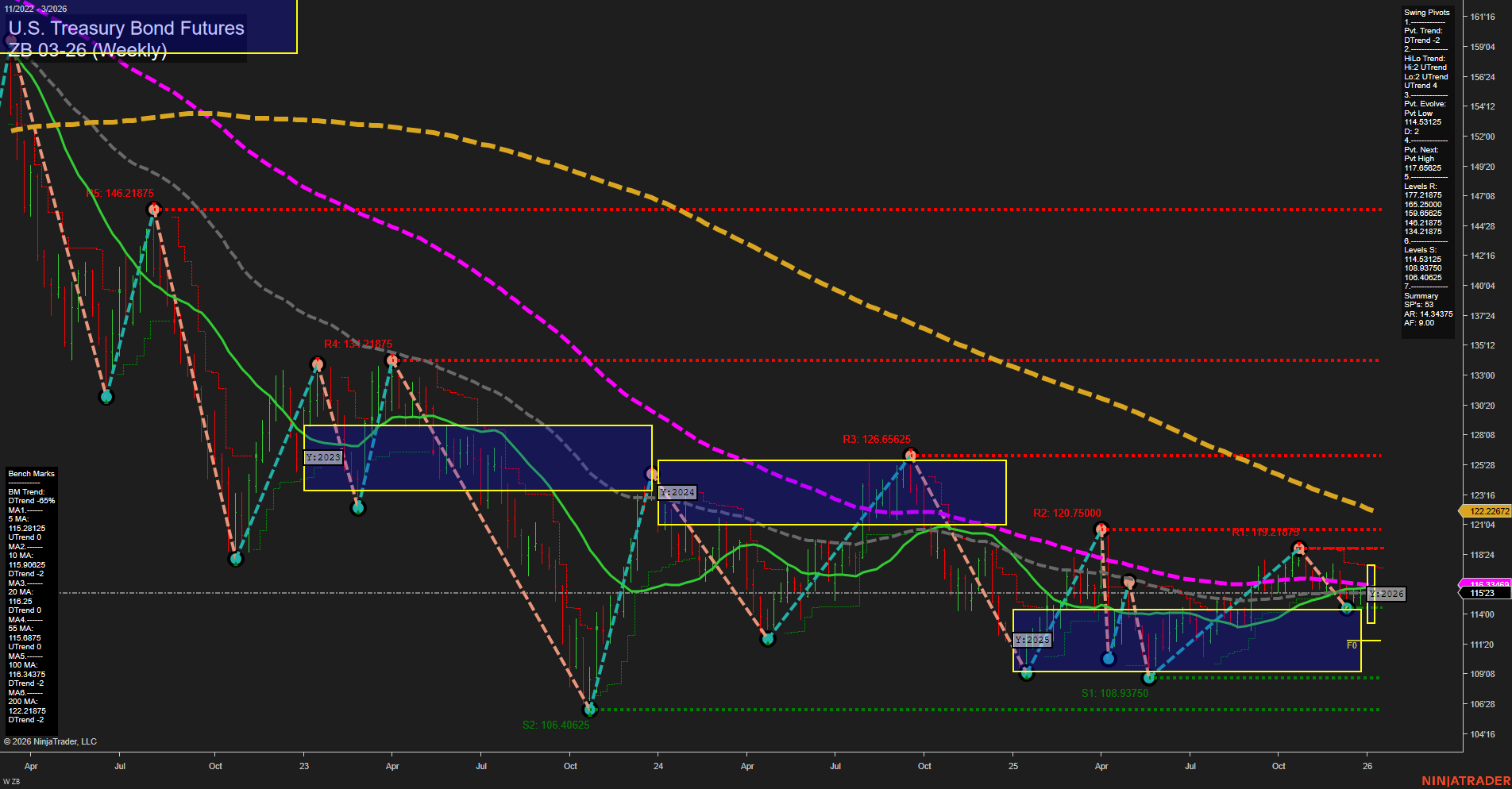

The ZB U.S. Treasury Bond Futures weekly chart shows a market in transition, with price currently sitting at 122.26'27. Price action is characterized by medium-sized bars and slow momentum, indicating a lack of strong directional conviction. The short-term swing pivot trend is down, supported by both the 5- and 10-week moving averages trending lower, while the intermediate-term HiLo trend remains up, suggesting some underlying support from recent higher lows. Long-term moving averages are mixed, with the 20- and 55-week MAs trending up but the 100- and 200-week MAs still in decline, reflecting a market that is consolidating after a prolonged downtrend. The price is currently within the Neutral Trading Zone (NTZ) of the yearly session fib grid, with all session fib grid trends (weekly, monthly, yearly) showing a neutral bias. Resistance levels are stacked well above current price, while support is clustered in the 106-109 range, indicating a wide range of potential movement if volatility returns. The chart structure suggests ongoing consolidation, with no clear breakout or breakdown, and a choppy, range-bound environment dominating. This aligns with the broader macro backdrop of uncertainty in rates and bond market direction, as well as typical seasonal indecision at the start of the year. Overall, the market is in a holding pattern, with short-term bearishness, but intermediate and long-term trends still searching for direction.