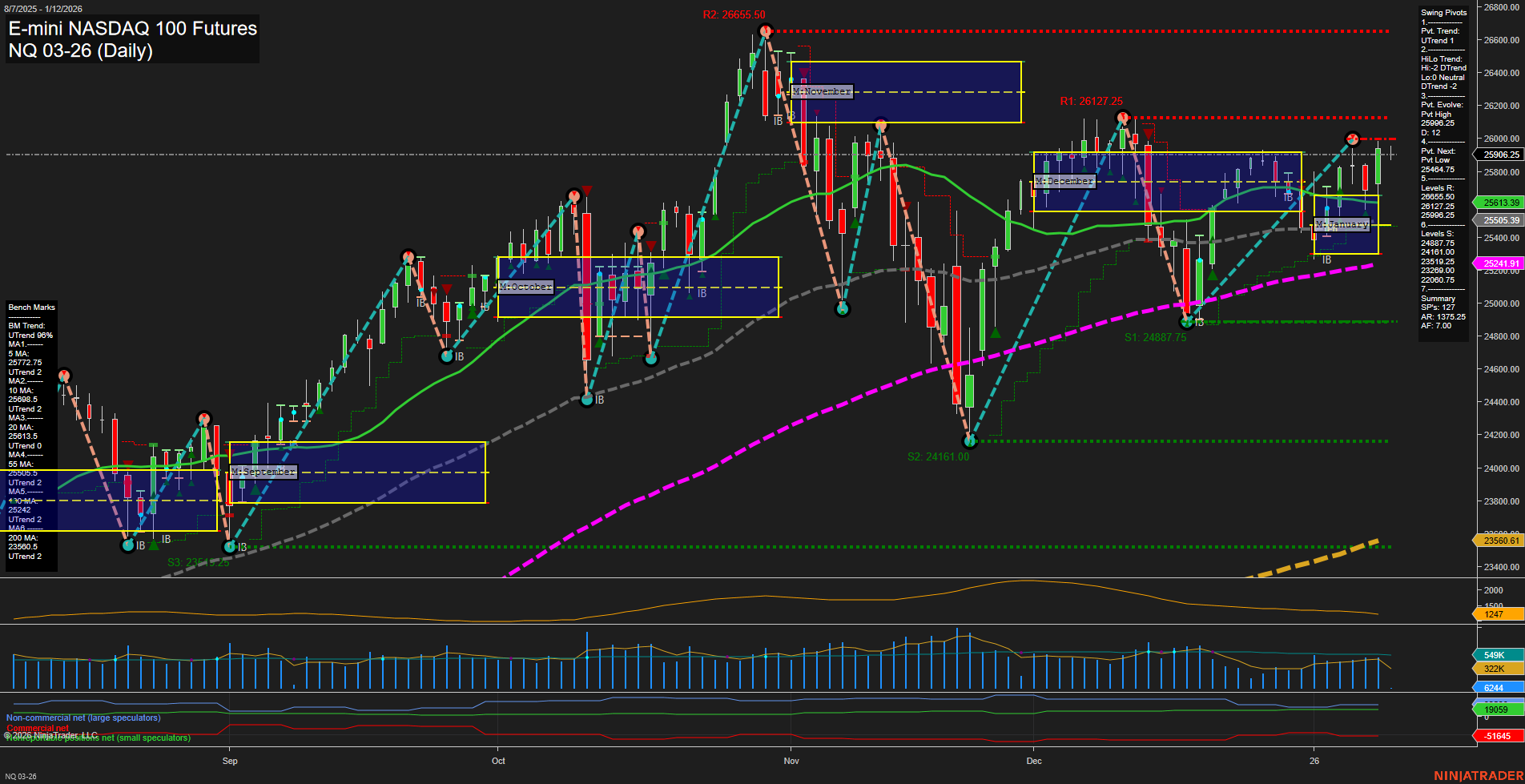

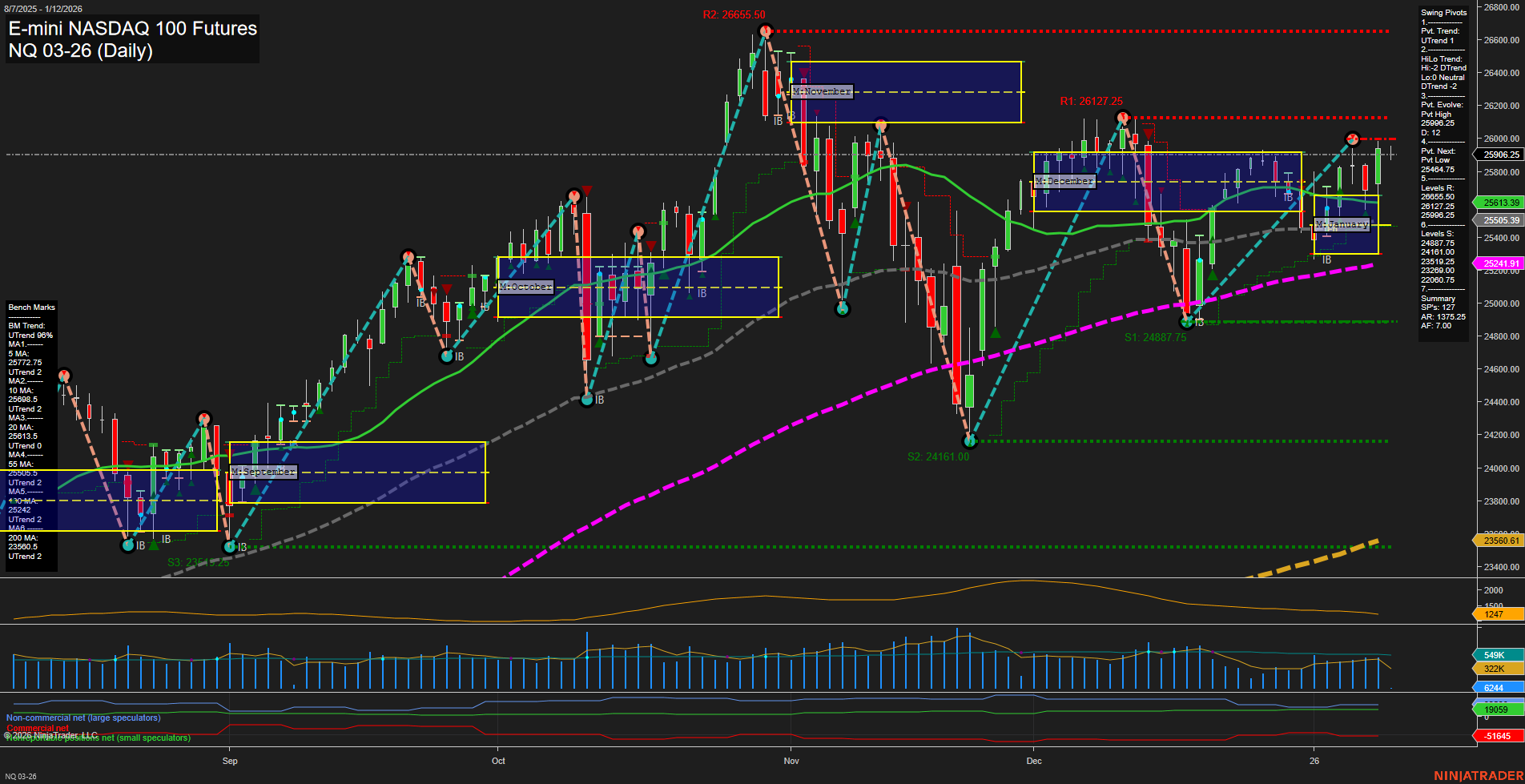

NQ E-mini NASDAQ 100 Futures Daily Chart Analysis: 2026-Jan-11 18:11 CT

Price Action

- Last: 25960.25,

- Bars: Medium,

- Mom: Average.

WSFG Weekly

- Short-Term

- WSFG Current: -9%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: 28%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: 1%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt High 25960.25,

- 4. Pvt. Next: Pvt Low 25484.75,

- 5. Levels R: 26655.50, 26127.25, 25960.25,

- 6. Levels S: 25484.75, 24887.75, 24161.00, 23208.00, 22006.75.

Daily Benchmarks

- (Short-Term) 5 Day: 25772.75 Up Trend,

- (Short-Term) 10 Day: 25688.5 Up Trend,

- (Intermediate-Term) 20 Day: 25613.5 Up Trend,

- (Intermediate-Term) 55 Day: 25491.91 Up Trend,

- (Long-Term) 100 Day: 24887.75 Up Trend,

- (Long-Term) 200 Day: 23680.5 Up Trend.

Additional Metrics

- ATR: 1618,

- VOLMA: 626746.

Recent Trade Signals

- 09 Jan 2026: Long NQ 03-26 @ 25961.25 Signals.USAR.TR120

- 08 Jan 2026: Long NQ 03-26 @ 25780.75 Signals.USAR-MSFG

- 07 Jan 2026: Long NQ 03-26 @ 25970.25 Signals.USAR.TR720

- 05 Jan 2026: Long NQ 03-26 @ 25554.25 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The NQ E-mini NASDAQ 100 Futures daily chart shows a market in transition. Price action is currently near recent highs, with medium-sized bars and average momentum, indicating a balanced but active environment. The short-term WSFG trend is down, with price below the weekly NTZ, suggesting some near-term resistance or consolidation. However, the monthly MSFG and yearly YSFG both show price above their respective NTZs and are trending up, reflecting a strong intermediate and long-term bullish structure.

Swing pivots highlight a short-term uptrend, but the intermediate-term HiLo trend remains down, pointing to a market that is potentially in a corrective phase within a larger uptrend. Resistance is clustered near recent highs, while support levels are well-defined below, providing clear reference points for swing traders.

All benchmark moving averages from short to long-term are in uptrends, reinforcing the underlying bullish bias. The ATR and VOLMA indicate healthy volatility and participation, supporting the potential for continued movement.

Recent trade signals have all been to the long side, aligning with the prevailing intermediate and long-term trends. Overall, the market is showing signs of short-term consolidation or pause within a broader bullish context, with the potential for further upside if resistance levels are overcome and the short-term trend resumes upward momentum.

Chart Analysis ATS AI Generated: 2026-01-11 18:12 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.