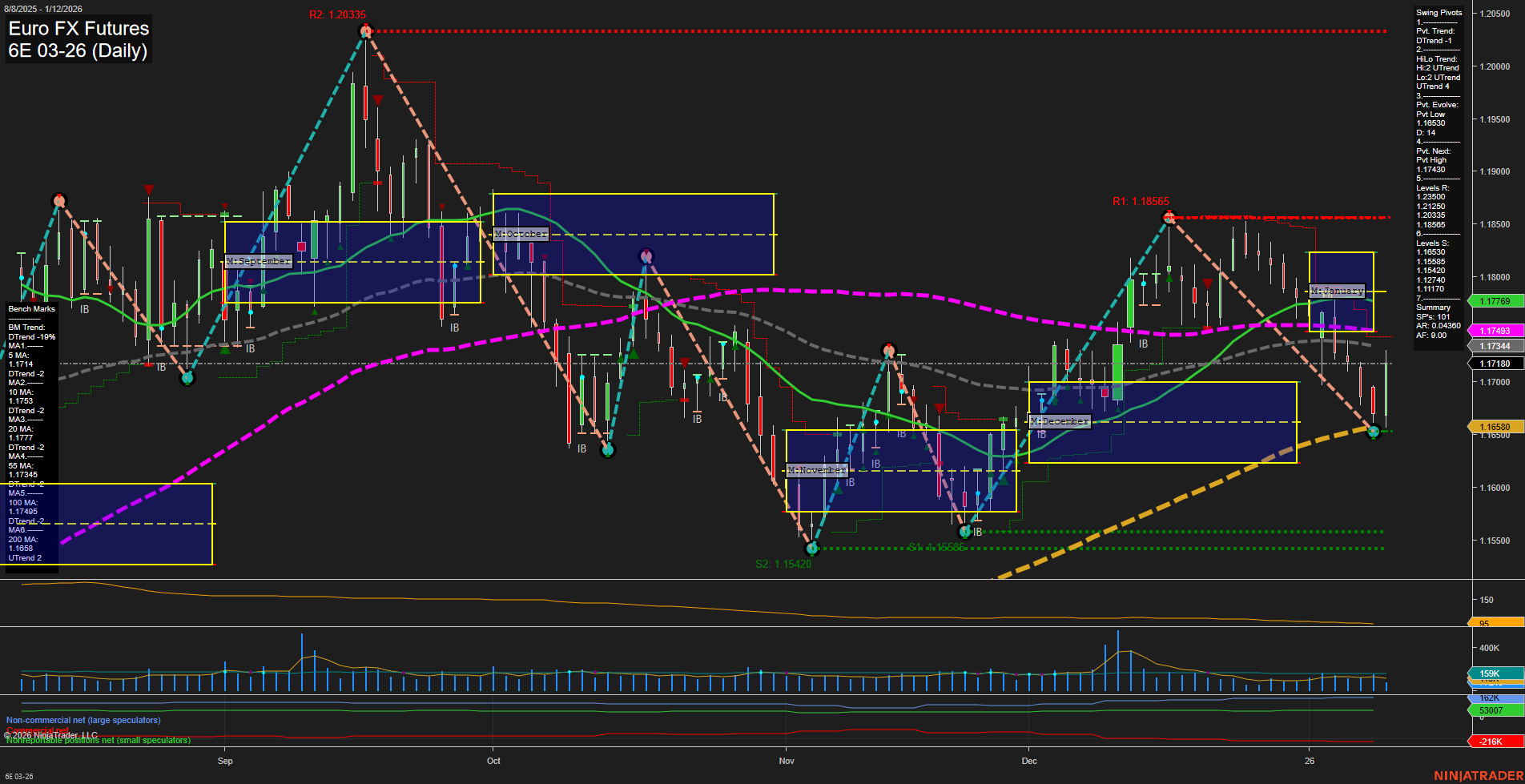

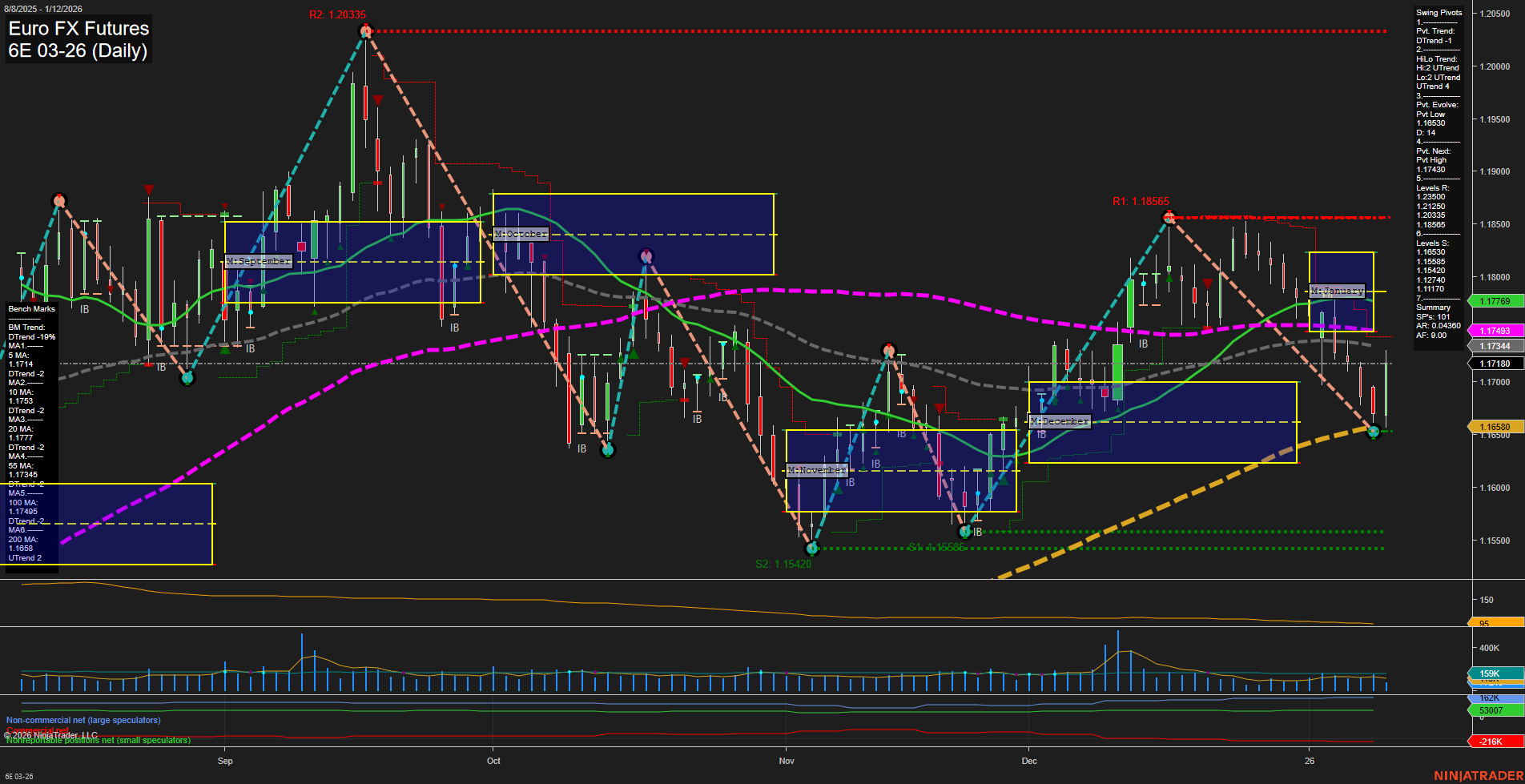

6E Euro FX Futures Daily Chart Analysis: 2026-Jan-12 07:02 CT

Price Action

- Last: 1.17180,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 46%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: -25%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2026

- Long-Term

- YSFG Current: -7%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 1.16580,

- 4. Pvt. Next: Pvt high 1.17430,

- 5. Levels R: 1.18565, 1.17430, 1.17230,

- 6. Levels S: 1.16580, 1.15420.

Daily Benchmarks

- (Short-Term) 5 Day: 1.17174 Down Trend,

- (Short-Term) 10 Day: 1.17777 Down Trend,

- (Intermediate-Term) 20 Day: 1.17769 Down Trend,

- (Intermediate-Term) 55 Day: 1.17435 Down Trend,

- (Long-Term) 100 Day: 1.1688 Up Trend,

- (Long-Term) 200 Day: 1.15745 Up Trend.

Additional Metrics

Recent Trade Signals

- 12 Jan 2026: Long 6E 03-26 @ 1.17045 Signals.USAR.TR120

- 12 Jan 2026: Short 6E 03-26 @ 1.1659 Signals.USAR-WSFG

- 07 Jan 2026: Short 6E 03-26 @ 1.1723 Signals.USAR-MSFG

- 05 Jan 2026: Short 6E 03-26 @ 1.17195 Signals.USAR.TR720

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

The 6E Euro FX Futures daily chart shows a market in transition, with mixed signals across timeframes. Short-term price action is weak, with slow momentum and a recent swing pivot low at 1.16580, while the short-term trend (WSFG) is up but the pivot trend is down, indicating choppy or indecisive action. Most short-term and intermediate-term moving averages are trending down, reinforcing a bearish bias in the near term. Intermediate-term (monthly) and long-term (yearly) session fib grid trends remain down, with price below key NTZ levels, suggesting the broader trend is still under pressure. However, the intermediate-term HiLo trend is up, hinting at potential for a bounce or consolidation phase. Resistance is clustered at 1.17430 and 1.18565, while support is at 1.16580 and 1.15420. Recent trade signals reflect this indecision, with both long and short entries triggered in close succession. Volatility (ATR) and volume (VOLMA) are moderate, indicating neither a breakout nor a collapse. Overall, the market is in a corrective or consolidative phase, with a bearish tilt in the short and long term, but some potential for intermediate-term stabilization or reversal if support holds and momentum improves.

Chart Analysis ATS AI Generated: 2026-01-12 07:02 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.