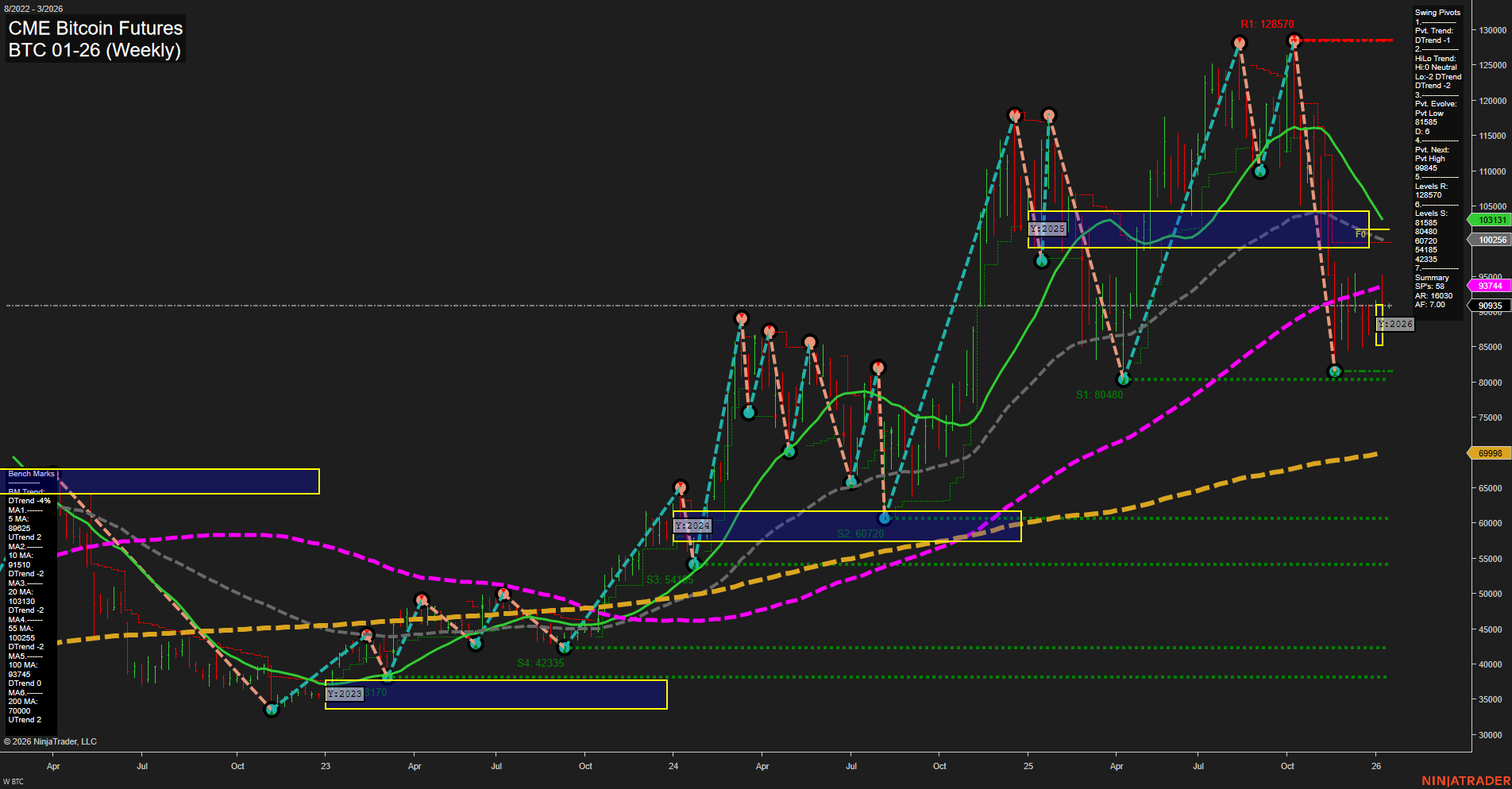

The current weekly chart for CME Bitcoin Futures shows a market in transition. Price action is consolidating with medium-sized bars and slow momentum, reflecting indecision after a recent sell-off. The short-term WSFG trend is down, with price below the NTZ center, and both the short-term and intermediate-term swing pivot trends are down, confirming a bearish bias for swing traders in the near term. Key resistance levels are stacked above at 97,470, 105,050, and 120,485, while support sits at 90,935 and further below at 80,480 and 60,720, indicating a wide range for potential volatility. All major weekly moving averages (5, 10, 20, 55, 100) are trending down, reinforcing the bearish short- and intermediate-term outlook. However, the 200-week MA remains in an uptrend, and both the monthly and yearly session fib grids show price above their NTZ centers with an upward trend, suggesting the longer-term structure is still bullish. Recent trade signals reflect this mixed environment, with a short signal triggered on 08 Jan and a long signal just prior on 06 Jan, highlighting choppy, two-way action. The market appears to be in a corrective phase within a larger bullish cycle, with the potential for further downside tests before any sustained recovery. Swing traders should note the risk of further pullbacks and the importance of watching for a reversal at key support levels or a breakout above resistance to confirm a new directional move.