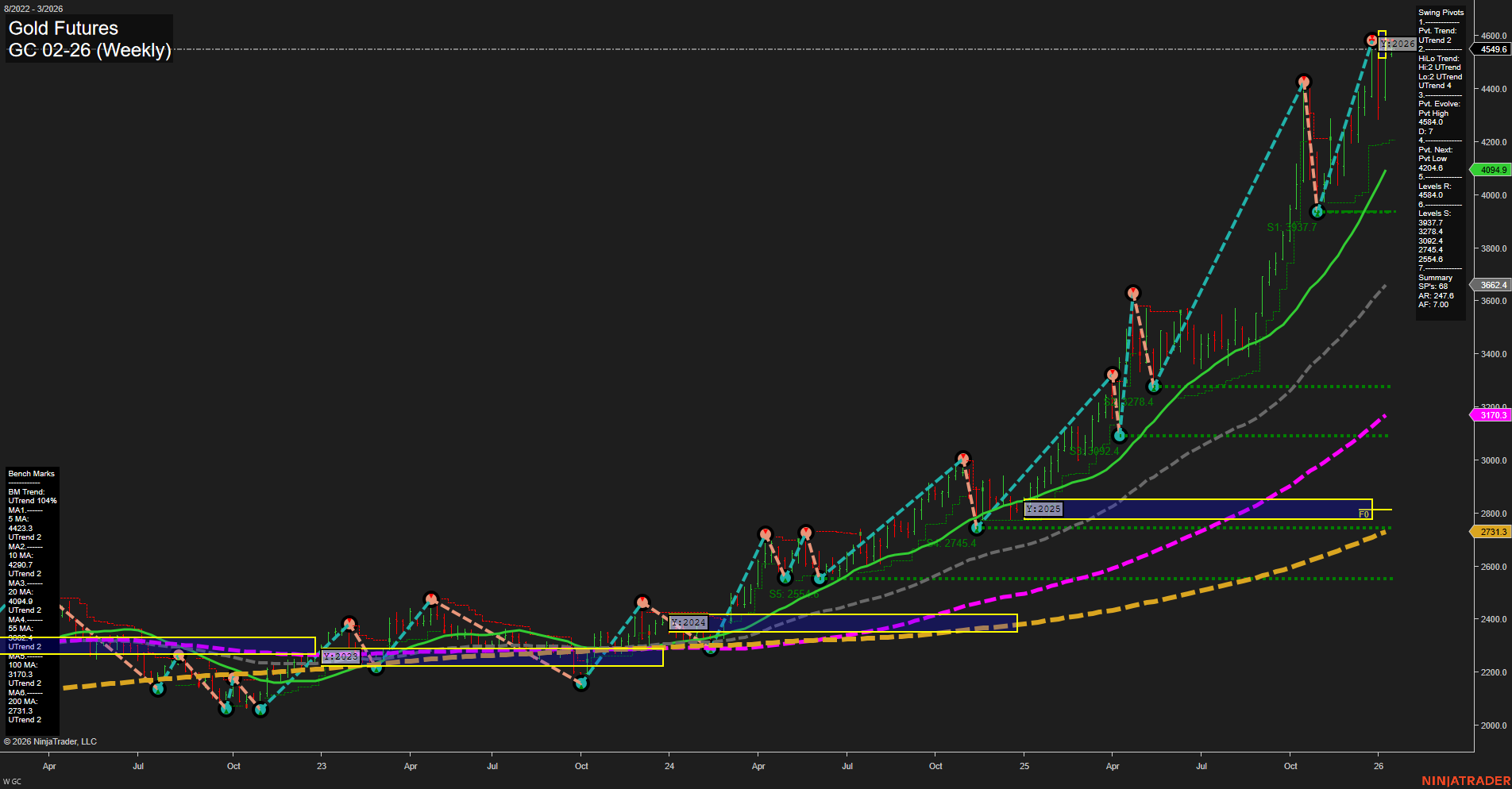

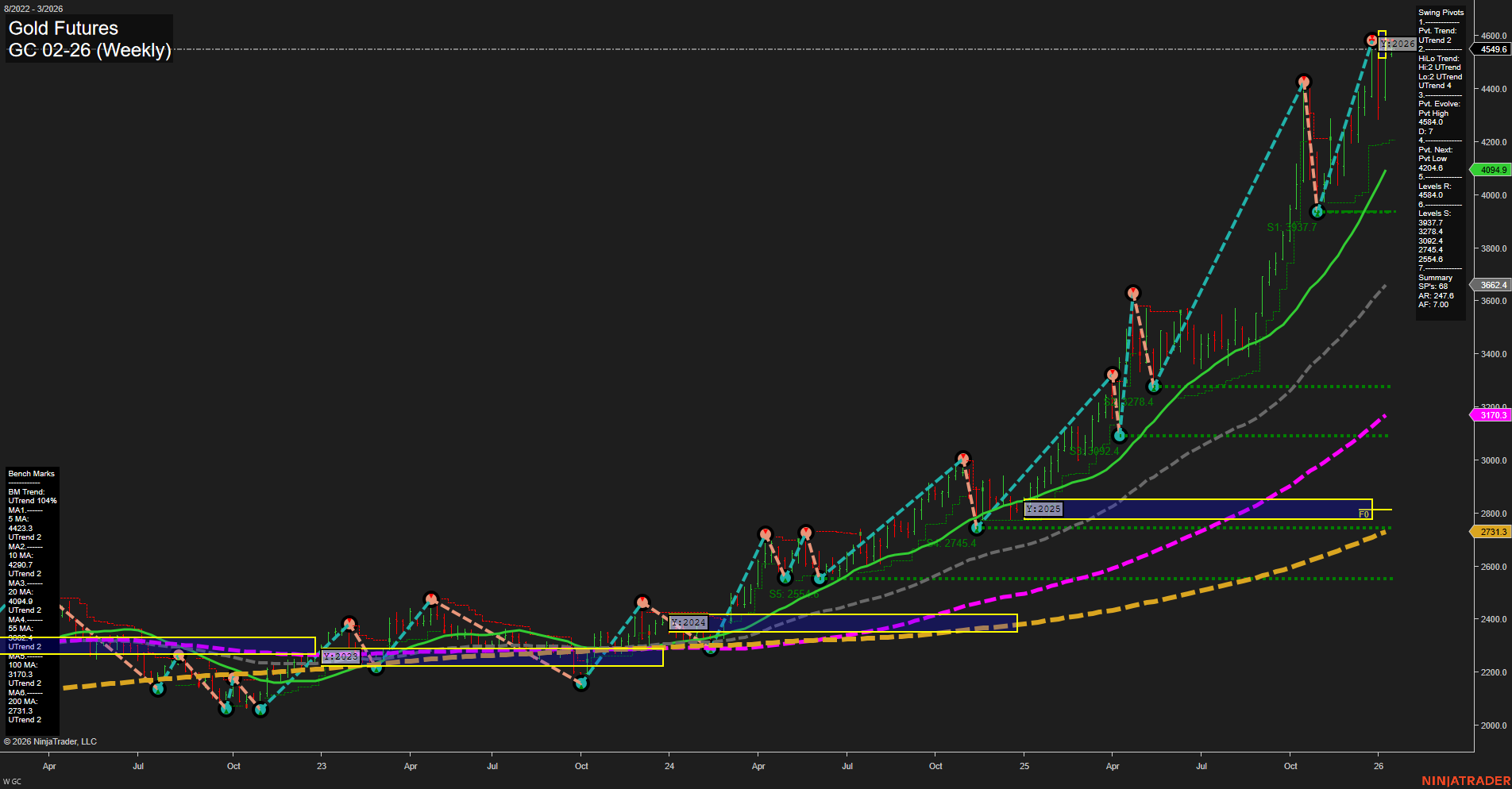

GC Gold Futures Weekly Chart Analysis: 2026-Jan-11 18:09 CT

Price Action

- Last: 4549.6,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: 100%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: 53%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: -3%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 4549.6,

- 4. Pvt. Next: Pvt low 4094.9,

- 5. Levels R: 4549.6, 4504.9,

- 6. Levels S: 4094.9, 3787.7, 3278.4, 3204.4, 3024.4, 2784.4, 2554.6.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 4423.3 Up Trend,

- (Intermediate-Term) 10 Week: 4404.0 Up Trend,

- (Long-Term) 20 Week: 4094.9 Up Trend,

- (Long-Term) 55 Week: 3662.4 Up Trend,

- (Long-Term) 100 Week: 3170.3 Up Trend,

- (Long-Term) 200 Week: 2731.3 Up Trend.

Recent Trade Signals

- 09 Jan 2026: Long GC 02-26 @ 4516.4 Signals.USAR.TR720

- 09 Jan 2026: Long GC 02-26 @ 4516.4 Signals.USAR.TR120

- 05 Jan 2026: Long GC 02-26 @ 4429.9 Signals.USAR-MSFG

- 05 Jan 2026: Long GC 02-26 @ 4404.6 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

Gold futures have demonstrated a strong and persistent uptrend on both the short- and intermediate-term timeframes, as evidenced by large, fast-momentum bars and a series of higher swing highs and higher swing lows. The price is currently trading well above all key moving averages, with the 5, 10, 20, 55, 100, and 200-week benchmarks all trending upward, confirming broad-based strength. The WSFG and MSFG both show price above their respective NTZ/F0% levels, reinforcing the bullish bias for the near and intermediate term. However, the YSFG (yearly) trend remains slightly negative, with price just below the yearly NTZ/F0%, suggesting some longer-term caution or potential for mean reversion. Recent trade signals have all been to the long side, aligning with the prevailing momentum. Key support levels are well below current price, indicating a significant buffer before any major trend reversal would be confirmed. Overall, the technical structure favors continued bullishness in the short and intermediate term, while the long-term picture is more neutral, awaiting further confirmation of a sustained breakout above yearly resistance.

Chart Analysis ATS AI Generated: 2026-01-11 18:10 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.