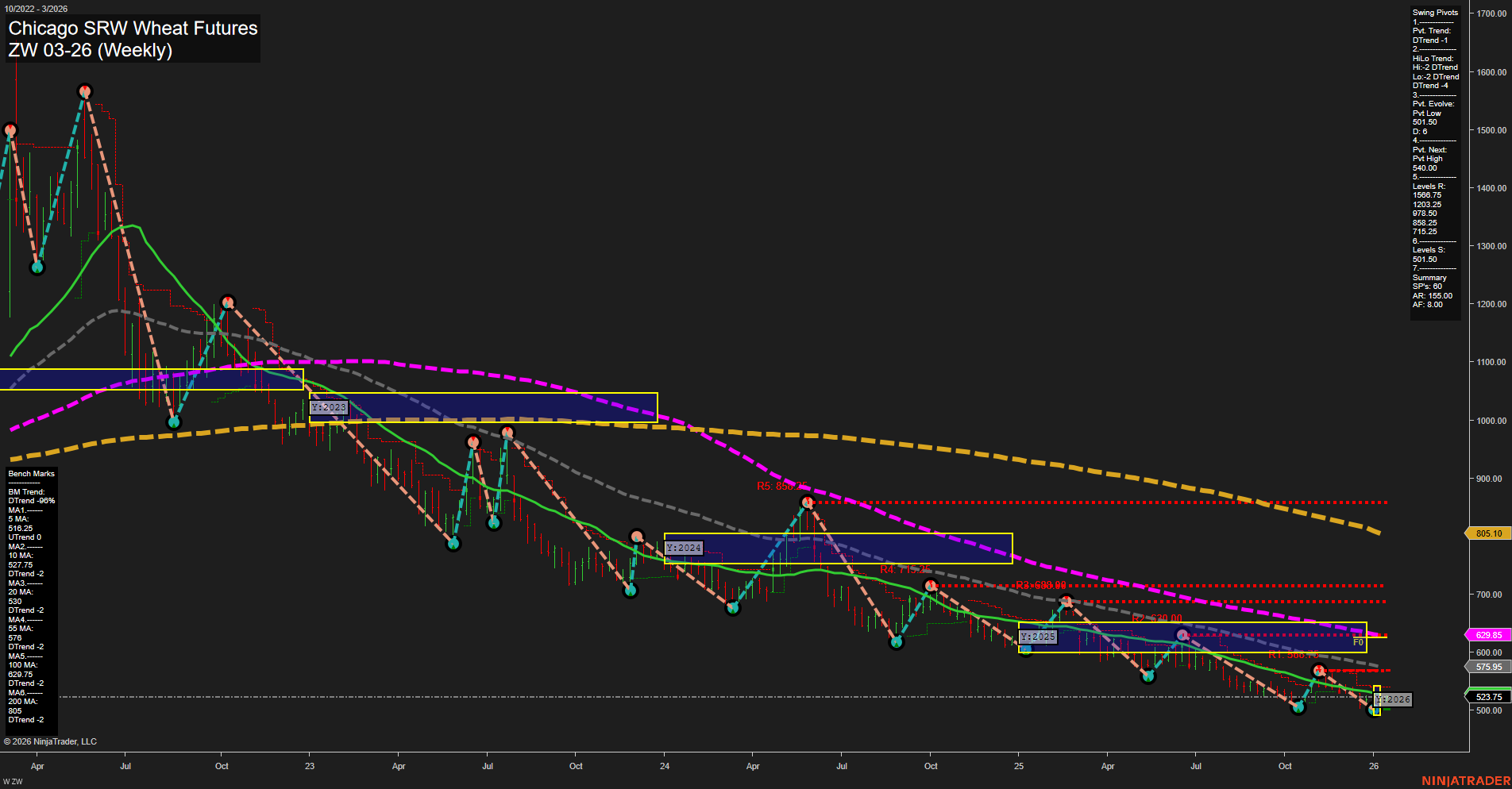

The ZW Chicago SRW Wheat Futures weekly chart shows a market that has been in a persistent downtrend, as evidenced by the dominant downward swing pivot structure and all major moving averages trending lower. Price action is currently subdued, with small bars and slow momentum, indicating a lack of strong directional conviction in the very near term. Despite the recent cluster of long trade signals, the short-term and intermediate-term swing pivot trends remain down, and price is only marginally above the NTZ center of the session fib grids, suggesting a tentative attempt at a base or minor bounce rather than a confirmed reversal. Resistance levels are stacked well above current price, with the next significant swing high at 640.00 and major moving averages overhead, reinforcing the overhead supply. Support is defined at the recent swing low of 501.50. While the session fib grid trends (WSFG, MSFG, YSFG) are technically up, this is more a reflection of price stabilizing above the NTZ center rather than a robust uptrend. The overall structure remains bearish on the long-term view, with only neutral readings in the short and intermediate term as the market consolidates after an extended decline. This environment suggests a market in transition, with potential for further base-building or a relief rally, but with significant technical resistance to overcome before a sustained bullish trend can be established.