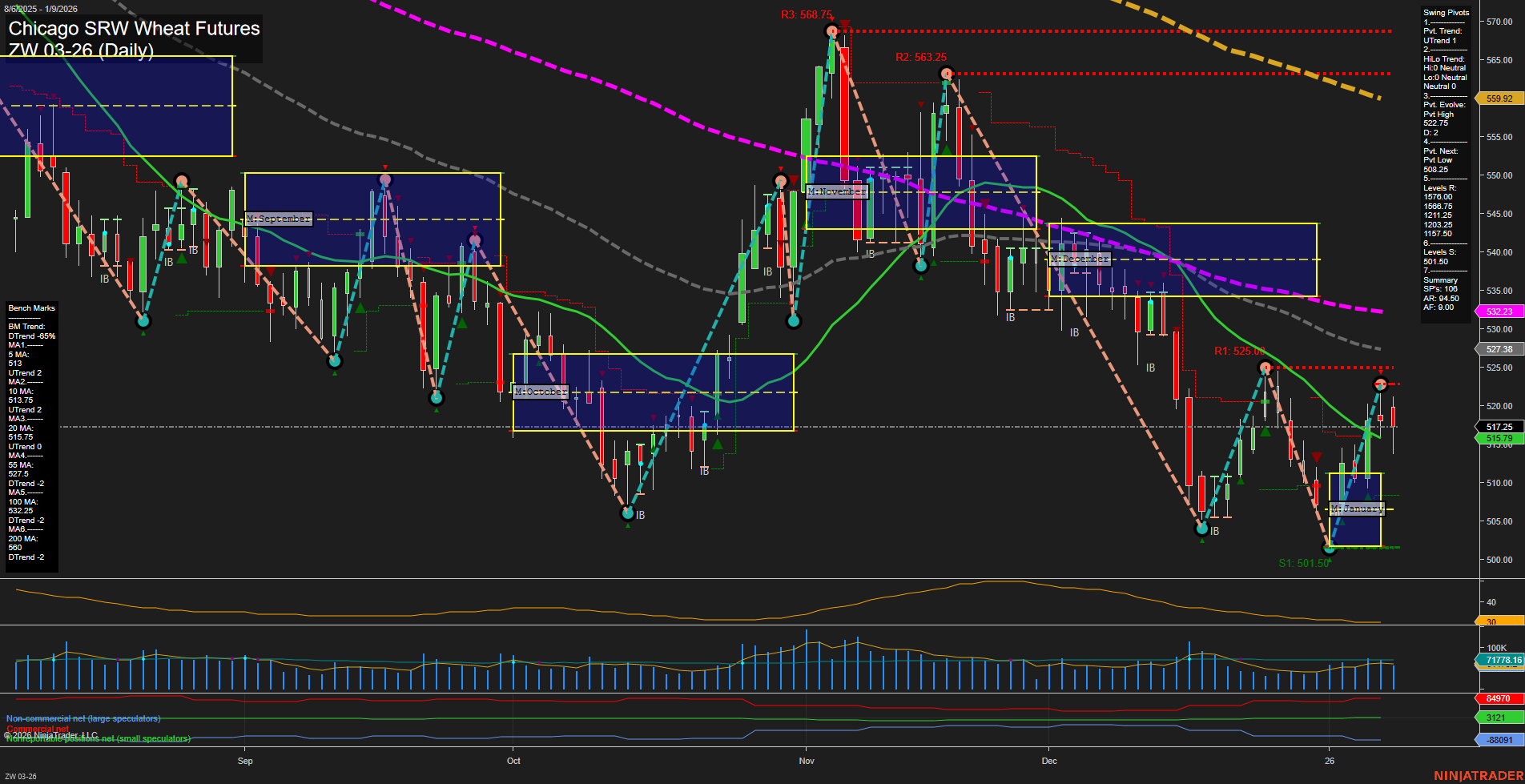

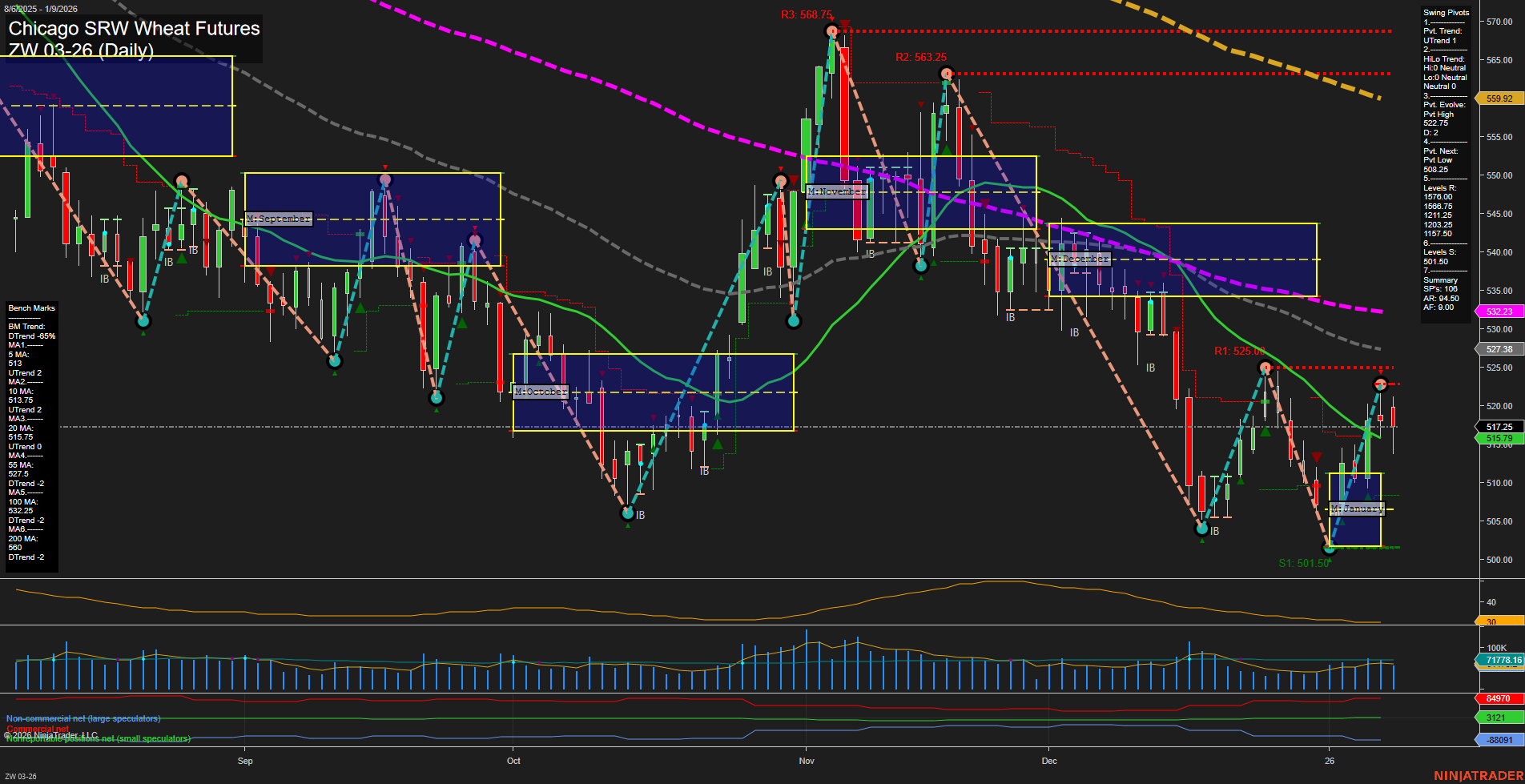

ZW Chicago SRW Wheat Futures Daily Chart Analysis: 2026-Jan-11 18:20 CT

Price Action

- Last: 517.25,

- Bars: Medium,

- Mom: Average.

WSFG Weekly

- Short-Term

- WSFG Current: 60%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: 26%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: 0%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: Neutral,

- 3. Pvt. Evolve: Pvt High 522.75,

- 4. Pvt. Next: Pvt Low 506.25,

- 5. Levels R: 559.92, 568.75, 563.25, 525.00,

- 6. Levels S: 501.50, 487.75.

Daily Benchmarks

- (Short-Term) 5 Day: 513 Up Trend,

- (Short-Term) 10 Day: 513.75 Up Trend,

- (Intermediate-Term) 20 Day: 515.75 Up Trend,

- (Intermediate-Term) 55 Day: 527.38 Down Trend,

- (Long-Term) 100 Day: 532.25 Down Trend,

- (Long-Term) 200 Day: 560 Down Trend.

Additional Metrics

Recent Trade Signals

- 08 Jan 2026: Long ZW 03-26 @ 521.75 Signals.USAR.TR720

- 06 Jan 2026: Long ZW 03-26 @ 512.25 Signals.USAR-MSFG

- 05 Jan 2026: Long ZW 03-26 @ 512.25 Signals.USAR.TR120

- 05 Jan 2026: Long ZW 03-26 @ 510.25 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

The ZW Chicago SRW Wheat Futures daily chart shows a recent shift in short-term momentum, with price action moving above key short-term and intermediate-term moving averages and the WSFG/MSFG grids, indicating a bullish bias in the near term. The current swing pivot trend is up, supported by a series of recent long trade signals and higher lows, suggesting a potential continuation of the short-term rally. However, intermediate and long-term trends remain neutral to bearish, as reflected by the 55, 100, and 200-day moving averages trending down and price still below these longer-term benchmarks. Resistance levels are clustered above, with 525.00 as the nearest, while support is established at 501.50. Volatility is moderate, and volume is steady, indicating active participation but not extreme conditions. The market appears to be in a recovery phase from a recent low, with a possible test of overhead resistance zones if momentum persists. The overall structure suggests a short-term bullish opportunity within a broader context of consolidation and longer-term downtrend pressure.

Chart Analysis ATS AI Generated: 2026-01-11 18:20 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.