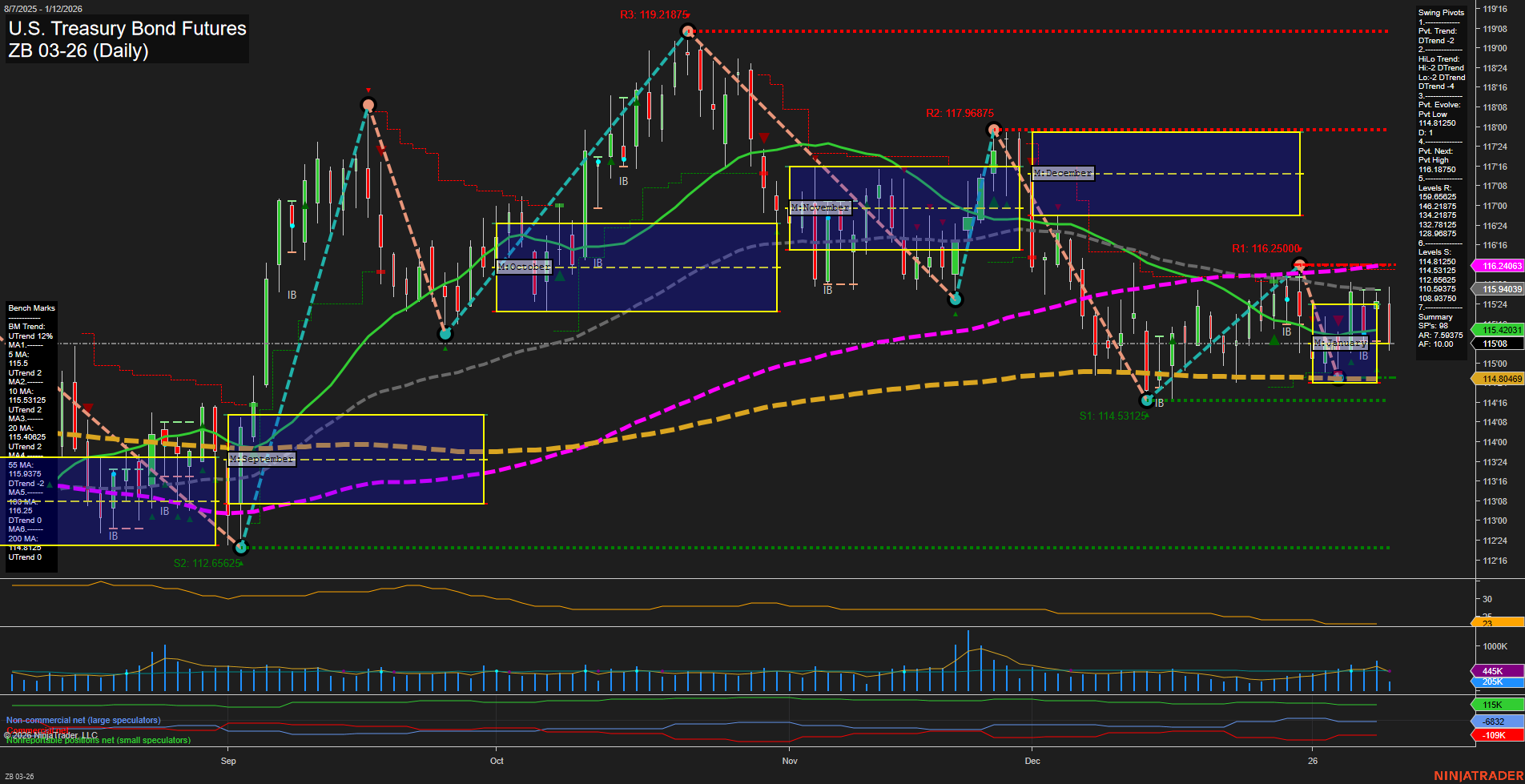

The ZB U.S. Treasury Bond Futures daily chart currently reflects a market in consolidation with a slight bearish tilt on the intermediate-term horizon. Price action is subdued, with medium-sized bars and slow momentum, indicating a lack of strong directional conviction. Both the weekly and monthly session fib grids (WSFG, MSFG) show a neutral trend and bias, suggesting that neither bulls nor bears have a clear advantage in the short to intermediate term. Swing pivot analysis highlights a short-term and intermediate-term downtrend (DTrend), with the most recent pivot low at 114.81250 and the next potential reversal at the pivot high of 116.25000. Resistance levels are stacked above at 116.25000, 117.96875, and 119.21875, while support is found at 114.81250, 114.53125, and 112.65625. Daily benchmarks show short-term moving averages (5 and 10 day) in an uptrend, but intermediate and long-term averages (20, 55, 100 day) remain in a downtrend, reflecting ongoing pressure from higher timeframes. The 200-day MA is slightly supportive, but not enough to shift the long-term outlook away from neutral. ATR and volume metrics indicate moderate volatility and participation, with no signs of a breakout or breakdown. The overall environment is characterized by choppy, range-bound price action, with the market testing support and resistance levels but failing to establish a decisive trend. In summary, the ZB futures market is in a holding pattern, with short-term neutrality, intermediate-term bearishness, and a long-term neutral stance. Swing traders may observe for a break of key pivot levels or a shift in momentum to signal the next directional move.