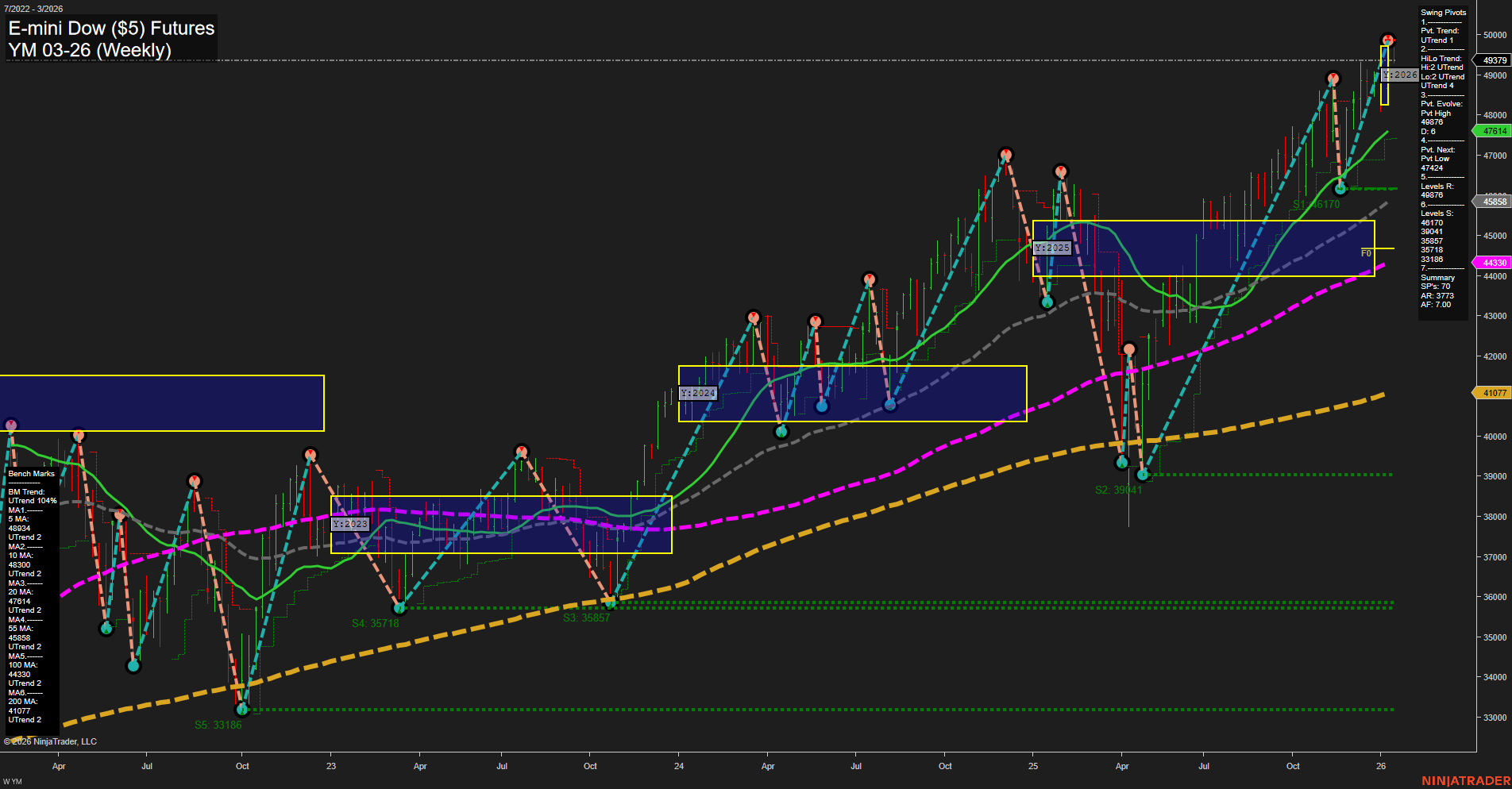

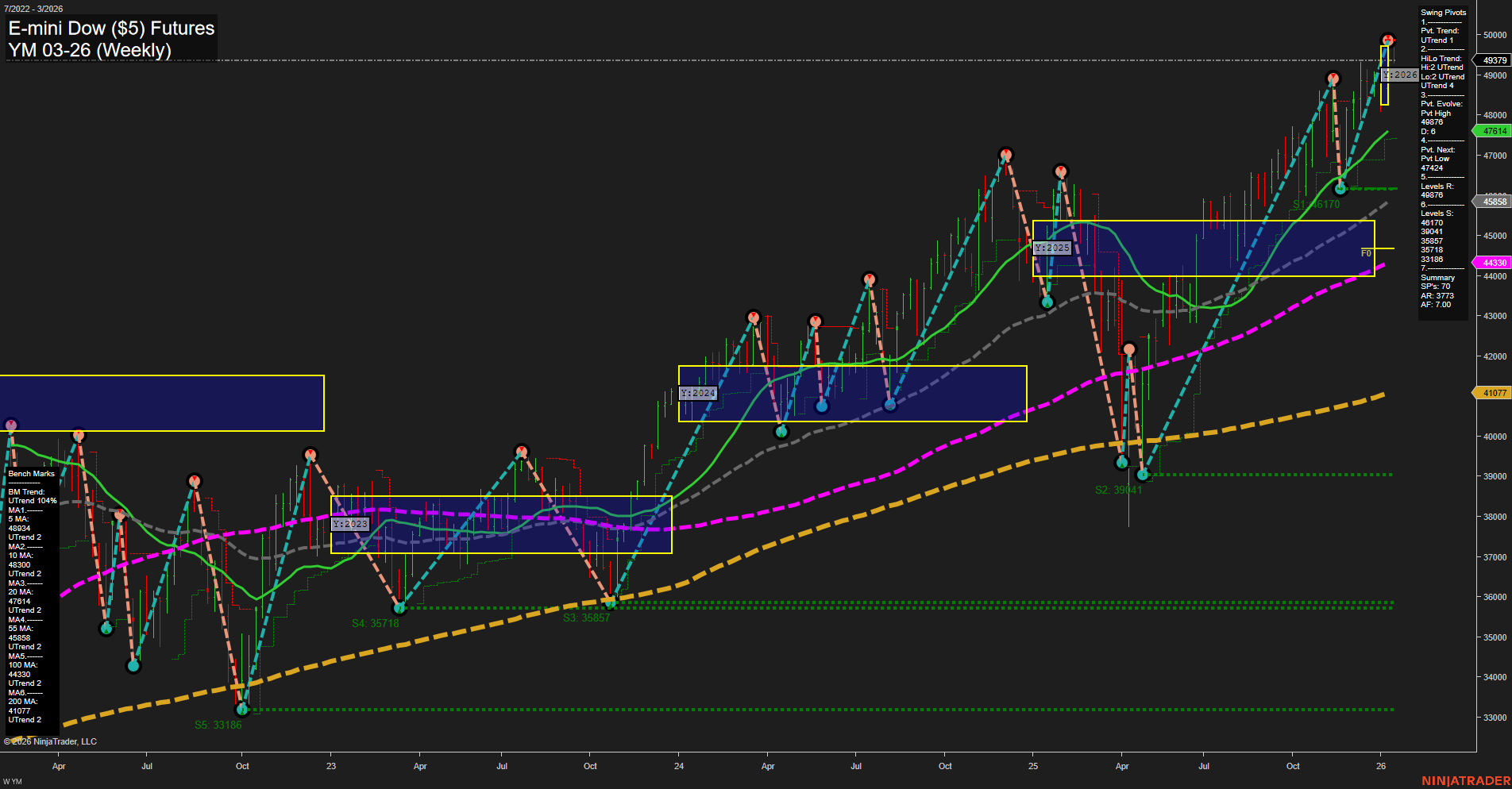

YM E-mini Dow ($5) Futures Weekly Chart Analysis: 2026-Jan-12 07:22 CT

Price Action

- Last: 49,379,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: -34%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: 52%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: 5%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 49,379,

- 4. Pvt. Next: Pvt low 47,624,

- 5. Levels R: 45,588, 43,632, 41,714,

- 6. Levels S: 39,441, 35,857, 35,718, 33,186.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 48,034 Up Trend,

- (Intermediate-Term) 10 Week: 47,300 Up Trend,

- (Long-Term) 20 Week: 45,633 Up Trend,

- (Long-Term) 55 Week: 43,632 Up Trend,

- (Long-Term) 100 Week: 41,714 Up Trend,

- (Long-Term) 200 Week: 41,077 Up Trend.

Recent Trade Signals

- 12 Jan 2026: Short YM 03-26 @ 49,352 Signals.USAR.TR120

- 05 Jan 2026: Long YM 03-26 @ 48,675 Signals.USAR-MSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The YM E-mini Dow futures weekly chart shows a strong long-term and intermediate-term uptrend, supported by all major moving averages trending higher and price action consistently above key benchmarks. The swing pivot structure confirms an ongoing uptrend, with the most recent pivot high at 49,379 and the next potential support at 47,624. Despite a short-term pullback indicated by the WSFG trend turning down and price dipping below the weekly NTZ, momentum remains fast and bars are large, suggesting volatility and active participation. Recent trade signals reflect mixed short-term direction but continued intermediate-term strength. The market is experiencing a classic trend continuation phase with periodic pullbacks, typical of a strong bull cycle, and is currently testing upper resistance levels after a significant rally. The overall structure favors the bulls on higher timeframes, while short-term traders may see choppy or corrective action as the market digests recent gains.

Chart Analysis ATS AI Generated: 2026-01-12 07:23 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.