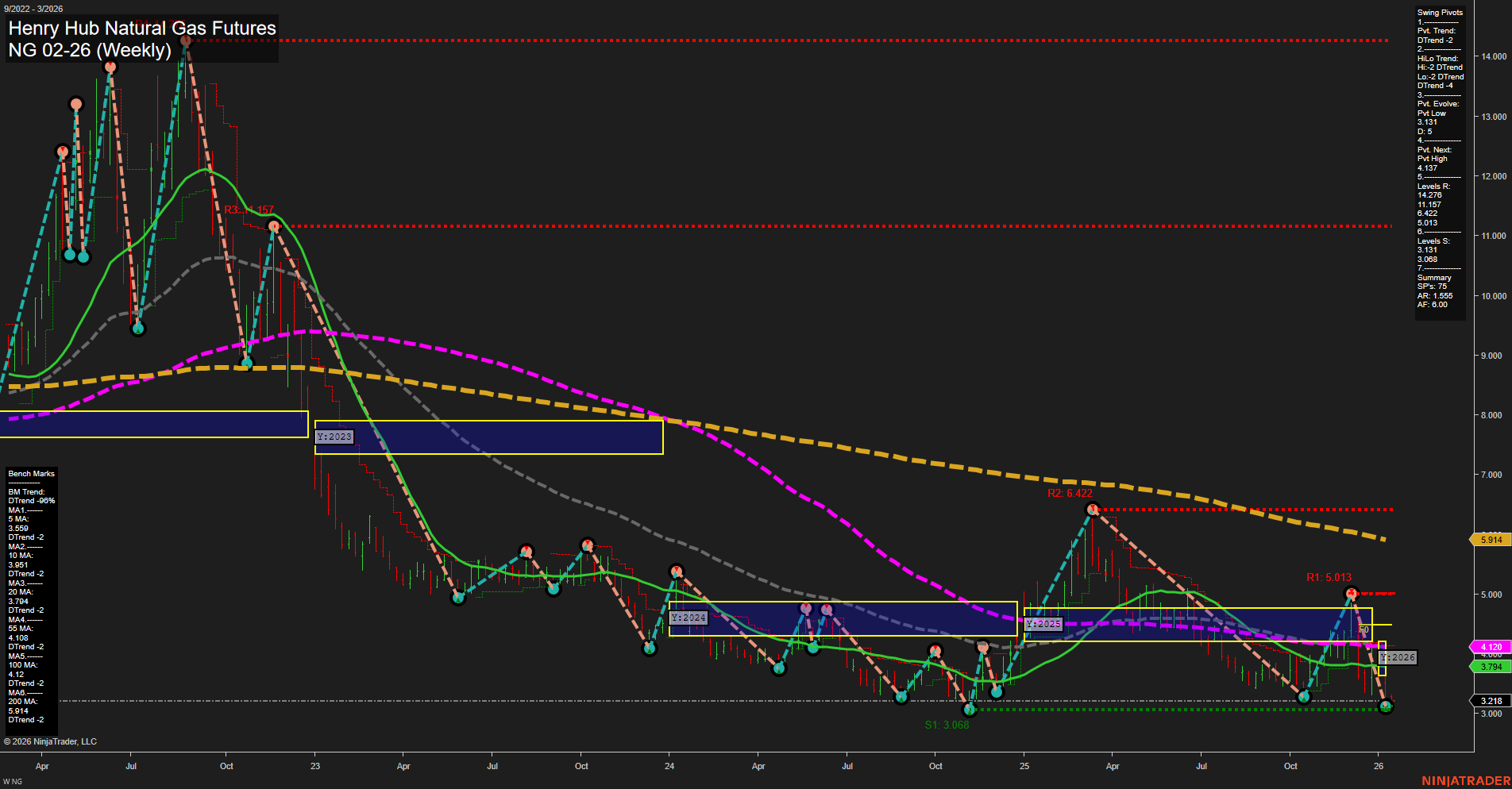

The chart reflects a persistent bearish environment across all timeframes for Henry Hub Natural Gas Futures. Price action is subdued with slow momentum and medium-sized bars, indicating a lack of strong buying interest. All major session fib grid trends (weekly, monthly, yearly) are negative, with price consistently below their respective NTZ/F0% levels, reinforcing the prevailing downtrend. Swing pivot analysis confirms a dominant downtrend in both short- and intermediate-term, with the most recent pivot low at 3.131 and the next potential resistance at 4.137. Key resistance levels remain far above current price, while support is clustered just below, suggesting limited downside before a potential technical bounce. All benchmark moving averages are trending down, with price trading below each, further confirming the bearish structure. The market appears to be in a prolonged corrective phase, with no immediate signs of reversal, and is likely experiencing continued pressure from oversupply, weak seasonal demand, or broader macroeconomic headwinds. Volatility remains contained, and the absence of strong reversal signals points to ongoing consolidation or further downside risk in the near term.