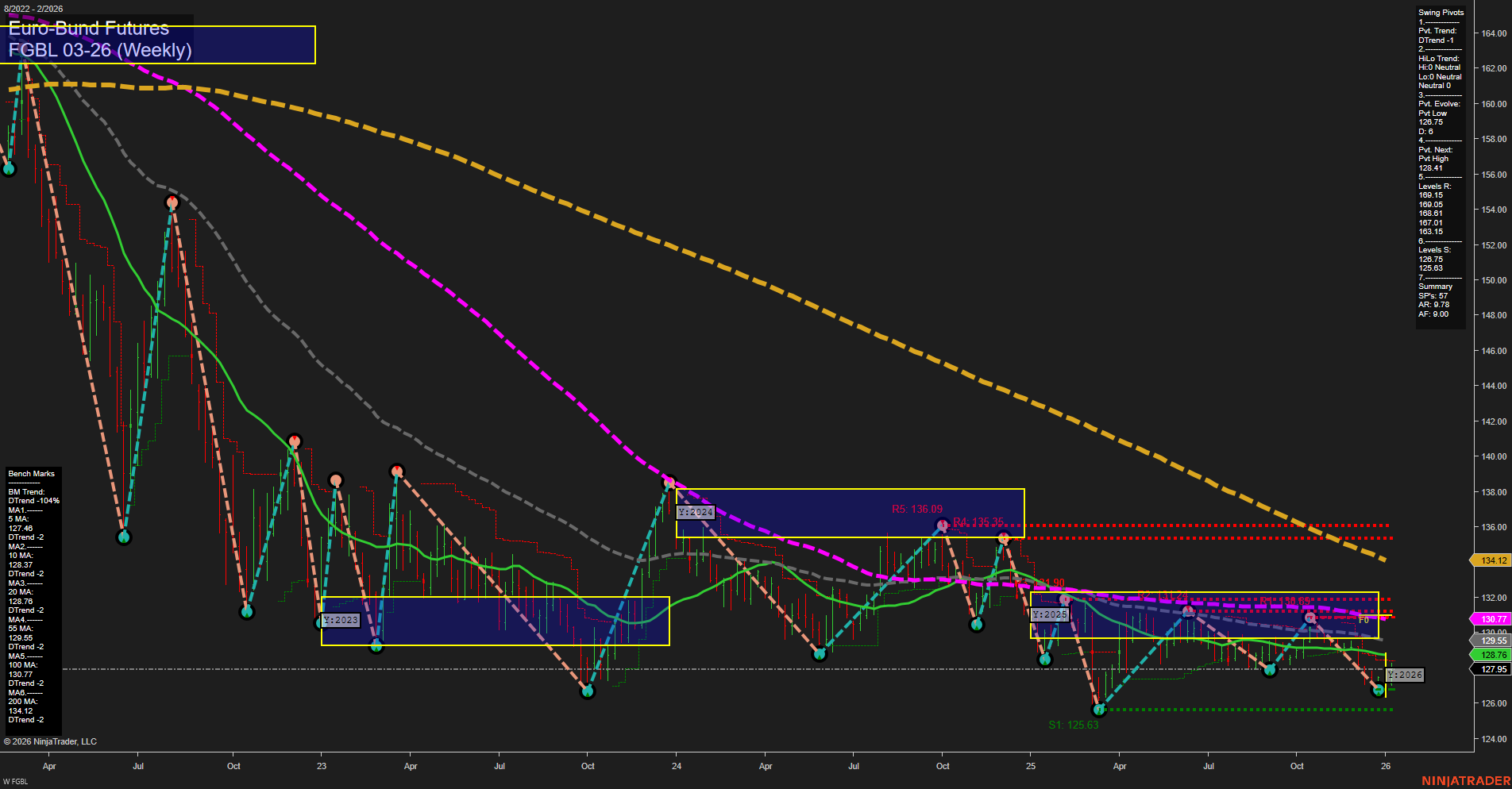

The FGBL Euro-Bund Futures weekly chart shows a market in a corrective phase after a prolonged downtrend. Price action is currently subdued with slow momentum and medium-sized bars, indicating a lack of strong conviction in either direction. While the Weekly and Monthly Session Fib Grids (WSFG, MSFG) both show an upward trend and price holding above their respective NTZ/F0% levels, the swing pivot structure remains bearish in the short term (DTrend), and the intermediate-term HiLo trend is neutral, suggesting indecision and potential for range-bound trading. All major moving average benchmarks (5, 10, 20, 55, 100, 200 week) are trending down and positioned above the current price, reinforcing a dominant long-term bearish bias. Resistance levels cluster between 129.15 and 136.09, while support is found at 126.63 and 125.63, highlighting a narrow trading range with overhead supply. Recent trade signals have triggered long entries, but these are counter to the prevailing long-term trend and may reflect attempts to capture a short-term bounce or mean reversion. Overall, the market is in a consolidation phase with a bearish tilt, as evidenced by the alignment of moving averages and swing pivots. The short-term outlook remains bearish, the intermediate-term is neutral due to mixed signals, and the long-term remains bearish. Traders should be attentive to potential breakout or breakdown scenarios as the market tests key support and resistance levels within this range-bound environment.