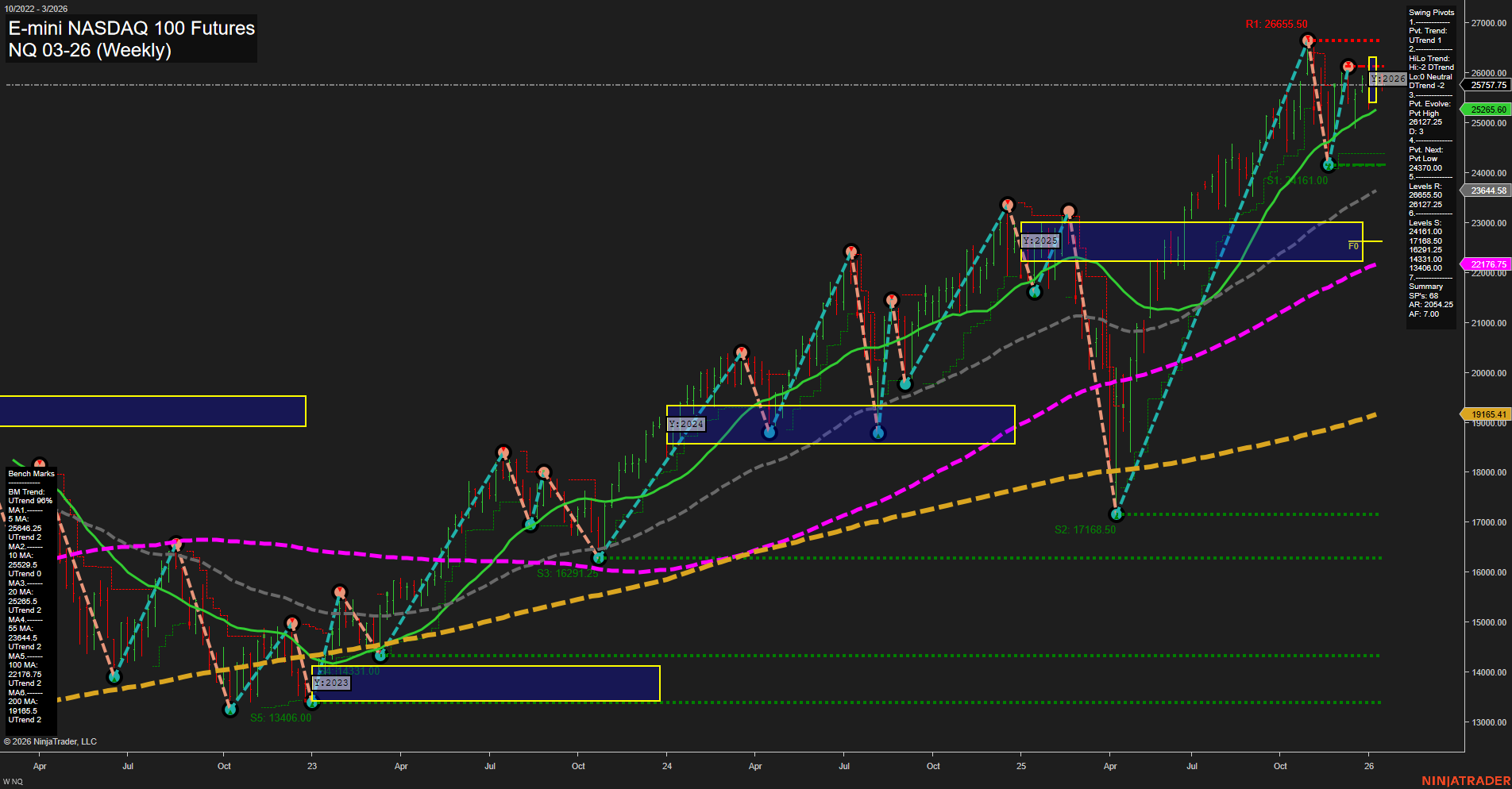

The NQ E-mini NASDAQ 100 Futures weekly chart shows a market in a consolidation phase after a strong rally, with price currently trading just below recent highs and above key moving averages. Short-term momentum is average, and the most recent bars are medium-sized, reflecting a pause after a prior upward move. The Weekly Session Fib Grid (WSFG) trend is down, with price below the NTZ center, suggesting short-term resistance and a lack of immediate bullish momentum. However, the Monthly Session Fib Grid (MSFG) remains up, indicating that the intermediate-term trend is still positive, supported by a series of higher lows and recent long trade signals. The Yearly Session Fib Grid (YSFG) trend is slightly down, with price just below the yearly NTZ, reflecting a neutral to cautious long-term outlook. Swing pivot analysis highlights an uptrend in the short-term pivot structure, but the intermediate-term HiLo trend is neutral, with the next significant pivot low at 23464.58 serving as a key support level. Resistance is layered above at 26655.50 and 26127.25, while support is well-defined below current price. All benchmark moving averages from 5-week to 200-week are in uptrends, reinforcing the underlying strength of the longer-term trend despite the current consolidation. Recent trade signals have been predominantly long, aligning with the intermediate-term bullish bias. Overall, the market is in a transition zone: short-term signals are mixed, intermediate-term remains bullish, and long-term is neutral as price consolidates near highs. This environment is characterized by potential for both trend continuation and deeper pullbacks, with volatility likely to persist as the market tests key resistance and support levels.