by the downward swing pivot trend and both 5- and 10-week moving averages trending lower. The WSFG (Weekly Session Fib Grid) trend is up, but this is countered by the intermediate and long-term MSFG and YSFG trends, which are both down, suggesting that recent rallies have failed to sustain above key Fibonacci and pivot levels. Resistance is clustered near recent highs (128570, 117425), while support is well below at 80480 and lower, highlighting a wide trading range and the potential for further downside if support levels are tested. The long-term moving averages (55, 100, 200 week) remain in uptrends, which tempers the bearish outlook and suggests the broader trend is still intact, but under pressure. Overall, the market is in a corrective phase within a larger uptrend, with short- and intermediate-term signals pointing to continued weakness and possible further retracement before any sustained recovery.

Chart Analysis ATS AI Generated: 2026-01-29 07:05 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.