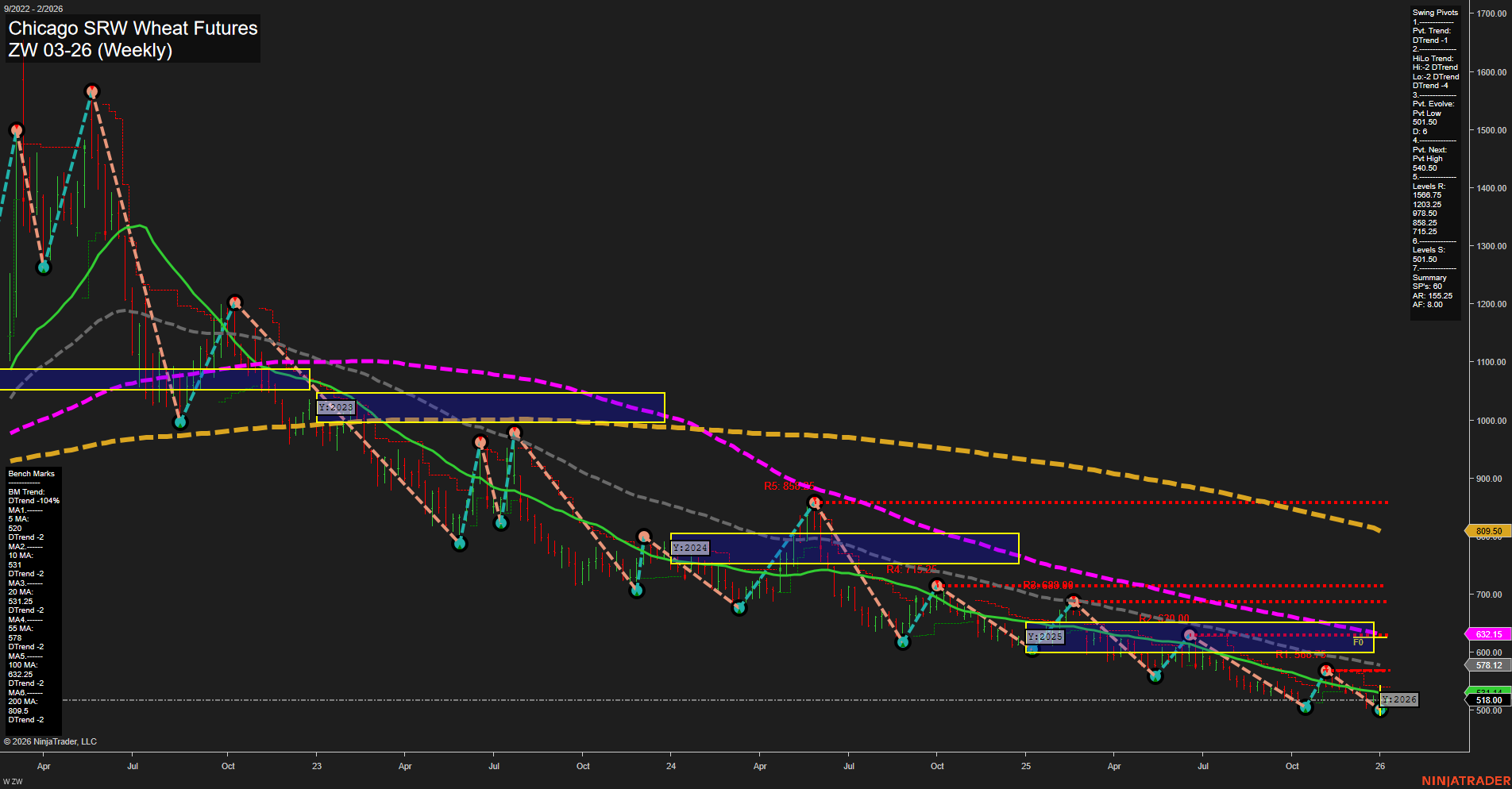

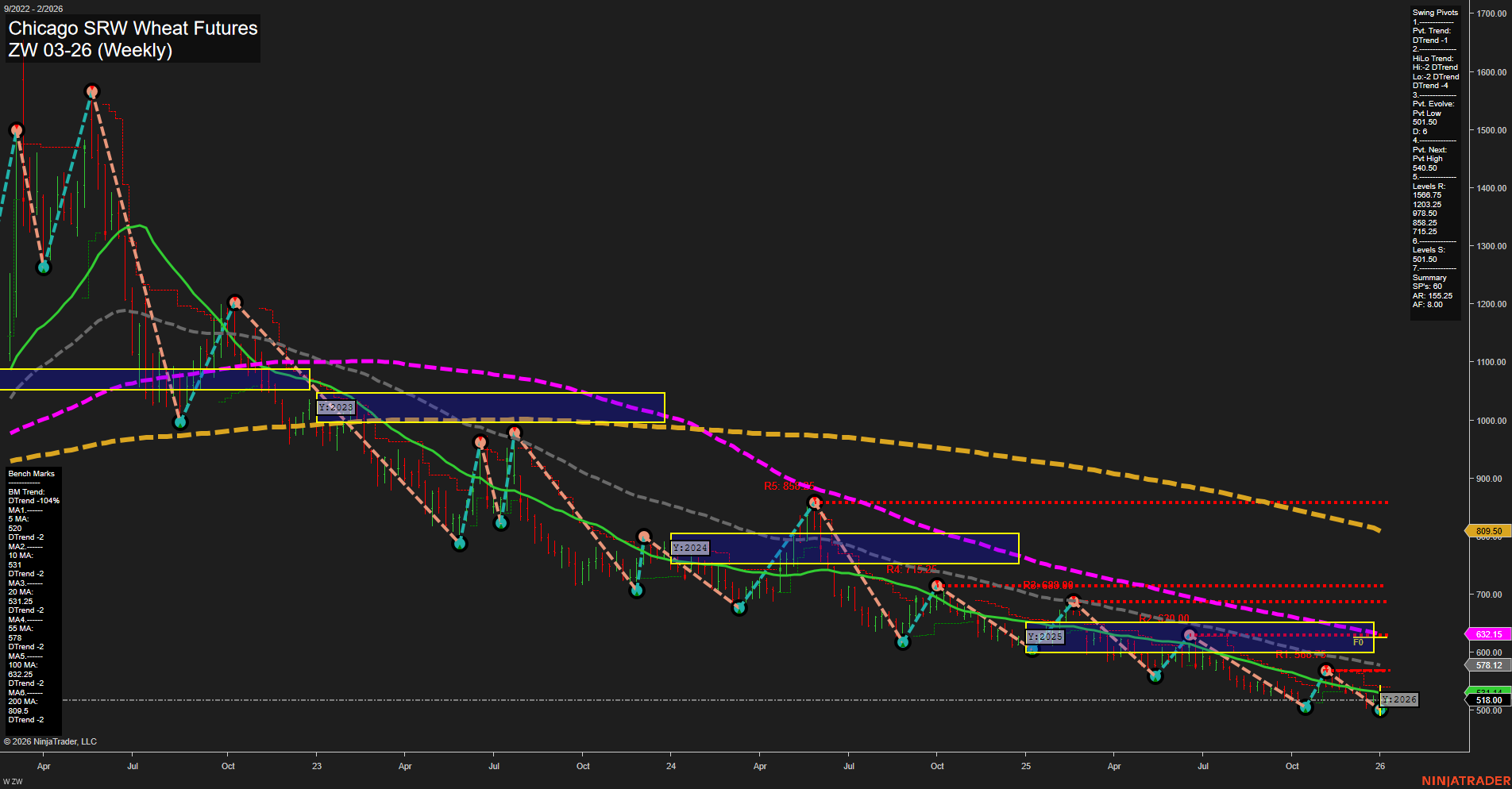

ZW Chicago SRW Wheat Futures Weekly Chart Analysis: 2026-Jan-11 18:20 CT

Price Action

- Last: 518.00,

- Bars: Small,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 60%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: 26%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: 0%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 501.50,

- 4. Pvt. Next: Pvt high 540.50,

- 5. Levels R: 1000.75, 886.25, 793.25, 698.00, 619.25, 578.12,

- 6. Levels S: 501.50.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 531.1 Down Trend,

- (Intermediate-Term) 10 Week: 523.5 Down Trend,

- (Long-Term) 20 Week: 578.12 Down Trend,

- (Long-Term) 55 Week: 632.15 Down Trend,

- (Long-Term) 100 Week: 763.26 Down Trend,

- (Long-Term) 200 Week: 809.50 Down Trend.

Recent Trade Signals

- 08 Jan 2026: Long ZW 03-26 @ 521.75 Signals.USAR.TR720

- 06 Jan 2026: Long ZW 03-26 @ 512.25 Signals.USAR-MSFG

- 05 Jan 2026: Long ZW 03-26 @ 512.25 Signals.USAR.TR120

- 05 Jan 2026: Long ZW 03-26 @ 510.25 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

The ZW Chicago SRW Wheat Futures weekly chart shows a market that has been in a persistent downtrend, as evidenced by the dominant downward trends in both swing pivots and all major moving averages. Price action is subdued, with small bars and slow momentum, indicating a lack of strong conviction from either buyers or sellers at current levels. While the short-term WSFG and MSFG grids show an upward trend with price above their respective NTZ/F0% levels, this is countered by the prevailing bearish structure in the intermediate and long-term timeframes. The most recent swing pivot is a low at 501.50, with the next potential resistance at 540.50, but significant resistance levels remain far above current price, suggesting any rallies may face overhead supply. Recent trade signals have triggered long entries, hinting at a possible short-term bounce or retracement, but the overall technical landscape remains heavy with long-term moving averages sloping down and price trading well below them. The market appears to be in a consolidation phase after an extended decline, with potential for a short-term corrective move, but the broader trend remains bearish until proven otherwise.

Chart Analysis ATS AI Generated: 2026-01-11 18:20 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.