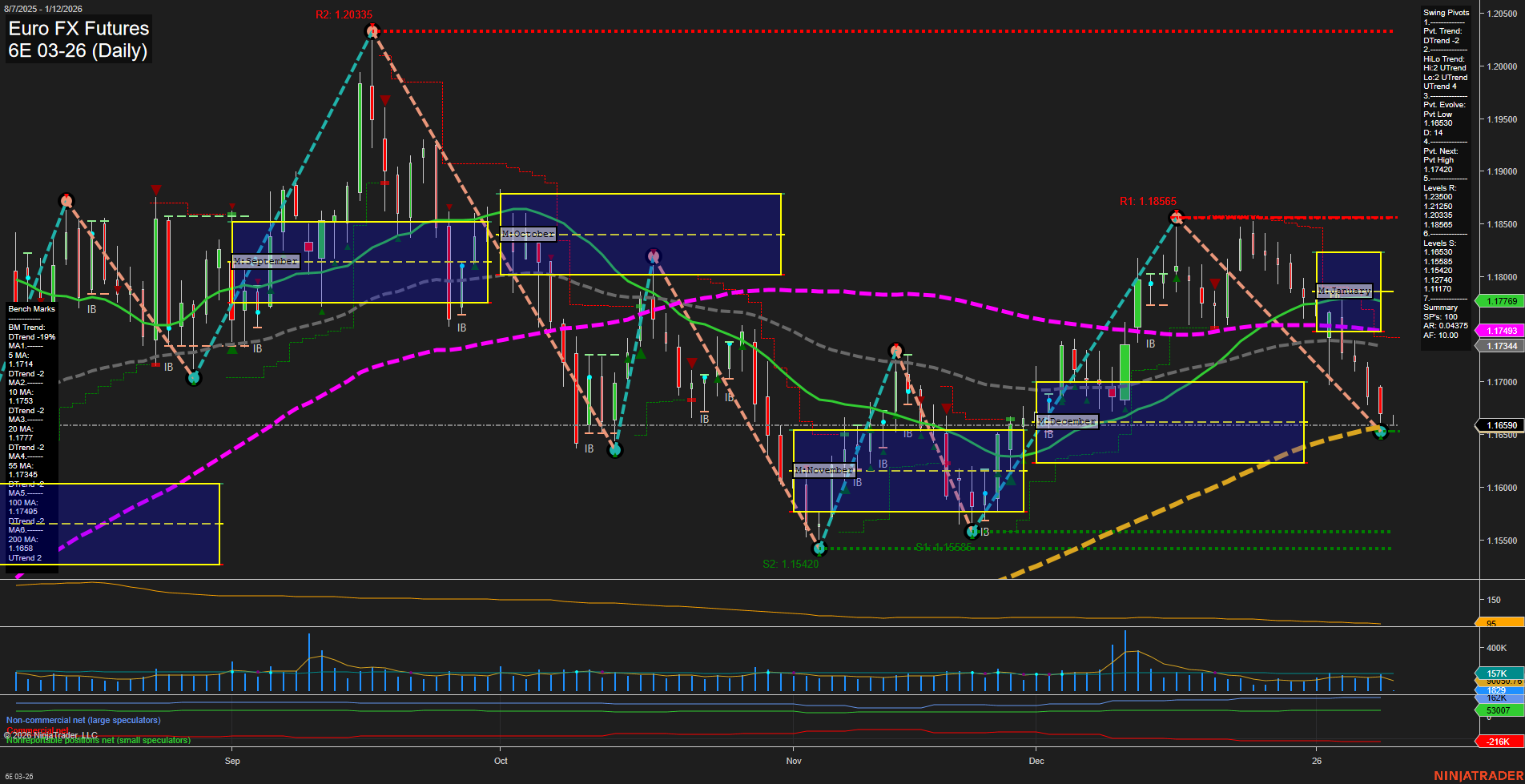

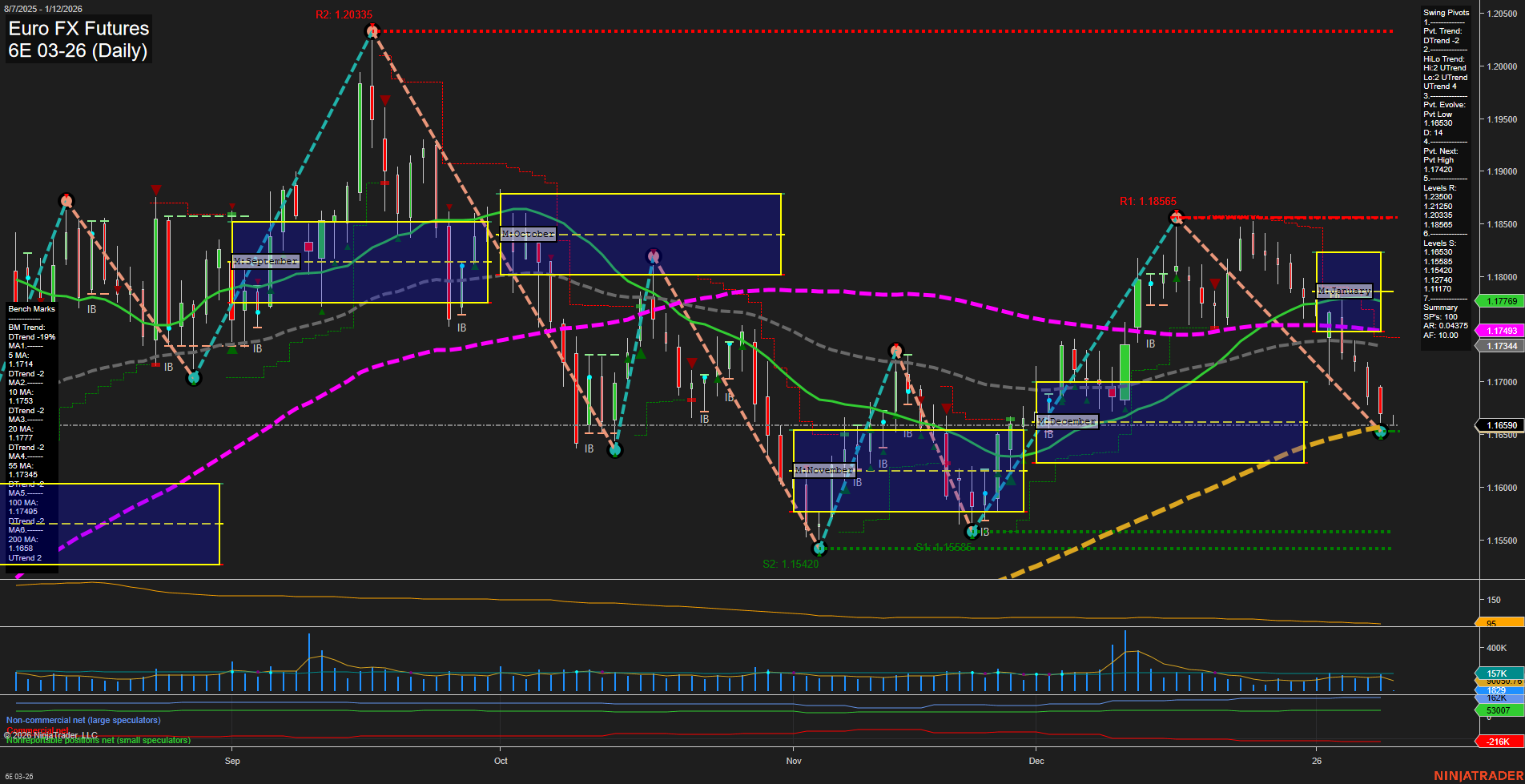

6E Euro FX Futures Daily Chart Analysis: 2026-Jan-11 18:01 CT

Price Action

- Last: 1.16590,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -106%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: -46%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2026

- Long-Term

- YSFG Current: -12%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 1.16590,

- 4. Pvt. Next: Pvt high 1.17420,

- 5. Levels R: 1.18565, 1.17420, 1.17235, 1.17170, 1.17144,

- 6. Levels S: 1.16590, 1.15420.

Daily Benchmarks

- (Short-Term) 5 Day: 1.1714 Down Trend,

- (Short-Term) 10 Day: 1.1733 Down Trend,

- (Intermediate-Term) 20 Day: 1.1777 Down Trend,

- (Intermediate-Term) 55 Day: 1.1743 Down Trend,

- (Long-Term) 100 Day: 1.1795 Down Trend,

- (Long-Term) 200 Day: 1.1749 Down Trend.

Additional Metrics

Recent Trade Signals

- 08 Jan 2026: Short 6E 03-26 @ 1.1717 Signals.USAR-WSFG

- 07 Jan 2026: Short 6E 03-26 @ 1.1723 Signals.USAR-MSFG

- 06 Jan 2026: Short 6E 03-26 @ 1.1726 Signals.USAR.TR120

- 05 Jan 2026: Short 6E 03-26 @ 1.17195 Signals.USAR.TR720

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

The 6E Euro FX Futures daily chart is exhibiting a clear bearish structure across all timeframes. Price action is characterized by medium-sized bars and slow momentum, with the last price at 1.16590, which is below all key moving averages and session fib grid levels. The weekly, monthly, and yearly session fib grids all show price below their respective NTZ/F0% levels, confirming persistent downward pressure. Swing pivot analysis highlights a dominant downtrend, with the most recent pivot low just established and the next potential reversal only above 1.17420. Resistance levels are stacked above, while support is thin, with the next major level at 1.15420. All benchmark moving averages are trending down, reinforcing the prevailing bearish sentiment. Recent trade signals have consistently favored the short side, aligning with the technical backdrop. Volatility (ATR) and volume (VOLMA) are moderate, suggesting controlled but persistent selling rather than panic. Overall, the market is in a sustained downtrend, with no immediate signs of reversal or significant support holding, and the technical environment favors continuation of the current bearish cycle.

Chart Analysis ATS AI Generated: 2026-01-11 18:01 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.