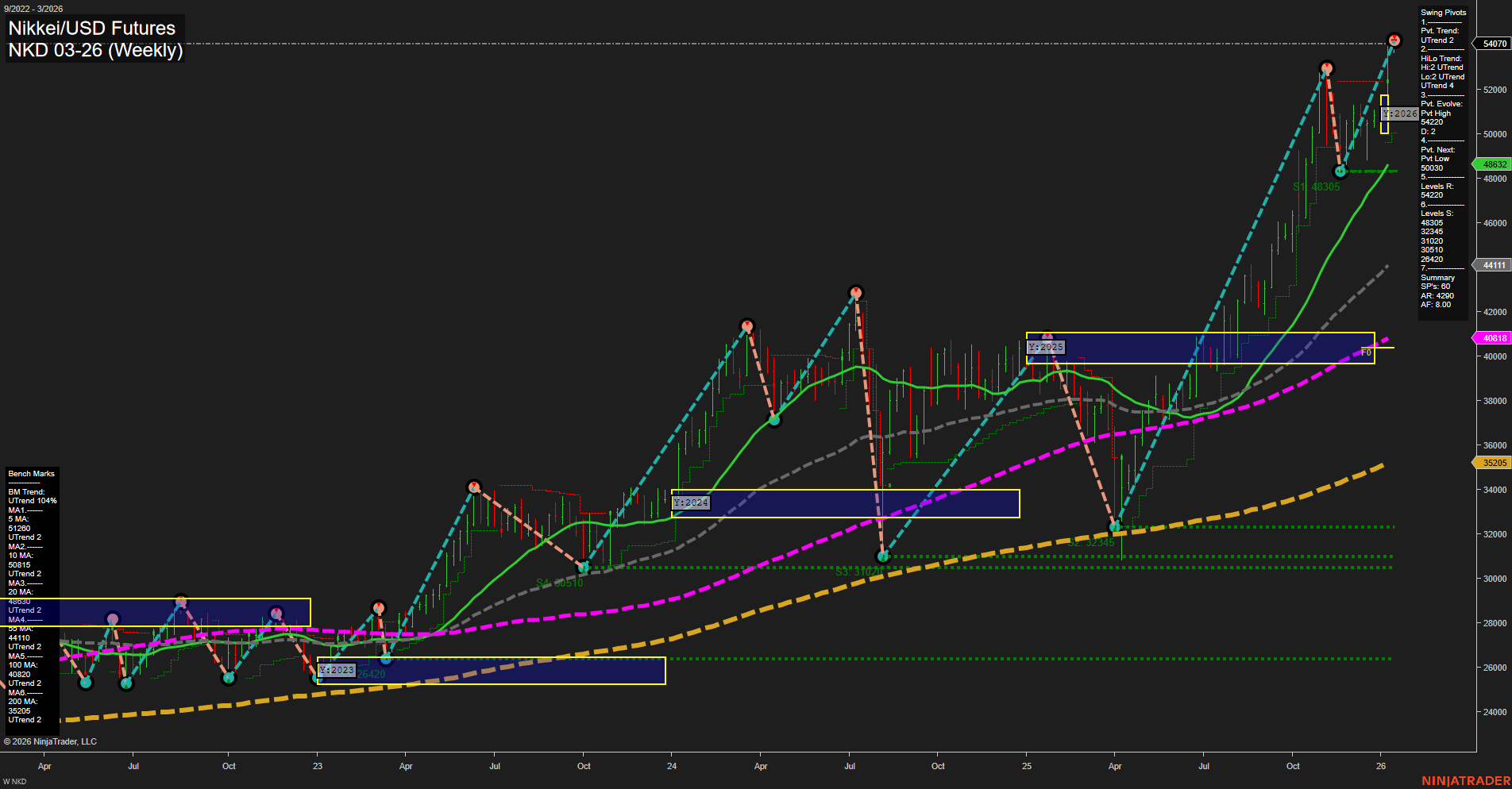

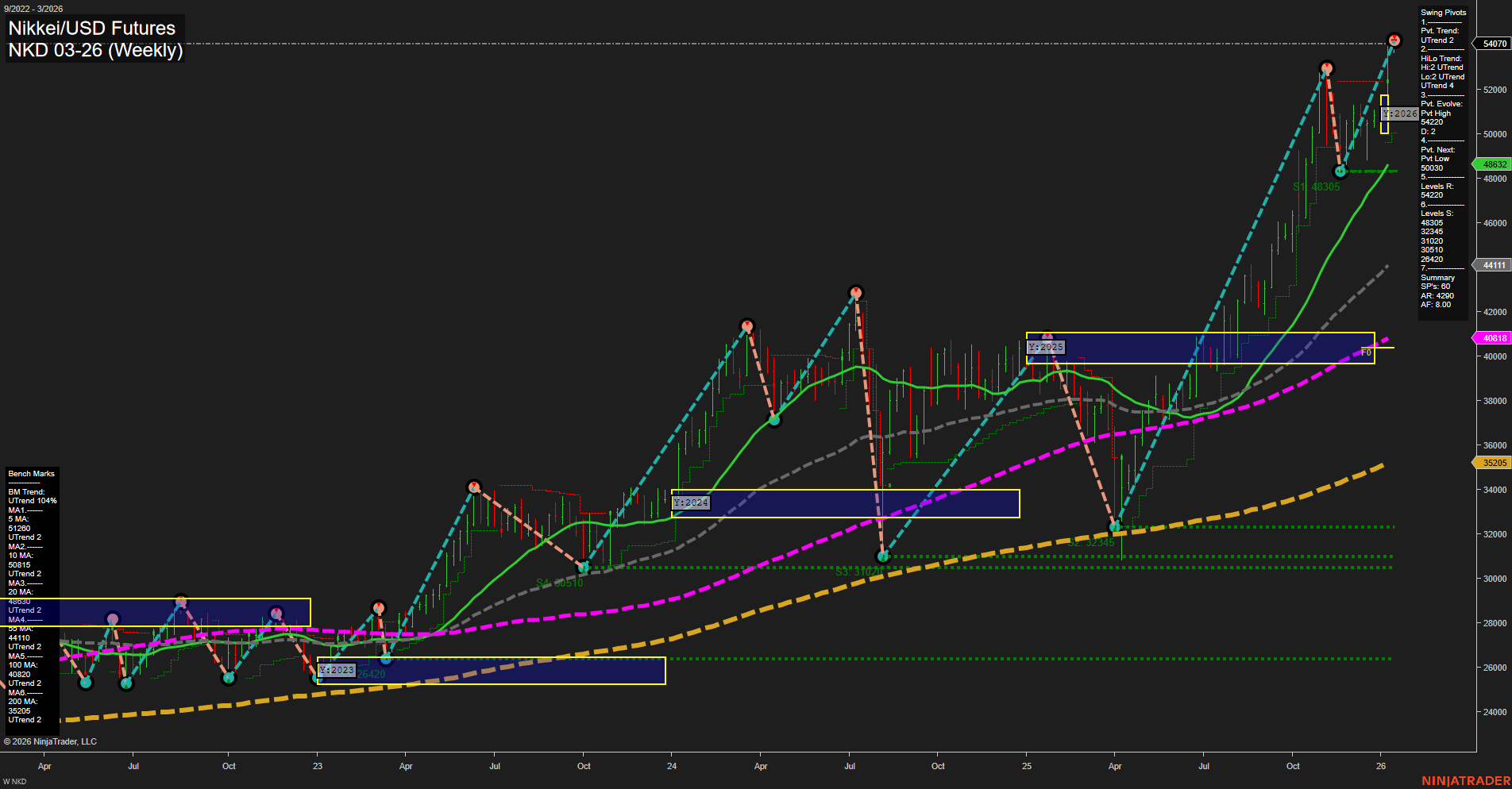

NKD Nikkei/USD Futures Weekly Chart Analysis: 2026-Jan-12 07:13 CT

Price Action

- Last: 54,070,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: 25%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: 86%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: 43%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 54,070,

- 4. Pvt. Next: Pvt low 48,305,

- 5. Levels R: 54,070, 52,226,

- 6. Levels S: 48,305, 44,111, 41,018, 36,420, 35,205.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 51,620 Up Trend,

- (Intermediate-Term) 10 Week: 50,315 Up Trend,

- (Long-Term) 20 Week: 48,352 Up Trend,

- (Long-Term) 55 Week: 44,111 Up Trend,

- (Long-Term) 100 Week: 41,018 Up Trend,

- (Long-Term) 200 Week: 35,205 Up Trend.

Recent Trade Signals

- 12 Jan 2026: Long NKD 03-26 @ 53,945 Signals.USAR-WSFG

- 09 Jan 2026: Long NKD 03-26 @ 52,135 Signals.USAR.TR120

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The NKD Nikkei/USD Futures weekly chart is displaying a strong bullish structure across all timeframes. Price action is characterized by large bars and fast momentum, indicating robust buying interest and a clear uptrend. The price is trading well above all key moving averages, with each benchmark (5, 10, 20, 55, 100, and 200 week) in a confirmed uptrend, reinforcing the strength of the current rally. The swing pivot analysis shows the most recent pivot high at 54,070, with the next significant support at 48,305, suggesting a wide range for potential retracements. Both the short-term and intermediate-term trends are up, as confirmed by the WSFG and MSFG grids, with price holding above the NTZ/F0% levels. Recent trade signals have triggered new long entries, aligning with the prevailing bullish momentum. The market has demonstrated a series of higher highs and higher lows, with no immediate signs of exhaustion or reversal. Overall, the technical landscape supports a continuation of the bullish trend, with any pullbacks likely to be viewed as corrective within a broader uptrend.

Chart Analysis ATS AI Generated: 2026-01-12 07:13 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.