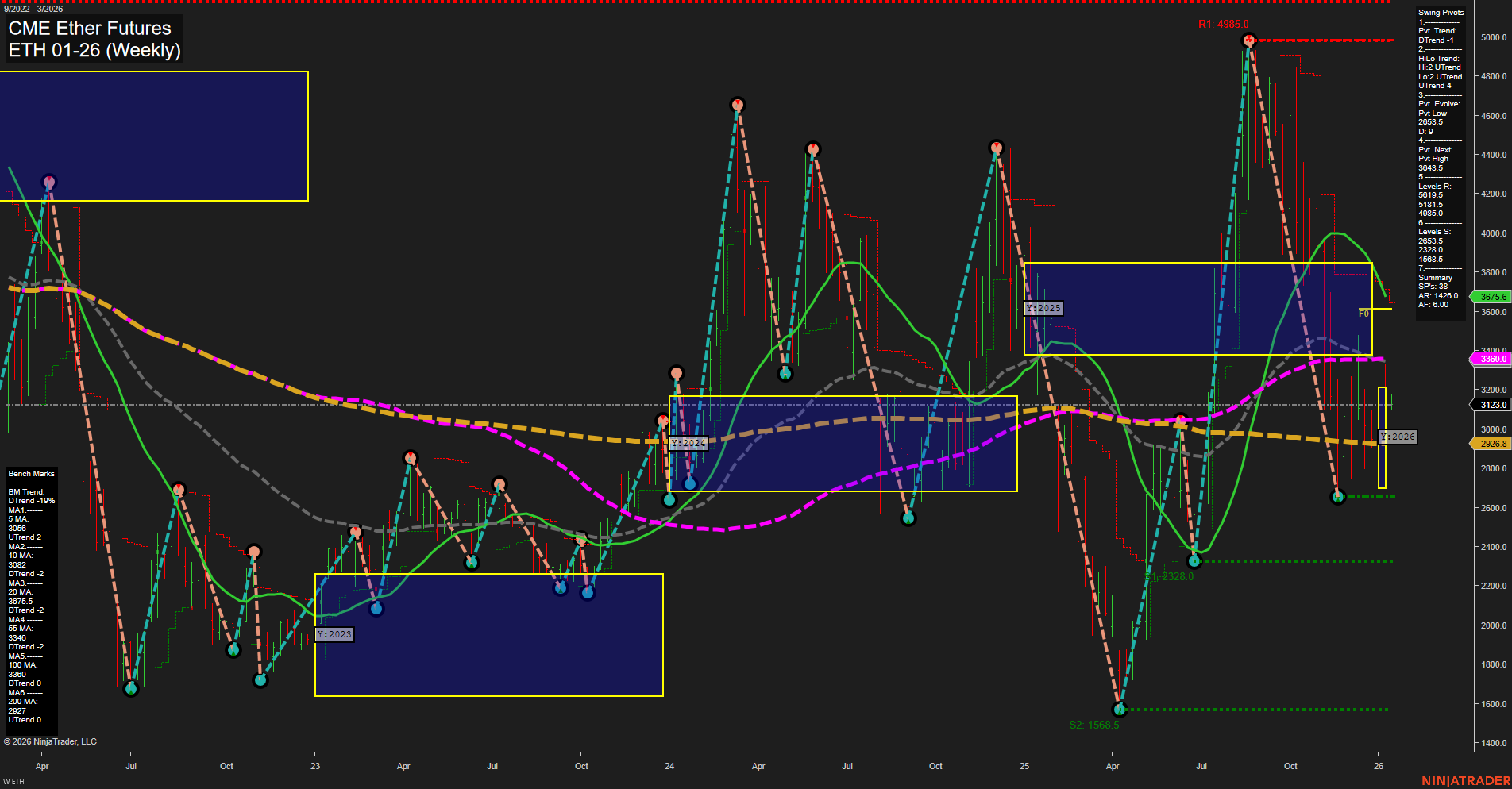

The weekly chart for ETH CME Ether Futures as of January 12, 2026, shows a market in transition. Price is currently at 3123.0, with medium-sized bars and slow momentum, indicating a pause or consolidation after recent volatility. The short-term Weekly Session Fib Grid (WSFG) and intermediate-term Monthly Session Fib Grid (MSFG) both show price above their respective NTZ/F0% levels, with uptrends in place, suggesting underlying bullish structure. However, the short-term swing pivot trend is down, reflecting recent pullbacks or corrective action, while the intermediate-term HiLo trend remains up, supporting a broader bullish bias. Key resistance levels are at 3285.5, 3643.5, and the major swing high at 4985.0, while support is found at 2328.0 and 1568.5, highlighting a wide trading range. Most weekly benchmarks (5, 10, 20, 55, 100 week MAs) are in downtrends, except for the 200-week MA, which is trending up and may act as a long-term support base. Recent trade signals have been mixed, with both long and short entries triggered in the past week, reflecting choppy, range-bound conditions and indecision at current levels. Overall, the short-term outlook is neutral as the market digests recent moves and tests key levels. The intermediate and long-term trends remain bullish, supported by higher lows and the persistence of uptrends in the session fib grids. The market appears to be in a consolidation phase within a larger uptrend, with potential for renewed upside if resistance levels are broken, but also risk of further retracement if support fails. Volatility and mixed signals suggest a period of price discovery, with traders watching for a decisive breakout or breakdown to confirm the next directional move.