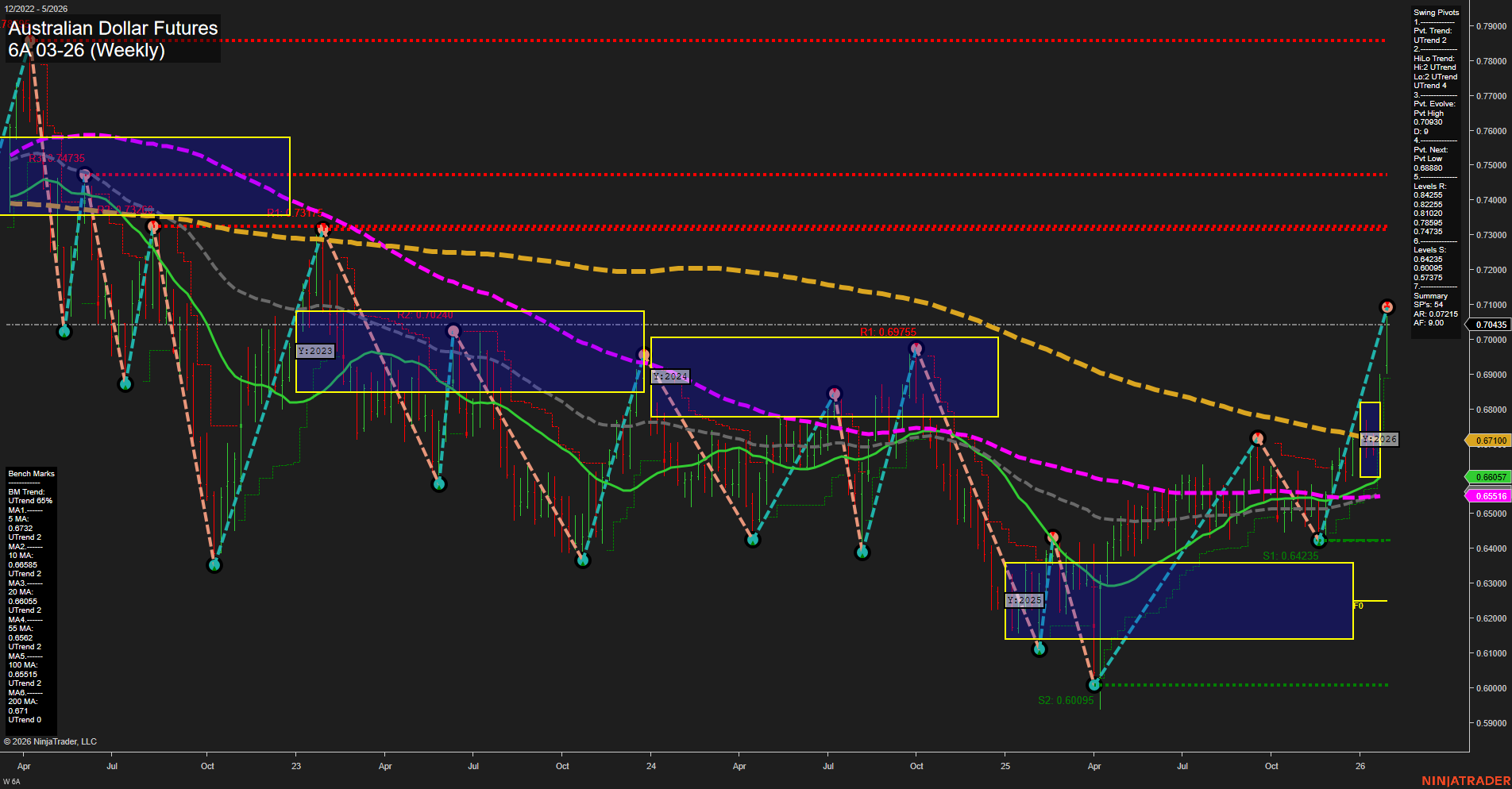

6A Australian Dollar Futures Weekly Chart Analysis: 2026-Jan-29 07:00 CT

Price Action

- Last: 0.70435,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2026

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 0.70435,

- 4. Pvt. Next: Pvt low 0.64235,

- 5. Levels R: 0.70435, 0.69765, 0.67375,

- 6. Levels S: 0.64235, 0.60095.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 0.66557 Up Trend,

- (Intermediate-Term) 10 Week: 0.65516 Up Trend,

- (Long-Term) 20 Week: 0.66057 Up Trend,

- (Long-Term) 55 Week: 0.65085 Up Trend,

- (Long-Term) 100 Week: 0.66145 Down Trend,

- (Long-Term) 200 Week: 0.67711 Down Trend.

Recent Trade Signals

- 27 Jan 2026: Long 6A 03-26 @ 0.6946 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

The Australian Dollar Futures (6A) weekly chart shows a strong bullish swing with fast momentum and large bars, indicating a decisive move higher. Both short-term and intermediate-term swing pivot trends are up, with the most recent pivot high at 0.70435 and the next key support at 0.64235. Resistance levels are stacked above, but the price has broken through previous resistance zones, suggesting a potential shift in market structure. All key weekly moving averages up to the 55-week are trending higher, reinforcing the bullish tone in the short and intermediate term, while the 100- and 200-week MAs remain in a downtrend, reflecting a longer-term neutral stance as the market tests these higher timeframe resistance areas. The recent long trade signal aligns with the current upward momentum. Overall, the chart reflects a strong recovery phase, with the market potentially transitioning from a prolonged consolidation or base-building period into a more sustained uptrend, though long-term resistance levels remain a key area to watch for further confirmation of trend continuation.

Chart Analysis ATS AI Generated: 2026-01-29 07:00 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.