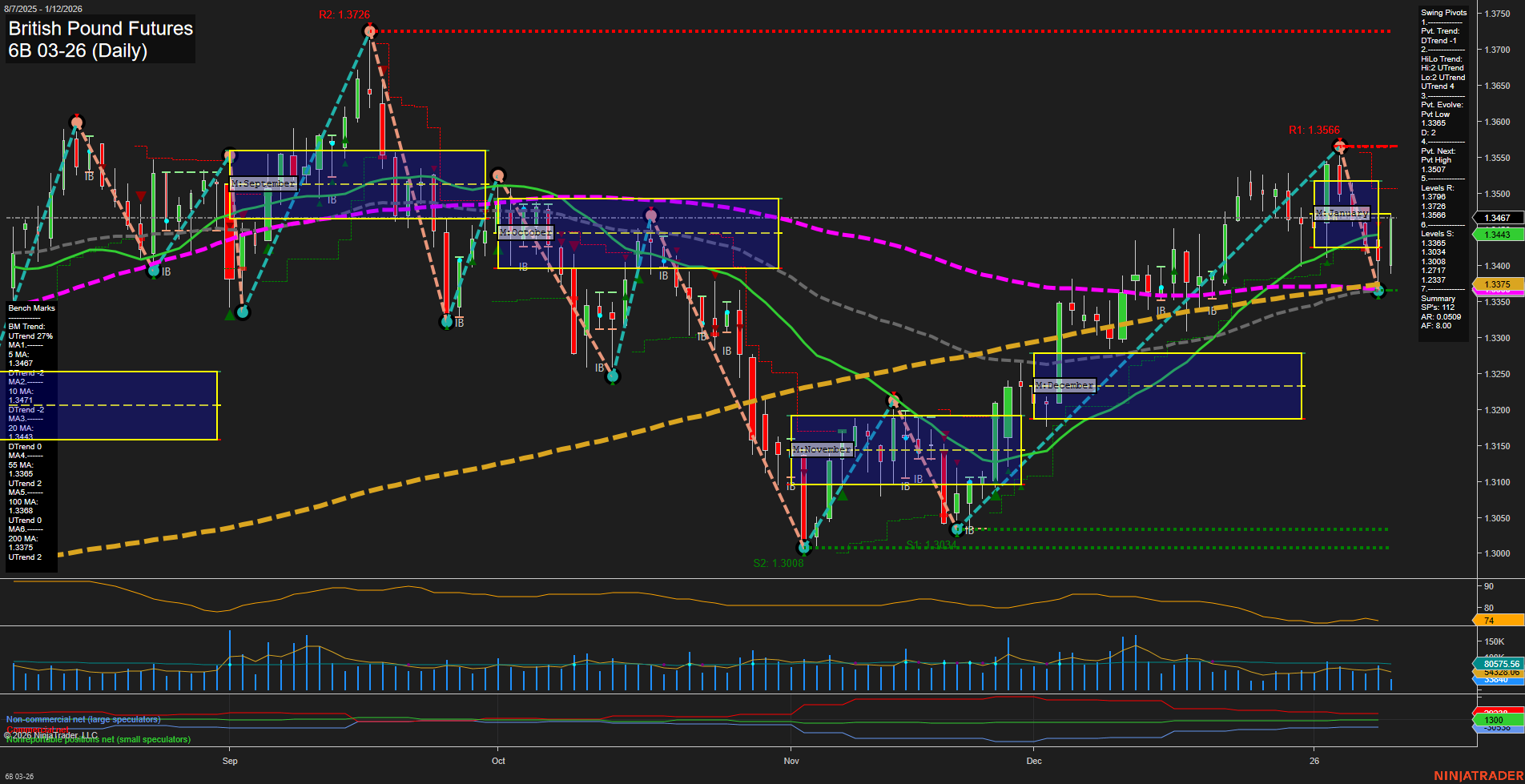

The British Pound Futures (6B) daily chart shows a mixed environment for swing traders. Price action is currently at 1.3467 with medium-sized bars and average momentum, indicating neither strong acceleration nor deceleration. The short-term WSFG trend is up, with price above the weekly NTZ, but the short-term swing pivot trend has shifted to down (DTrend), suggesting a recent pullback or correction within a broader uptrend. Intermediate and long-term MSFG and YSFG trends remain down, with price below their respective NTZs, but the HiLo swing trend is up, and all major moving averages from 20-day to 200-day are in uptrends, supporting a bullish bias for the intermediate and long-term outlooks. Recent trade signals reflect this indecision, with both long and short entries triggered in the last session, highlighting choppy or rotational price action. Key resistance levels are at 1.3726, 1.3566, and 1.3507, while support is found at 1.3365, 1.3308, and 1.3008. Volatility (ATR) and volume (VOLMA) are moderate, suggesting a balanced environment without extreme moves. Overall, the market is in a consolidation phase with a short-term neutral stance, but the underlying structure remains bullish for swing traders looking at the intermediate and long-term horizons. Watch for a decisive break above resistance or below support to confirm the next directional move.