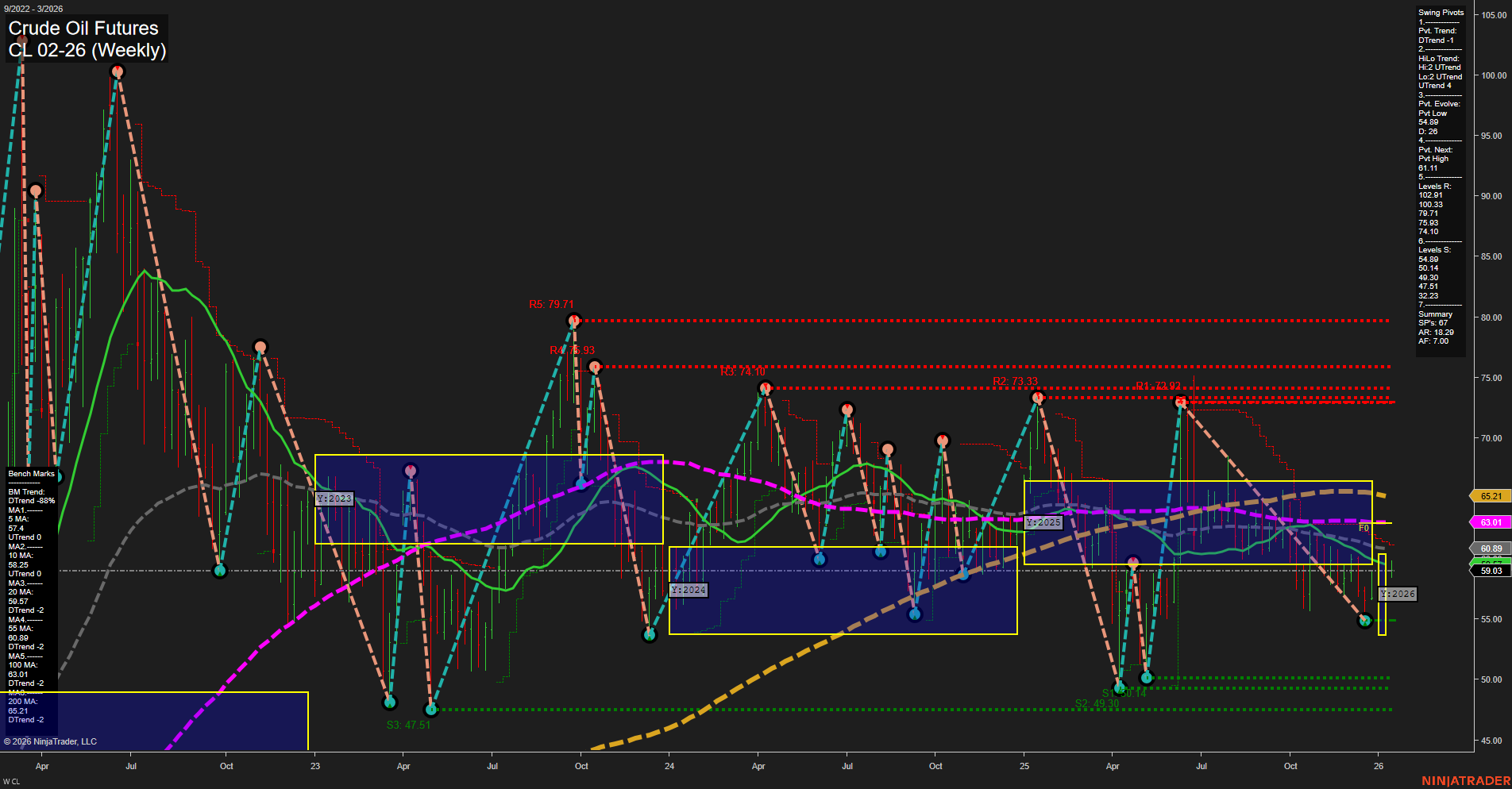

Crude oil futures are currently trading at 59.03, with medium-sized weekly bars and slow momentum, indicating a period of consolidation after recent volatility. The short-term WSFG trend is neutral, with price sitting at the NTZ center, suggesting indecision and a lack of clear directional bias in the immediate term. However, the intermediate-term MSFG and long-term YSFG both show price above their respective NTZ centers and are trending up, hinting at underlying bullishness on higher timeframes. Swing pivot analysis reveals a short-term downtrend, but the intermediate-term HiLo trend remains up, reflecting a market that is attempting to recover from recent lows. The most recent pivot low is at 58.28, with the next potential pivot high at 61.11, setting up a possible test of resistance if momentum improves. Key resistance levels are clustered in the 72-80 range, while support is well established below 54, with deeper levels down to the low 30s. All major weekly moving averages (5, 10, 20, 55, 100, 200) are in downtrends, reinforcing a bearish long-term structure despite the recent bounce. Recent trade signals have triggered long entries in early January, aligning with the intermediate-term uptrend and suggesting a possible short-term reversal attempt. Overall, the market is in a transitional phase: short-term action is neutral, intermediate-term is bullish, and long-term remains bearish. This reflects a market caught between a potential bottoming process and persistent overhead resistance, with price action likely to remain choppy until a decisive breakout or breakdown occurs.