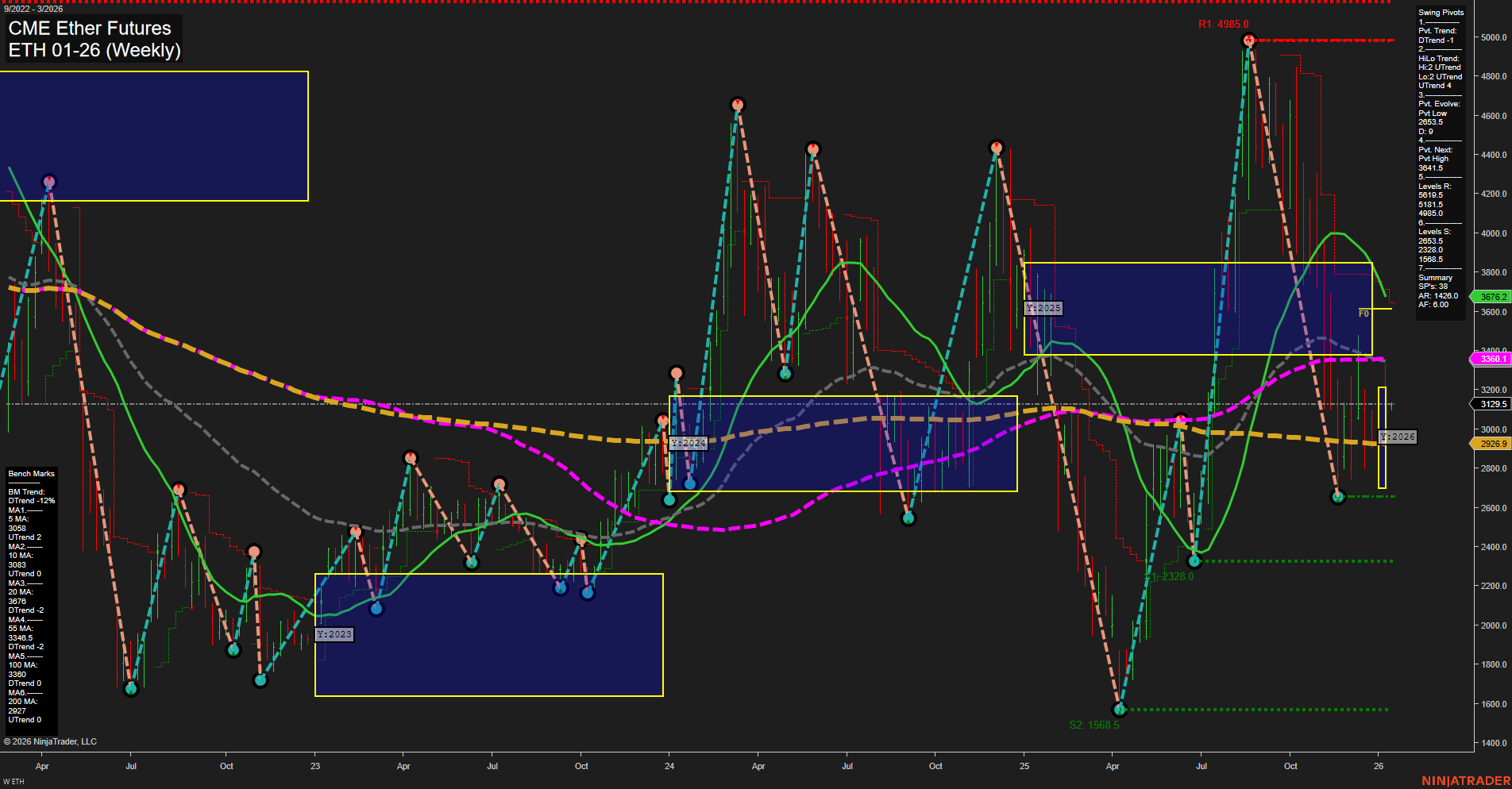

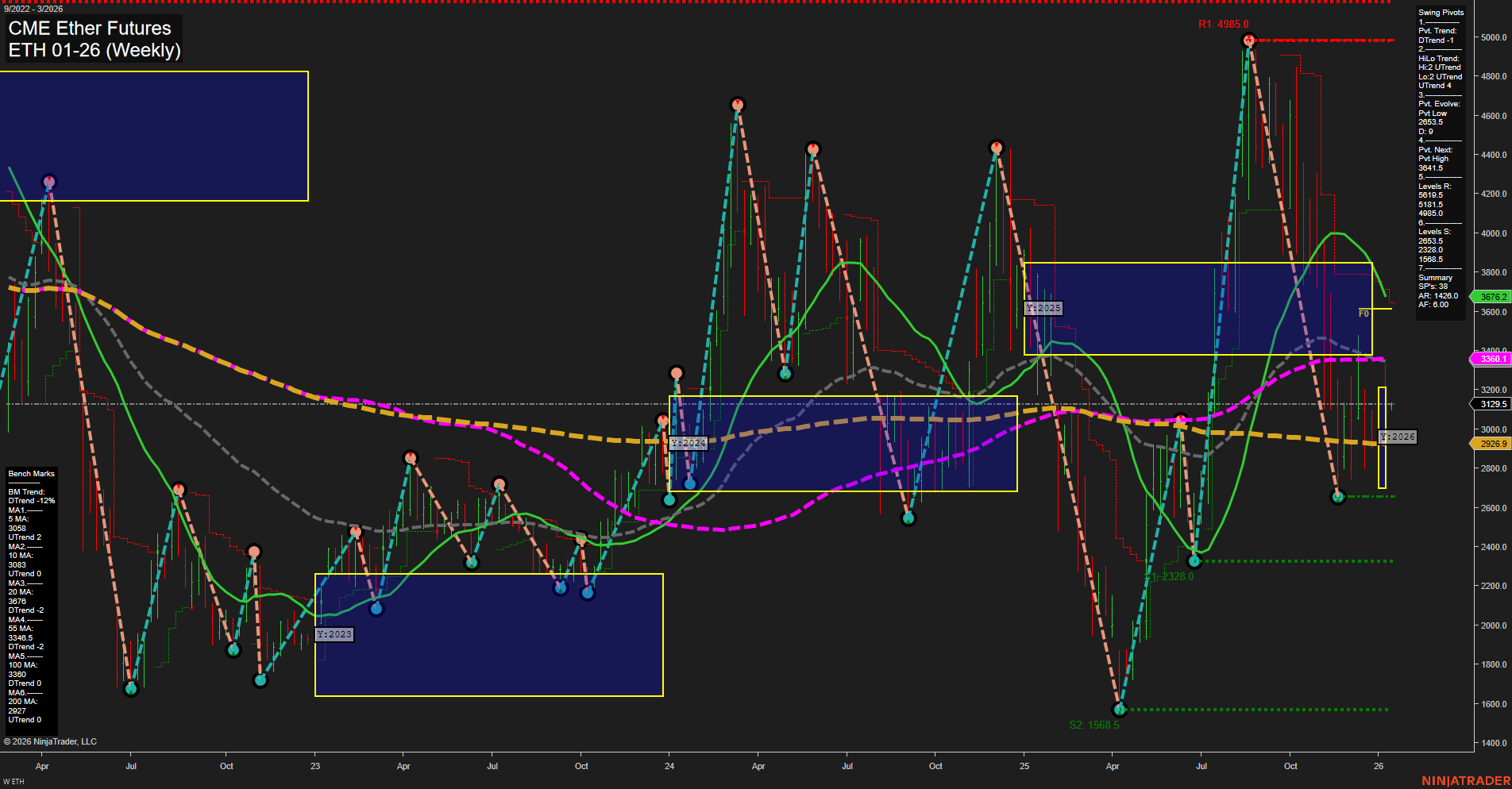

ETH CME Ether Futures Weekly Chart Analysis: 2026-Jan-11 18:06 CT

Price Action

- Last: 2926.5,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: -11%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: 9%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: 7%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 2926.5,

- 4. Pvt. Next: Pvt high 3641.5,

- 5. Levels R: 4985.0, 3641.5, 3367.0,

- 6. Levels S: 2328.0, 1568.5.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 3129.5 Down Trend,

- (Intermediate-Term) 10 Week: 3345.0 Down Trend,

- (Long-Term) 20 Week: 3360.1 Down Trend,

- (Long-Term) 55 Week: 3349.5 Down Trend,

- (Long-Term) 100 Week: 3300.0 Down Trend,

- (Long-Term) 200 Week: 2926.5 Down Trend.

Recent Trade Signals

- 09 Jan 2026: Short ETH 01-26 @ 3101 Signals.USAR-WSFG

- 07 Jan 2026: Short ETH 01-26 @ 3153 Signals.USAR.TR120

- 06 Jan 2026: Long ETH 01-26 @ 3255 Signals.USAR-MSFG

- 06 Jan 2026: Long ETH 01-26 @ 3264.5 Signals.USAR.TR720

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The current weekly chart for ETH CME Ether Futures shows a pronounced short-term bearish momentum, with price action breaking below the NTZ and F0% levels on the WSFG, supported by large, fast-moving bars and a recent sequence of short trade signals. The short-term swing pivot trend is down, and all key weekly moving averages are trending lower, reinforcing the immediate downside pressure. However, the intermediate and long-term outlooks remain constructive: both the MSFG and YSFG trends are up, with price holding above their respective NTZ/F0% levels, and the intermediate-term HiLo swing trend is up, suggesting underlying strength and potential for recovery. Key resistance levels are clustered above at 3367.0, 3641.5, and 4985.0, while support is found at 2328.0 and 1568.5. The market is currently in a corrective phase within a broader uptrend, with volatility elevated and the potential for sharp reversals or continuation moves. Swing traders should note the divergence between short-term weakness and longer-term bullish structure, indicating a market in transition, possibly setting up for a larger move once the current retracement resolves.

Chart Analysis ATS AI Generated: 2026-01-11 18:07 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.