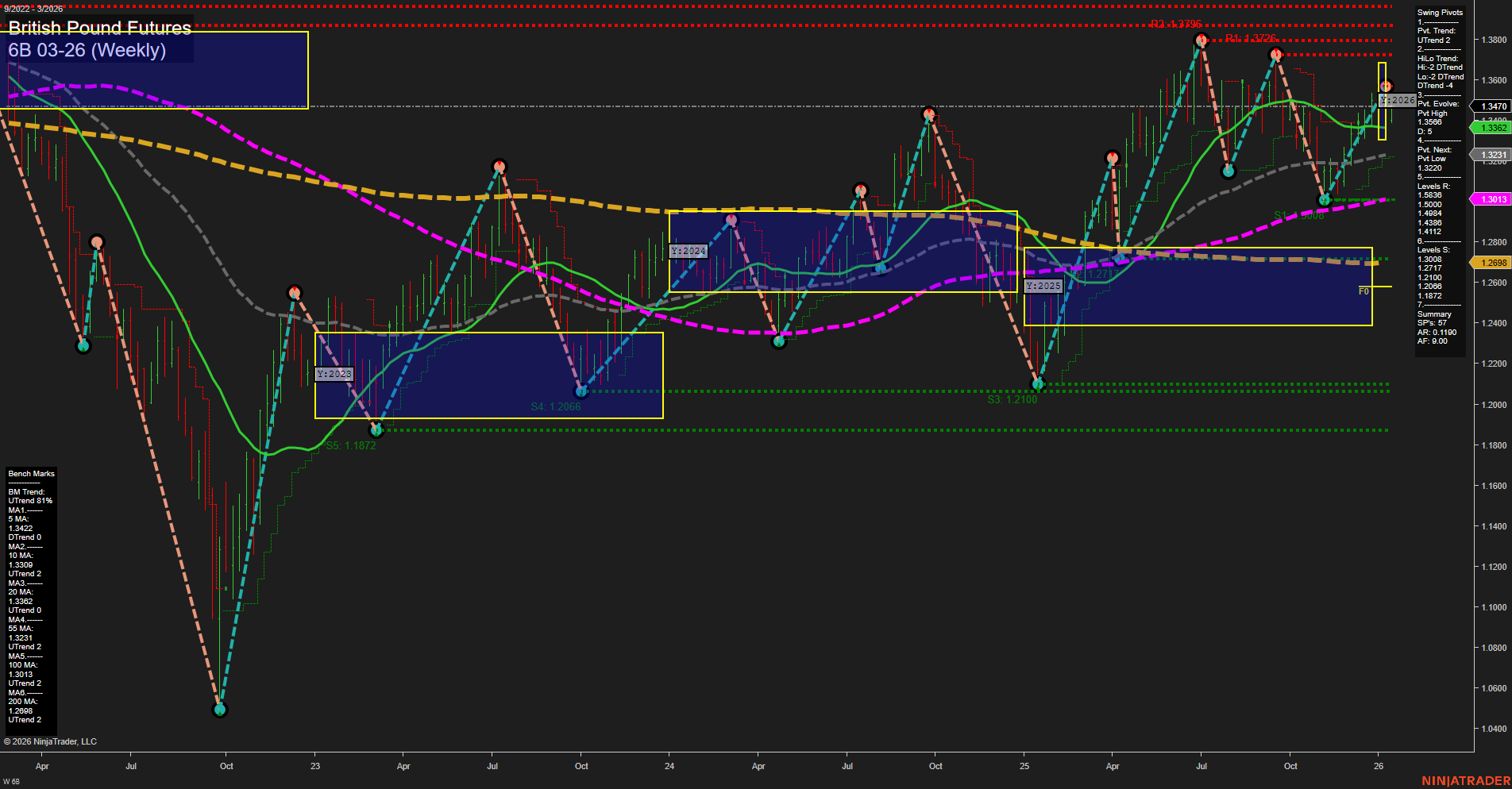

The British Pound Futures (6B) weekly chart shows a mixed but dynamic environment. Price action is currently at 1.3470 with medium-sized bars and average momentum, indicating a steady but not explosive move. The short-term WSFG trend is up, with price trading above the NTZ center, suggesting bullish sentiment in the near term. However, the intermediate-term MSFG and long-term YSFG both show price below their respective NTZ centers and a downtrend, highlighting underlying weakness or a possible retracement phase on higher timeframes. Swing pivots reveal a short-term uptrend, but the intermediate-term HiLo trend remains down, reflecting a market in transition. Resistance levels are clustered above at 1.3622, 1.3725, and 1.3796, while support is layered below at 1.3326, 1.3221, and further down to 1.2100, providing clear reference points for potential reversals or continuation. All benchmark moving averages from 5-week to 200-week are in uptrends, reinforcing the long-term bullish structure despite the current intermediate-term pullback. Recent trade signals are mixed, with both long and short entries triggered in close succession, reflecting the choppy and potentially volatile nature of the current market phase. Overall, the short-term outlook is bullish, supported by the uptrend in swing pivots and moving averages. The intermediate-term remains bearish due to the prevailing downtrend in the MSFG and HiLo trend. The long-term structure is bullish, as evidenced by the alignment of all major moving averages. The market appears to be in a consolidation or corrective phase within a broader uptrend, with potential for further upside if resistance levels are breached, but also risk of deeper pullbacks if support fails.