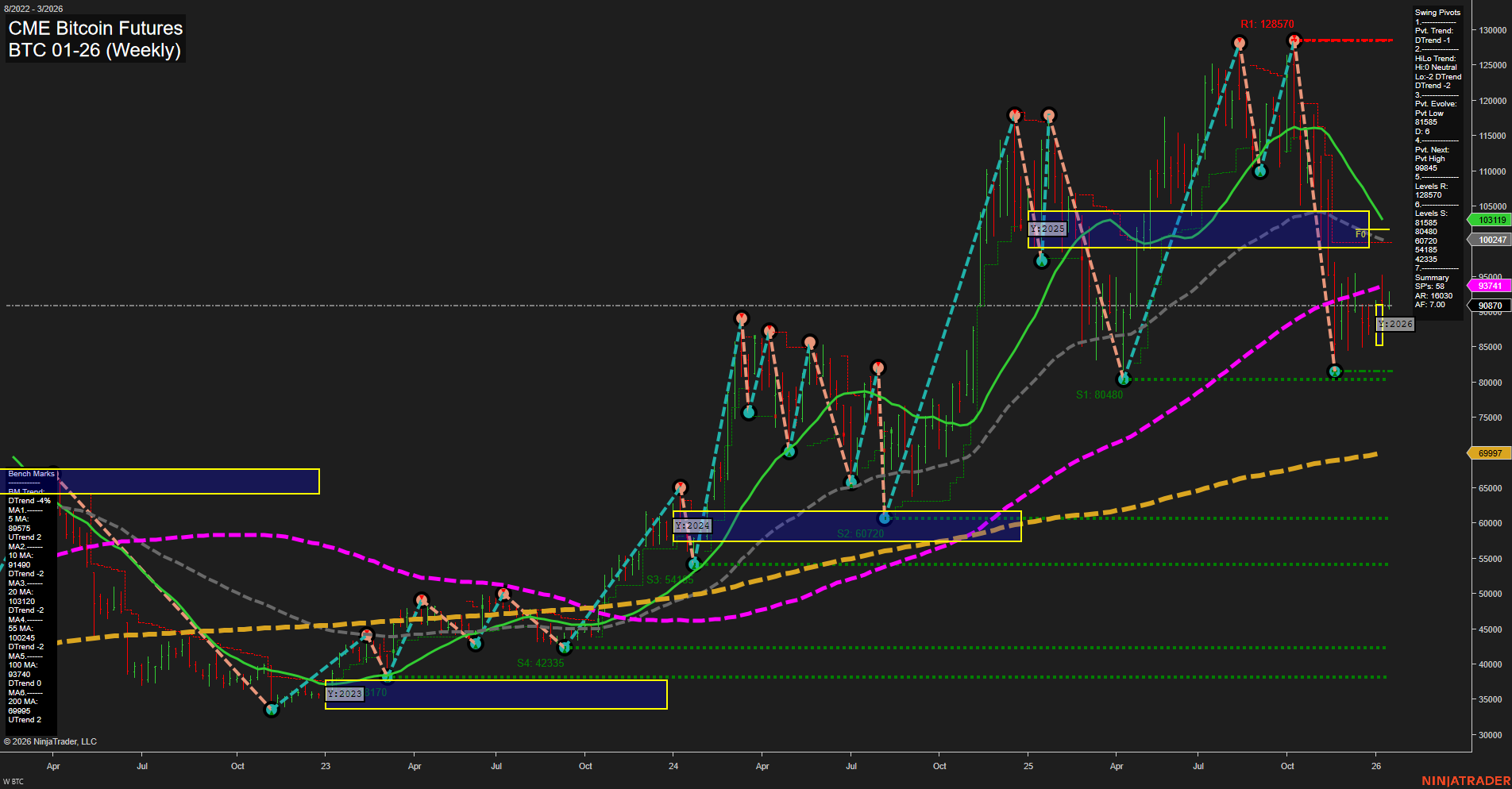

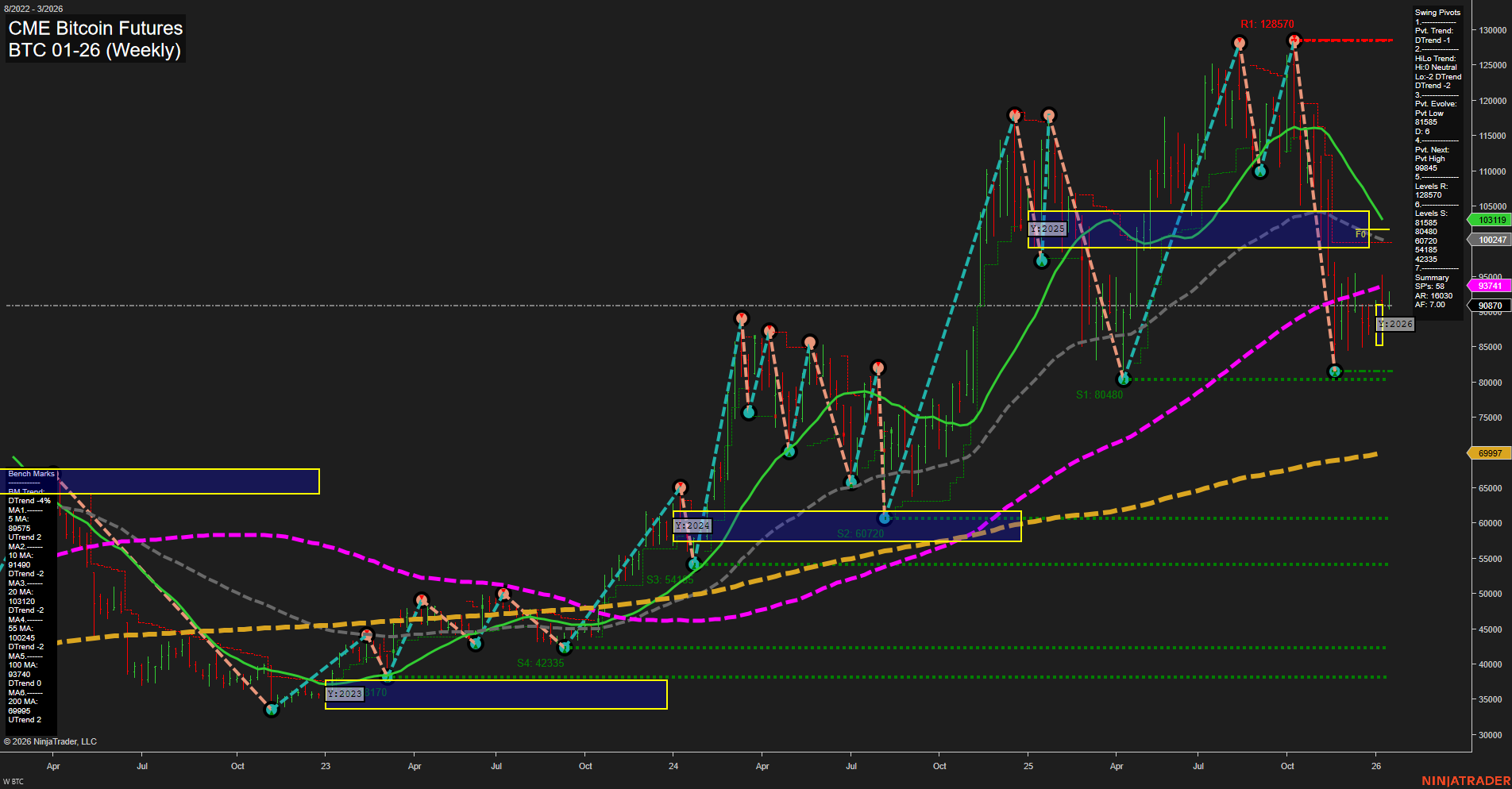

BTC CME Bitcoin Futures Weekly Chart Analysis: 2026-Jan-12 07:04 CT

Price Action

- Last: 93,741,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 3%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: 9%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: 9%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 90,870,

- 4. Pvt. Next: Pvt high 105,019,

- 5. Levels R: 128,570, 105,019, 98,445,

- 6. Levels S: 90,870, 80,480, 60,720, 54,400, 42,335.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 95,875 Down Trend,

- (Intermediate-Term) 10 Week: 102,447 Down Trend,

- (Long-Term) 20 Week: 100,599 Down Trend,

- (Long-Term) 55 Week: 93,091 Up Trend,

- (Long-Term) 100 Week: 69,997 Up Trend,

- (Long-Term) 200 Week: 42,066 Up Trend.

Recent Trade Signals

- 12 Jan 2026: Long BTC 01-26 @ 92,480 Signals.USAR-MSFG

- 12 Jan 2026: Long BTC 01-26 @ 91,450 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The BTC CME Bitcoin Futures weekly chart shows a market in transition. Price action is consolidating with medium-sized bars and slow momentum, indicating a pause after recent volatility. All Session Fib Grid trends (weekly, monthly, yearly) remain upward, with price holding above their respective NTZ/F0% levels, suggesting underlying bullish structure. However, both short-term and intermediate-term swing pivot trends are down, with the most recent pivot low at 90,870 acting as immediate support and the next resistance at 105,019. Key resistance remains at the prior high of 128,570.

Benchmark moving averages show a mixed picture: short and intermediate-term MAs (5, 10, 20 week) are in downtrends, reflecting recent corrective action, while longer-term MAs (55, 100, 200 week) are still trending up, supporting a bullish long-term outlook. Recent trade signals have triggered new long entries, aligning with the broader uptrend bias from the Session Fib Grids, but the market is currently digesting gains and testing support levels.

Overall, the chart suggests a consolidation phase within a larger uptrend, with the potential for renewed upside if support holds and momentum returns. The market is at a key inflection point, balancing between short-term corrective action and long-term bullish structure.

Chart Analysis ATS AI Generated: 2026-01-12 07:04 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.