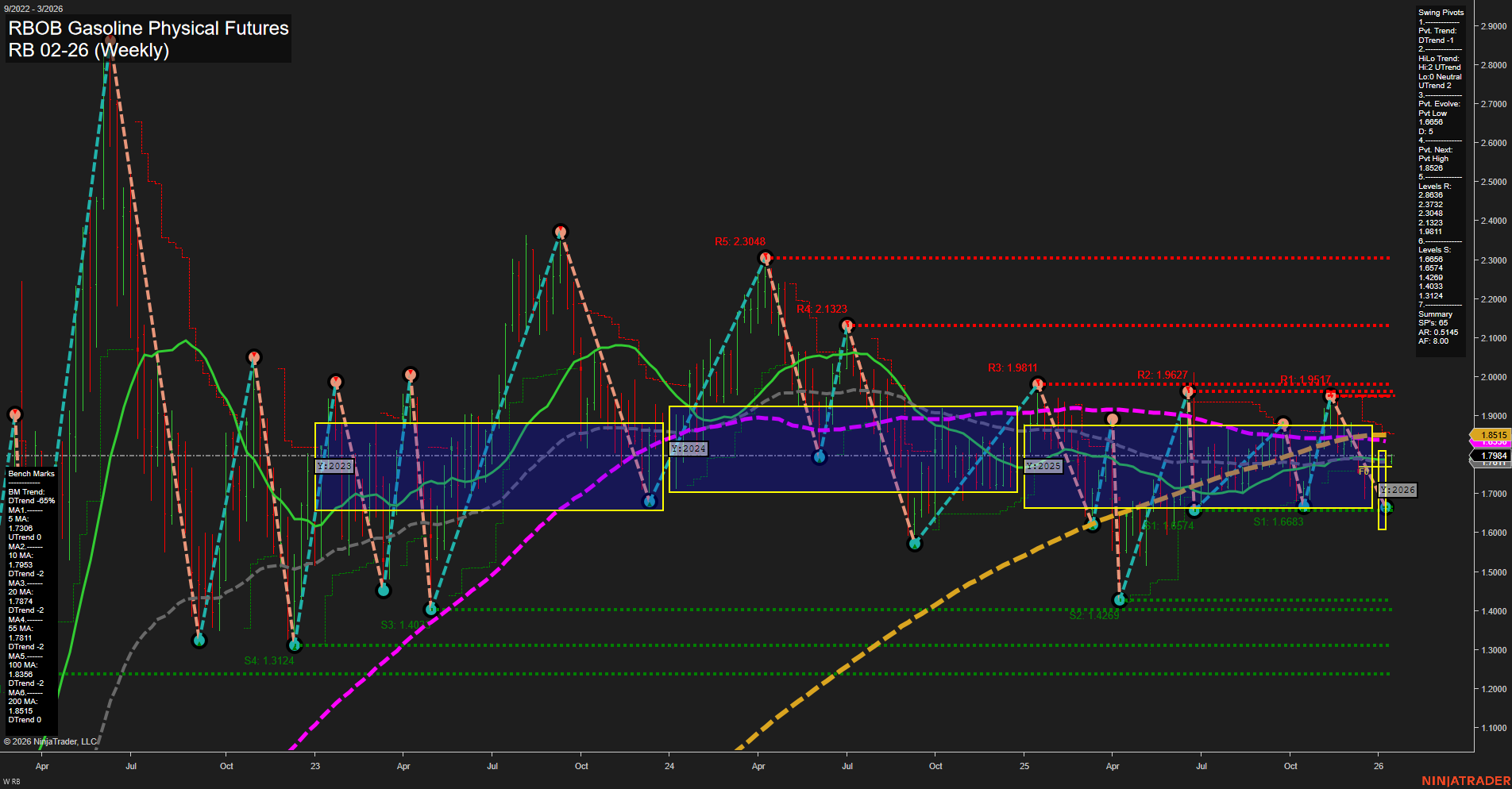

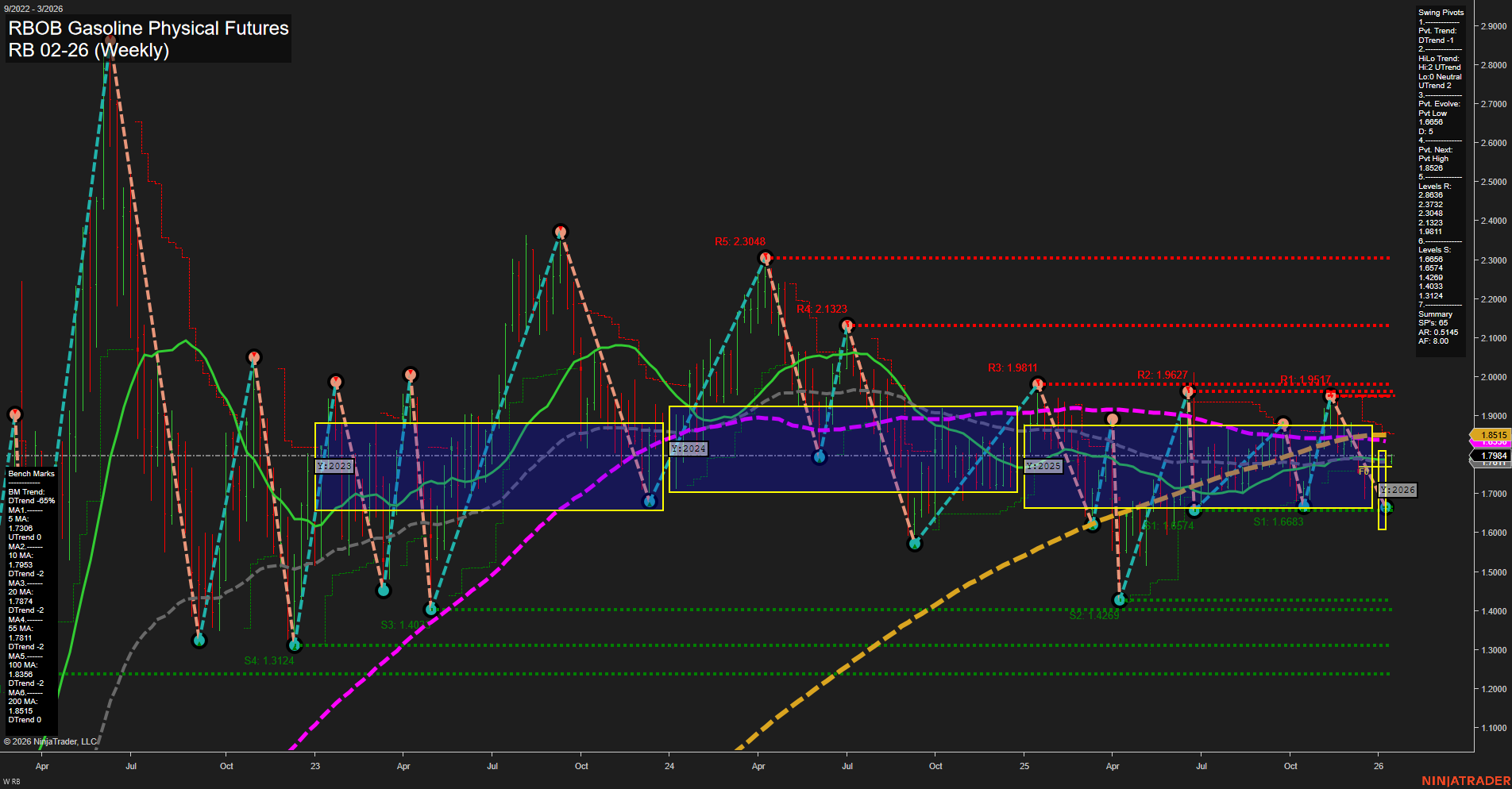

RB RBOB Gasoline Physical Futures Weekly Chart Analysis: 2026-Jan-11 18:13 CT

Price Action

- Last: 1.8515,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 154%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: 43%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: 9%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 1.6056,

- 4. Pvt. Next: Pvt high 1.8285,

- 5. Levels R: 2.3048, 2.1323, 1.9811, 1.9527, 1.9517, 1.8285,

- 6. Levels S: 1.6056, 1.4209, 1.4033, 1.3742, 1.3124.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1.7794 Up Trend,

- (Intermediate-Term) 10 Week: 1.7711 Up Trend,

- (Long-Term) 20 Week: 1.7984 Up Trend,

- (Long-Term) 55 Week: 1.8368 Up Trend,

- (Long-Term) 100 Week: 1.8636 Down Trend,

- (Long-Term) 200 Week: 1.8515 Down Trend.

Recent Trade Signals

- 09 Jan 2026: Long RB 02-26 @ 1.7774 Signals.USAR.TR720

- 08 Jan 2026: Long RB 02-26 @ 1.7314 Signals.USAR.TR120

- 08 Jan 2026: Long RB 02-26 @ 1.7314 Signals.USAR-MSFG

- 07 Jan 2026: Long RB 02-26 @ 1.7156 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The RBOB Gasoline futures weekly chart shows a constructive technical environment for swing traders. Price action is currently above all key session fib grid levels (weekly, monthly, yearly), with the last price at 1.8515 and average momentum. The short-term swing pivot trend is down, but the intermediate-term HiLo trend is up, indicating a possible transition phase or a pullback within a broader uptrend. All intermediate and long-term moving averages (5, 10, 20, 55 week) are trending up, with price now testing the 100 and 200 week MAs from below, suggesting a potential inflection point. Recent trade signals have all been to the long side, supporting the bullish bias. Resistance levels are clustered above, with the next significant pivot high at 1.8285 and further resistance up to 2.30. Support is well-defined below at 1.6056 and lower. Overall, the chart structure favors a bullish outlook across all timeframes, with the market emerging from a consolidation phase and showing signs of trend continuation. Volatility remains moderate, and the market is positioned for potential breakout moves if resistance levels are cleared.

Chart Analysis ATS AI Generated: 2026-01-11 18:13 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.