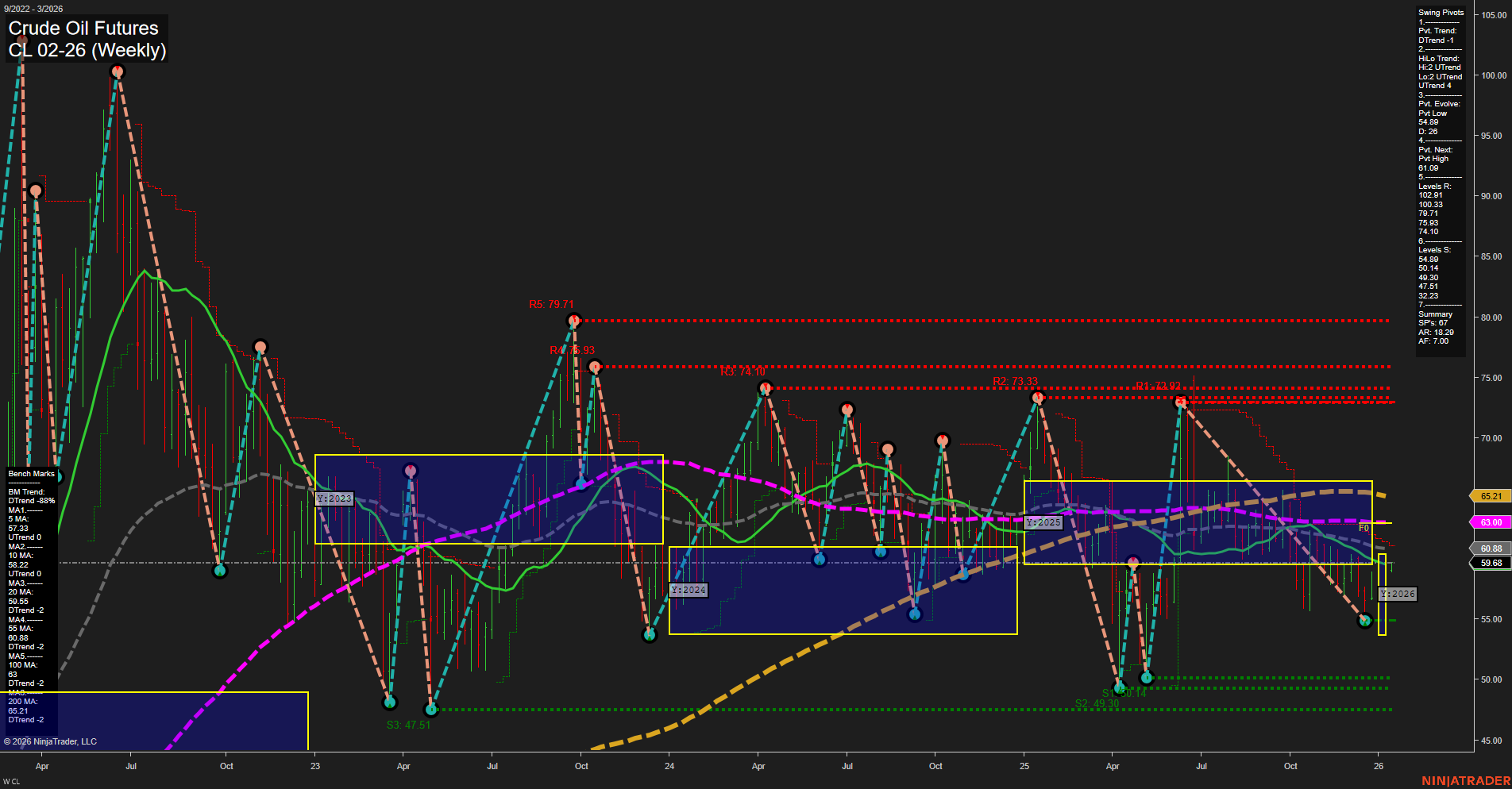

The weekly chart for CL Crude Oil Futures as of January 2026 shows a market in transition. Price action is currently subdued, with medium-sized bars and slow momentum, indicating a lack of strong conviction in either direction. The short-term Weekly Session Fib Grid (WSFG) and intermediate-term Monthly Session Fib Grid (MSFG) both show price above their respective NTZ/F0% levels, with uptrends in place, suggesting a recent shift toward bullishness. However, the short-term swing pivot trend remains down, while the intermediate-term HiLo trend is up, highlighting a divergence between immediate and broader trends. Resistance levels are clustered above, with significant barriers at 61.09, 65.21, and up to 79.71, while support is established at 54.08 and lower. All benchmark moving averages (from 5-week to 200-week) are trending down, reflecting persistent long-term weakness despite the recent bounce. Recent trade signals show mixed activity, with both long and short entries in early January, further supporting a neutral to cautiously bullish stance in the intermediate term. Overall, the market is consolidating after a prolonged downtrend, with early signs of a potential reversal. However, the presence of strong overhead resistance and downward-trending long-term averages suggests that sustained upside will require a decisive breakout above key resistance levels. The environment remains choppy, with the potential for both trend continuation and countertrend moves as the market seeks direction.