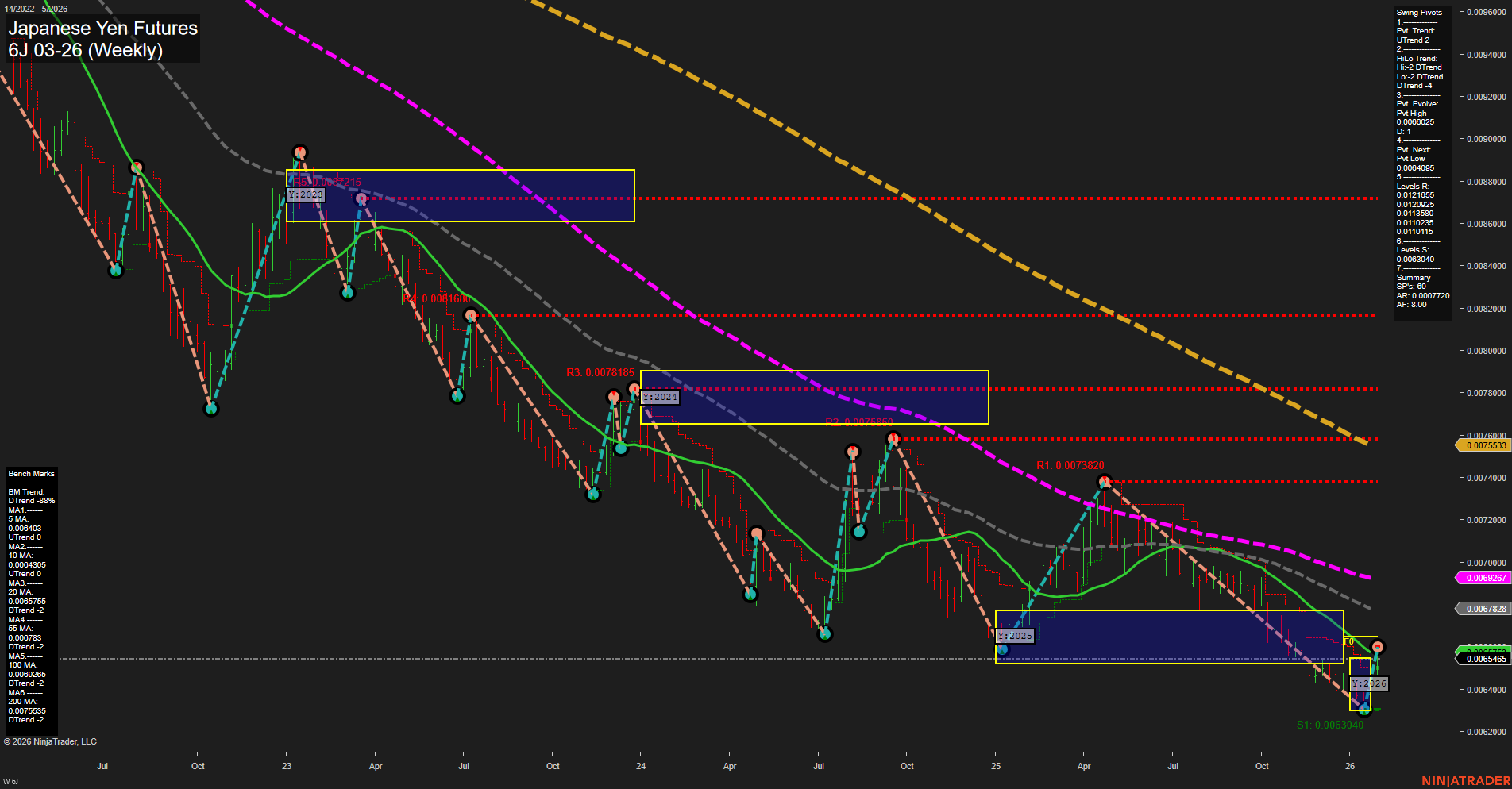

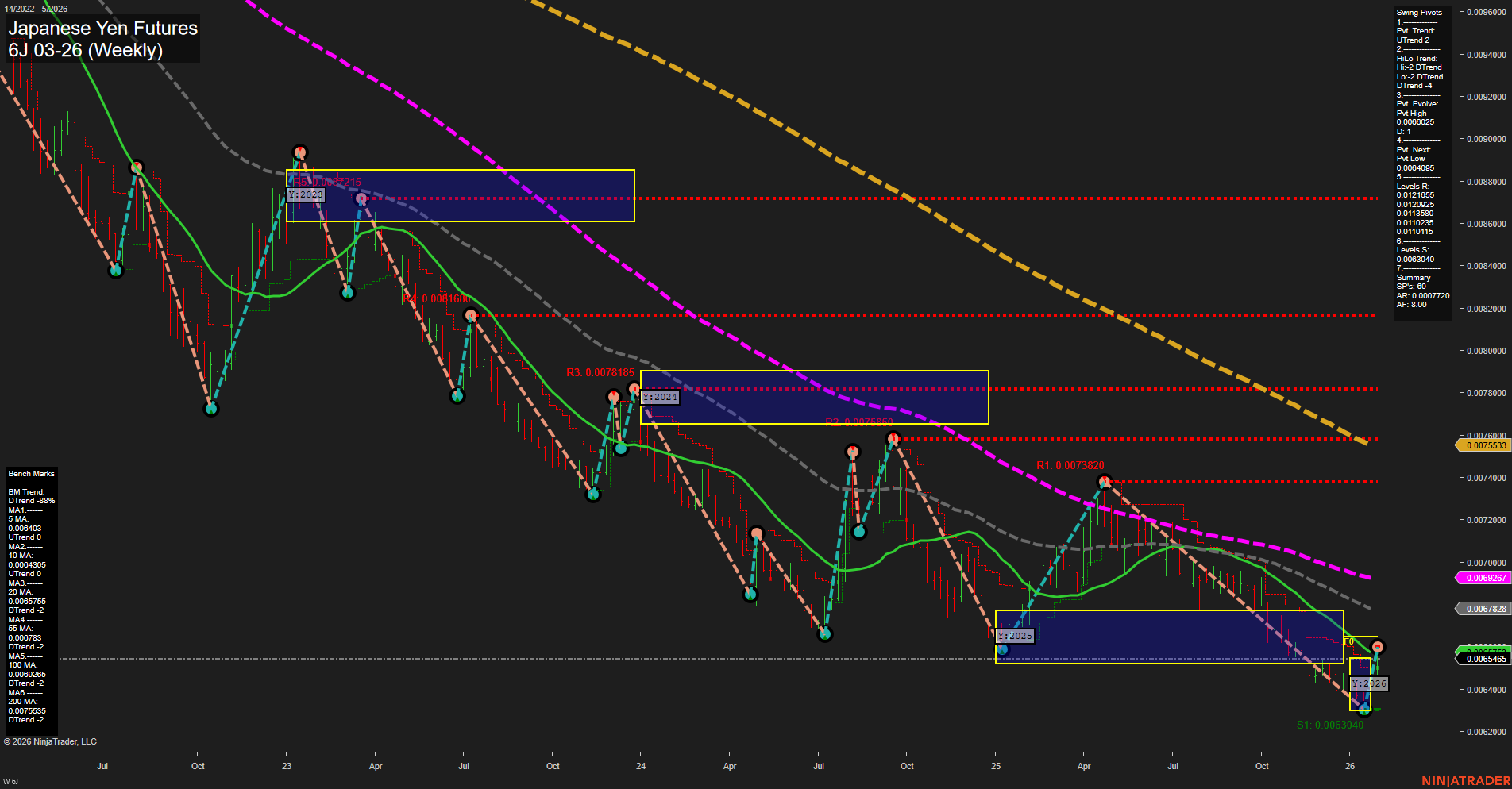

6J Japanese Yen Futures Weekly Chart Analysis: 2026-Jan-29 07:03 CT

Price Action

- Last: 0.0065430,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 55%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: 38%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: 10%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt High 0.0068025,

- 4. Pvt. Next: Pvt Low 0.0063040,

- 5. Levels R: 0.0073820, 0.0071805, 0.0070650, 0.0069115,

- 6. Levels S: 0.0063040.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 0.0064833 Down Trend,

- (Intermediate-Term) 10 Week: 0.0064305 Down Trend,

- (Long-Term) 20 Week: 0.0065755 Down Trend,

- (Long-Term) 55 Week: 0.0067283 Down Trend,

- (Long-Term) 100 Week: 0.0069267 Down Trend,

- (Long-Term) 200 Week: 0.0075533 Down Trend.

Recent Trade Signals

- 27 Jan 2026: Long 6J 03-26 @ 0.0065095 Signals.USAR-WSFG

- 23 Jan 2026: Long 6J 03-26 @ 0.0064315 Signals.USAR.TR120

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

The Japanese Yen futures (6J) weekly chart shows a recent shift in short-term momentum, with price action moving above the NTZ center and a new long signal triggered in late January. The short-term swing pivot trend has turned up, supported by the WSFG and MSFG both trending higher, indicating a potential short-term recovery or bounce from recent lows. However, the intermediate-term HiLo trend remains down, and all major moving averages (from 5 to 200 week) are still in a downtrend, reflecting persistent long-term bearishness. Resistance levels are clustered above, with the nearest at 0.0069115 and major resistance at 0.0073820, while support is established at 0.0063040. The overall structure suggests a possible counter-trend rally within a broader bearish context, with price attempting to recover from oversold conditions but facing significant overhead resistance and a dominant long-term downtrend. Swing traders may observe for confirmation of trend continuation or signs of reversal as price approaches key resistance levels.

Chart Analysis ATS AI Generated: 2026-01-29 07:04 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.