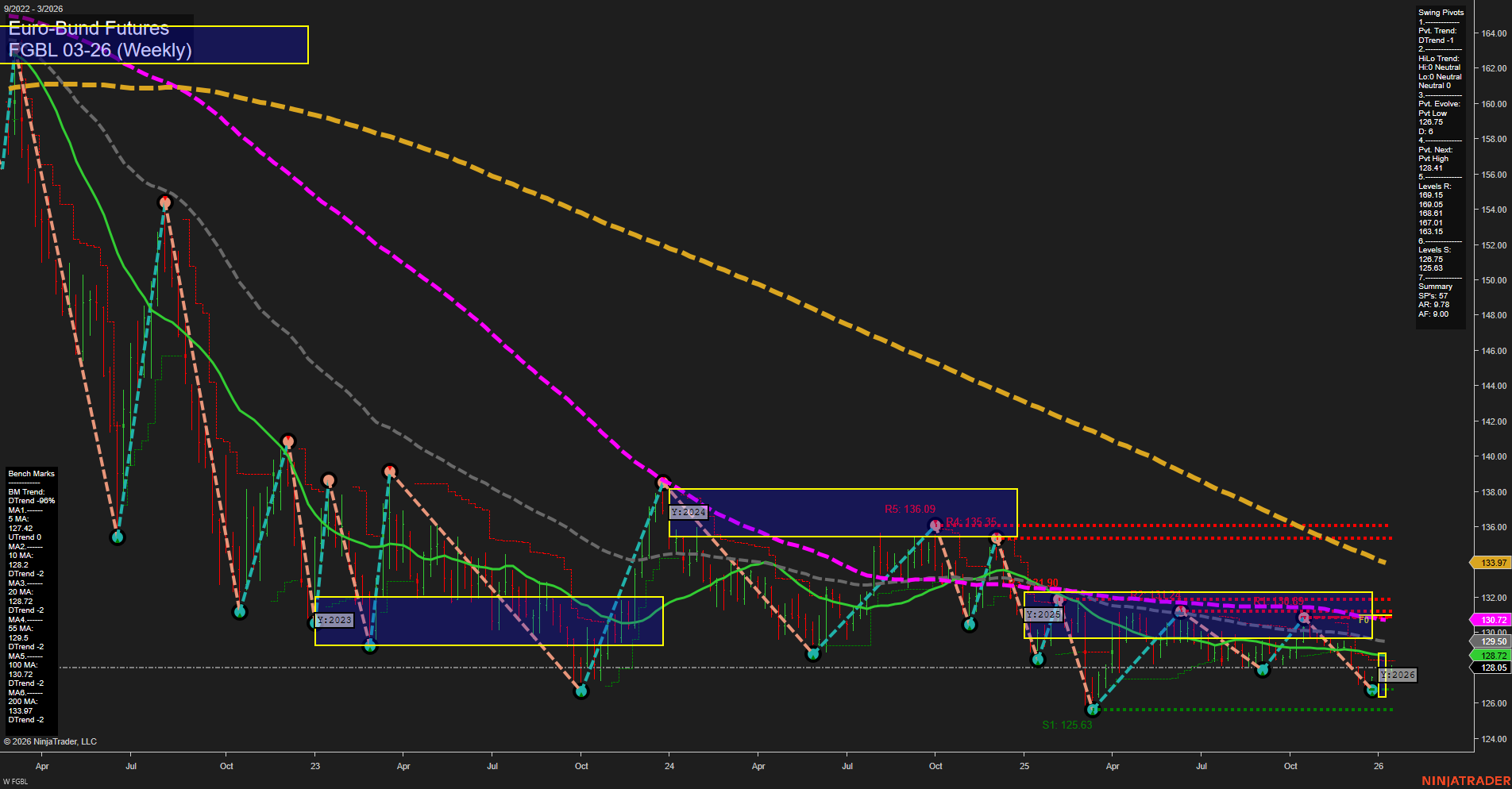

The FGBL Euro-Bund Futures weekly chart shows a market in transition. Price action is currently consolidating near the lower end of the recent range, with slow momentum and medium-sized bars, suggesting a lack of strong conviction from either buyers or sellers. The short-term and intermediate-term Fib grid trends (WSFG and MSFG) are both up, with price holding above their respective NTZ center lines, indicating some underlying bullish bias in the near term. However, the swing pivot trend remains down (DTrend) on the short-term, and the intermediate-term HiLo trend is neutral, reflecting indecision and a lack of clear directional follow-through. Key resistance levels are clustered above at 130.15, 132.81, and 133.07, while support is found at 128.05, 127.65, and 126.75. The most recent swing low at 126.75 and swing high at 132.81 define the current trading range. All major weekly moving averages (5, 10, 20, 55, 100, 200) are trending down, reinforcing a bearish long-term structure despite the recent short-term upward signals. Recent trade signals have triggered long entries, but these are counter to the prevailing long-term downtrend, suggesting any rallies may face significant overhead resistance. Overall, the market is in a consolidation phase with a neutral short- and intermediate-term outlook, but the dominant long-term trend remains bearish. Price is attempting to stabilize and possibly form a base, but sustained upside will require a break above multiple resistance levels and a shift in the moving average trends. The environment is characterized by choppy, range-bound action with potential for both mean reversion and trend continuation moves depending on how price reacts to the key support and resistance zones.