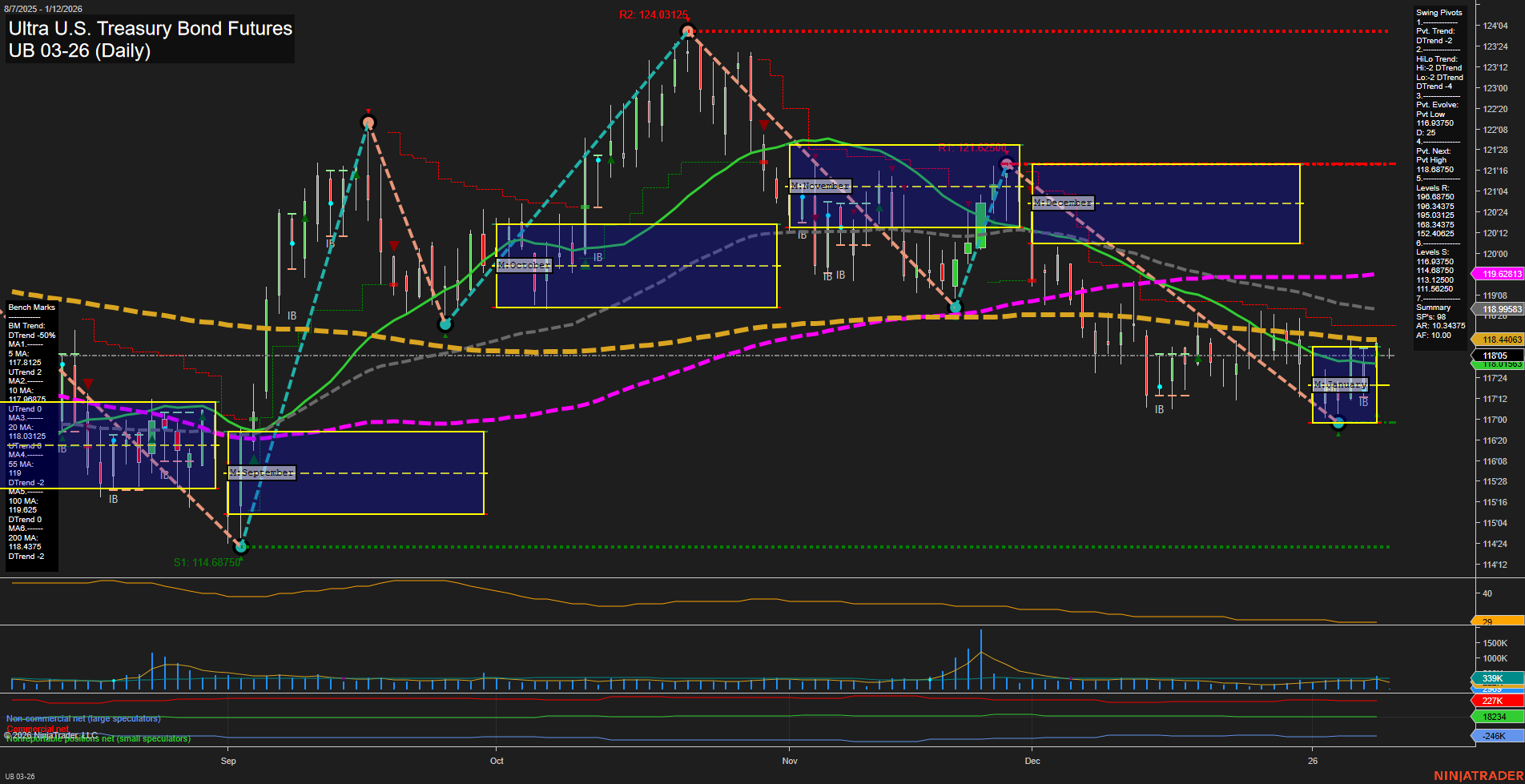

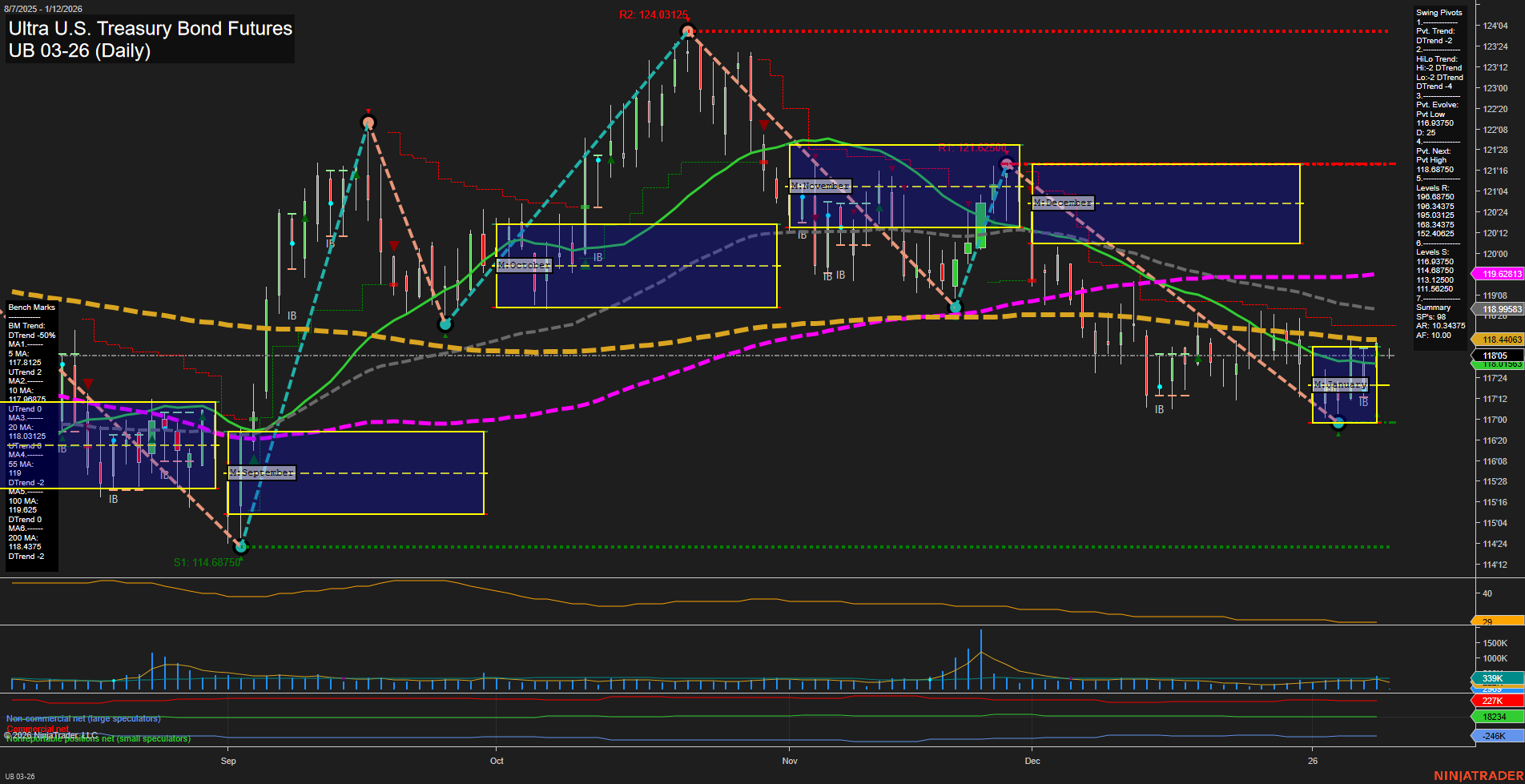

UB Ultra U.S. Treasury Bond Futures Daily Chart Analysis: 2026-Jan-11 18:16 CT

Price Action

- Last: 118.405,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -16%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: 15%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: 0%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 118.405,

- 4. Pvt. Next: Pvt high 119.6875,

- 5. Levels R: 119.6875, 119.947, 120.3475, 120.8325, 121.002, 121.0325, 124.03125,

- 6. Levels S: 118.405, 117.524, 114.6875.

Daily Benchmarks

- (Short-Term) 5 Day: 117.8125 Down Trend,

- (Short-Term) 10 Day: 118.03125 Down Trend,

- (Intermediate-Term) 20 Day: 118.99583 Down Trend,

- (Intermediate-Term) 55 Day: 119.62813 Down Trend,

- (Long-Term) 100 Day: 120.925 Down Trend,

- (Long-Term) 200 Day: 118.4375 Down Trend.

Additional Metrics

Recent Trade Signals

- 09 Jan 2026: Long UB 03-26 @ 118.125 Signals.USAR-MSFG

- 06 Jan 2026: Short UB 03-26 @ 117.0625 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Neutral.

Key Insights Summary

The UB Ultra U.S. Treasury Bond Futures daily chart reflects a market in transition. Short-term price action is bearish, with the last price at 118.405 and momentum remaining slow. The weekly session fib grid (WSFG) trend is down, and price is below the NTZ, reinforcing short-term weakness. Swing pivots confirm a short-term and intermediate-term downtrend, with the most recent pivot low at 118.405 and resistance levels stacked above. All benchmark moving averages across short, intermediate, and long-term horizons are trending down, indicating persistent selling pressure and a lack of sustained bullish momentum. However, the monthly session fib grid (MSFG) for January shows an uptrend with price above the NTZ, suggesting some intermediate-term support or a potential for a counter-trend rally. The long-term yearly grid remains neutral, with no clear directional bias. Recent trade signals show both long and short entries, highlighting the choppy and indecisive nature of the current environment. Volatility (ATR) is moderate, and volume is steady. Overall, the market is in a corrective or consolidative phase, with short-term bearishness dominating but intermediate and long-term trends lacking conviction. Swing traders should note the potential for further downside tests, but also be aware of possible mean reversion or bounce attempts as the market digests recent moves.

Chart Analysis ATS AI Generated: 2026-01-11 18:16 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.