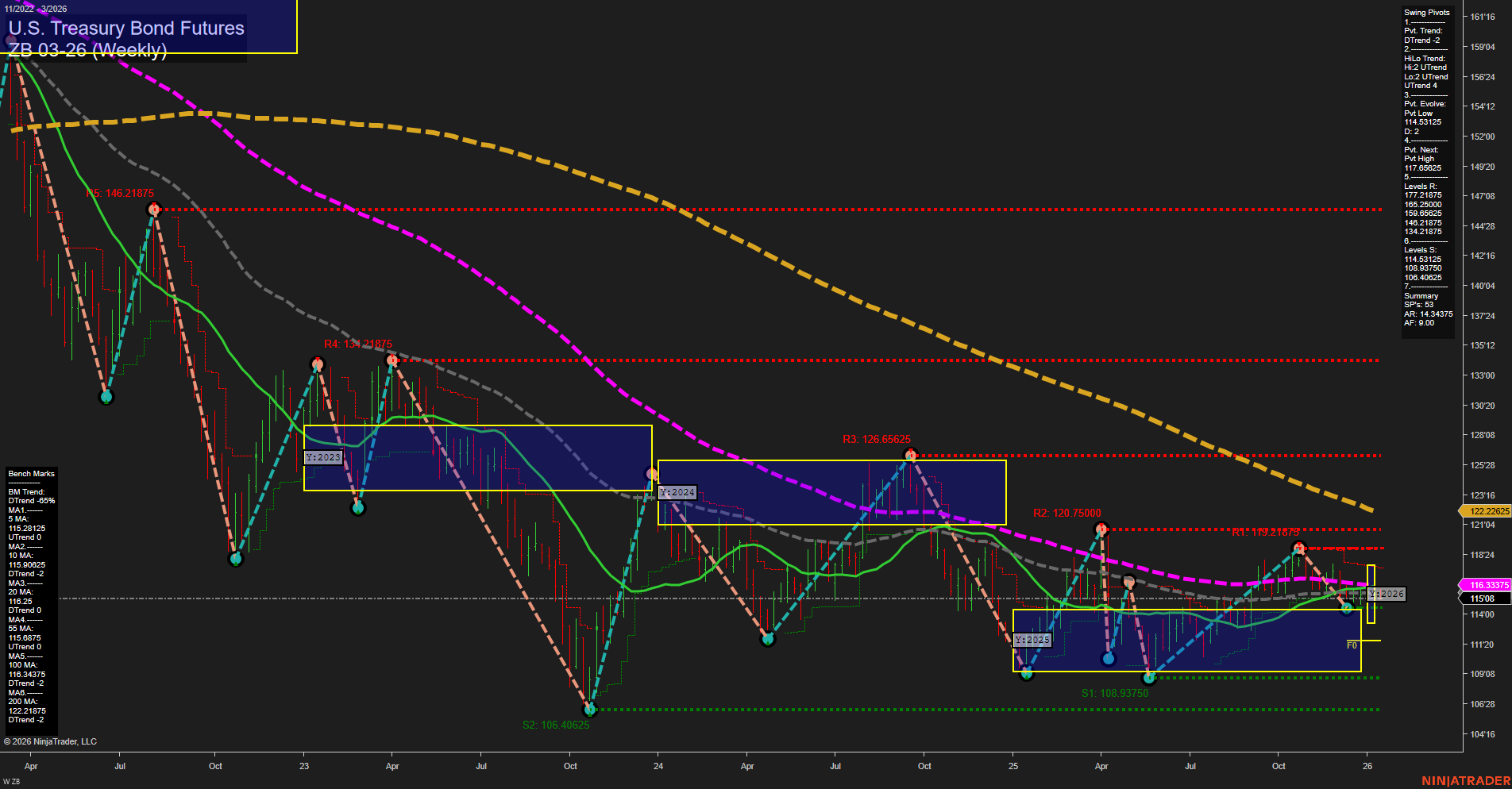

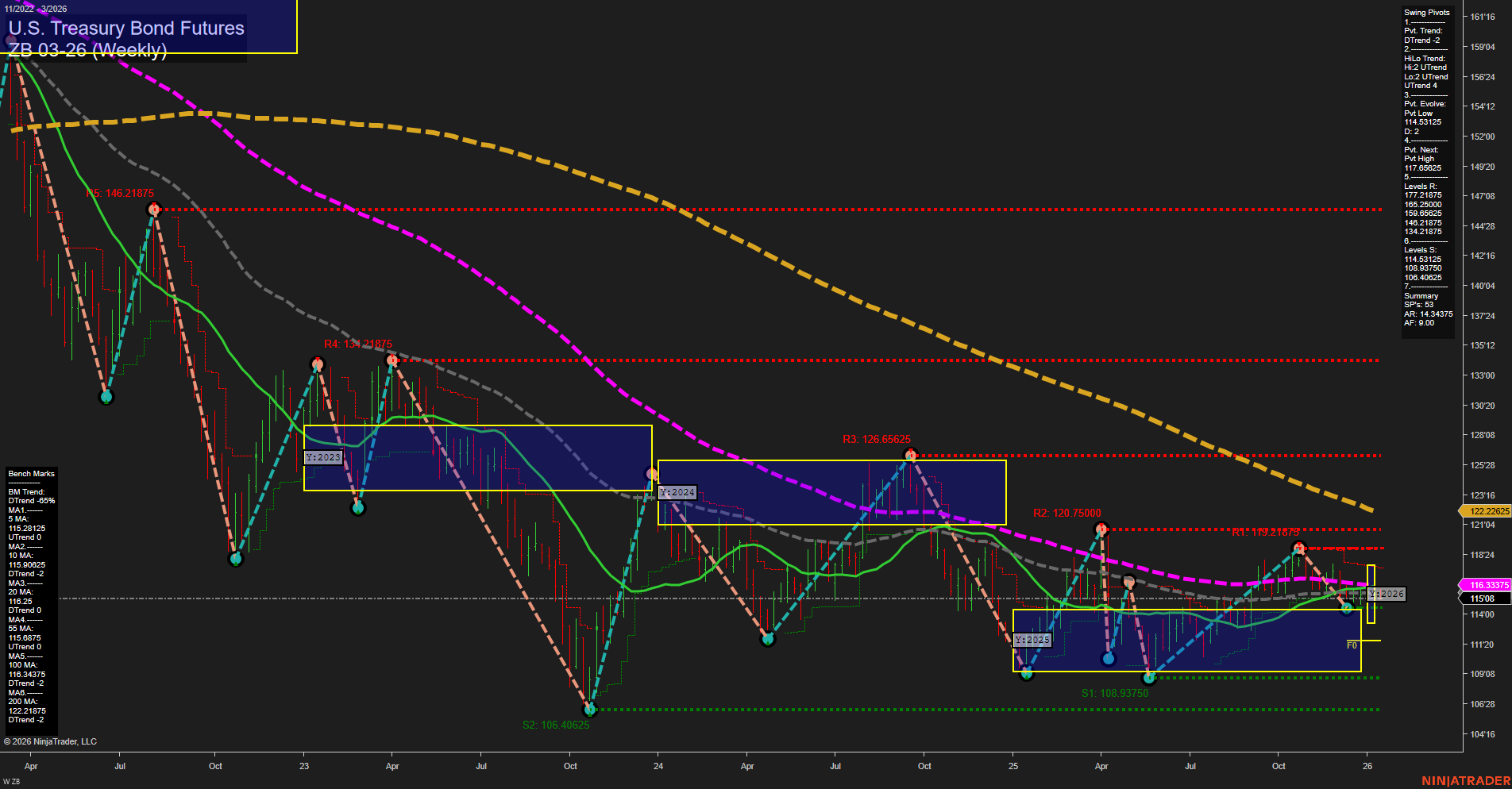

ZB U.S. Treasury Bond Futures Weekly Chart Analysis: 2026-Jan-12 07:23 CT

Price Action

- Last: 122.22625,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2026

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt Low 114.3125,

- 4. Pvt. Next: Pvt High 117.08625,

- 5. Levels R: 146.21875, 139.21875, 134.421875, 126.65625, 120.75000, 119.21875, 117.08625,

- 6. Levels S: 115.890625, 115.21875, 114.3125, 108.9375, 108.40625, 106.40625.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 115.21875 Down Trend,

- (Intermediate-Term) 10 Week: 115.890625 Up Trend,

- (Long-Term) 20 Week: 116.33375 Up Trend,

- (Long-Term) 55 Week: 115.8875 Up Trend,

- (Long-Term) 100 Week: 114.34375 Up Trend,

- (Long-Term) 200 Week: 122.21875 Down Trend.

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

The ZB U.S. Treasury Bond Futures weekly chart shows a market in transition. Price action is currently consolidating within a neutral zone, with medium-sized bars and slow momentum, indicating a lack of strong directional conviction. The short-term swing pivot trend is down, but the intermediate-term HiLo trend remains up, suggesting a possible counter-trend pullback within a broader recovery attempt. Key resistance levels are clustered above, with the next significant pivot high at 117.08625 and major resistance at 120.75 and 126.65. Support is layered below, with the most immediate at 115.89 and 114.31. Moving averages show mixed signals: short-term benchmarks are split, while most long-term averages are trending up except for the 200-week, which is still in a downtrend. Overall, the market is in a choppy, range-bound phase, with no clear breakout or breakdown, reflecting indecision as traders weigh macroeconomic factors and potential policy shifts. The technical structure suggests watching for a resolution of this consolidation, as a break of key support or resistance could set the tone for the next major swing.

Chart Analysis ATS AI Generated: 2026-01-12 07:23 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.