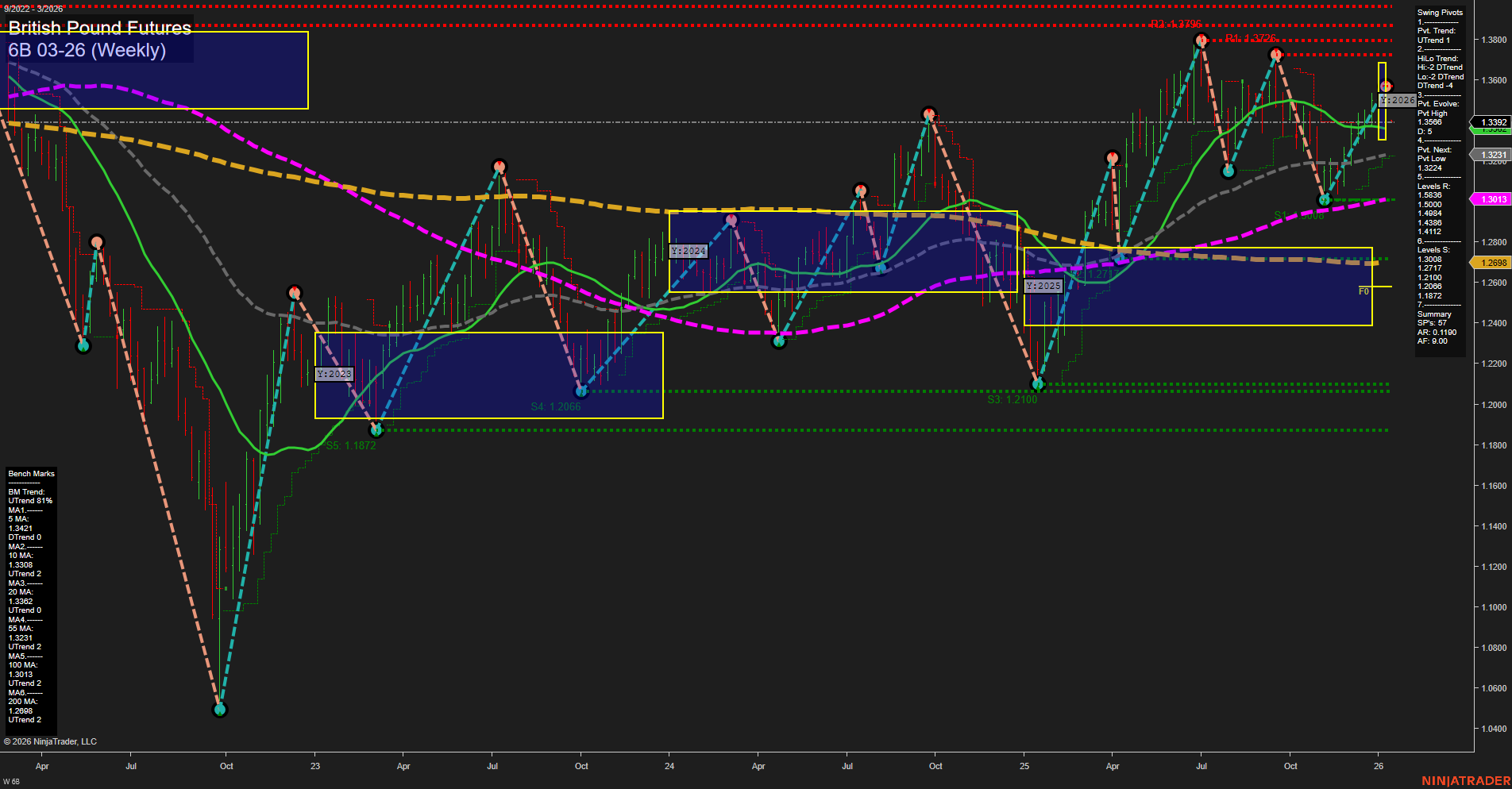

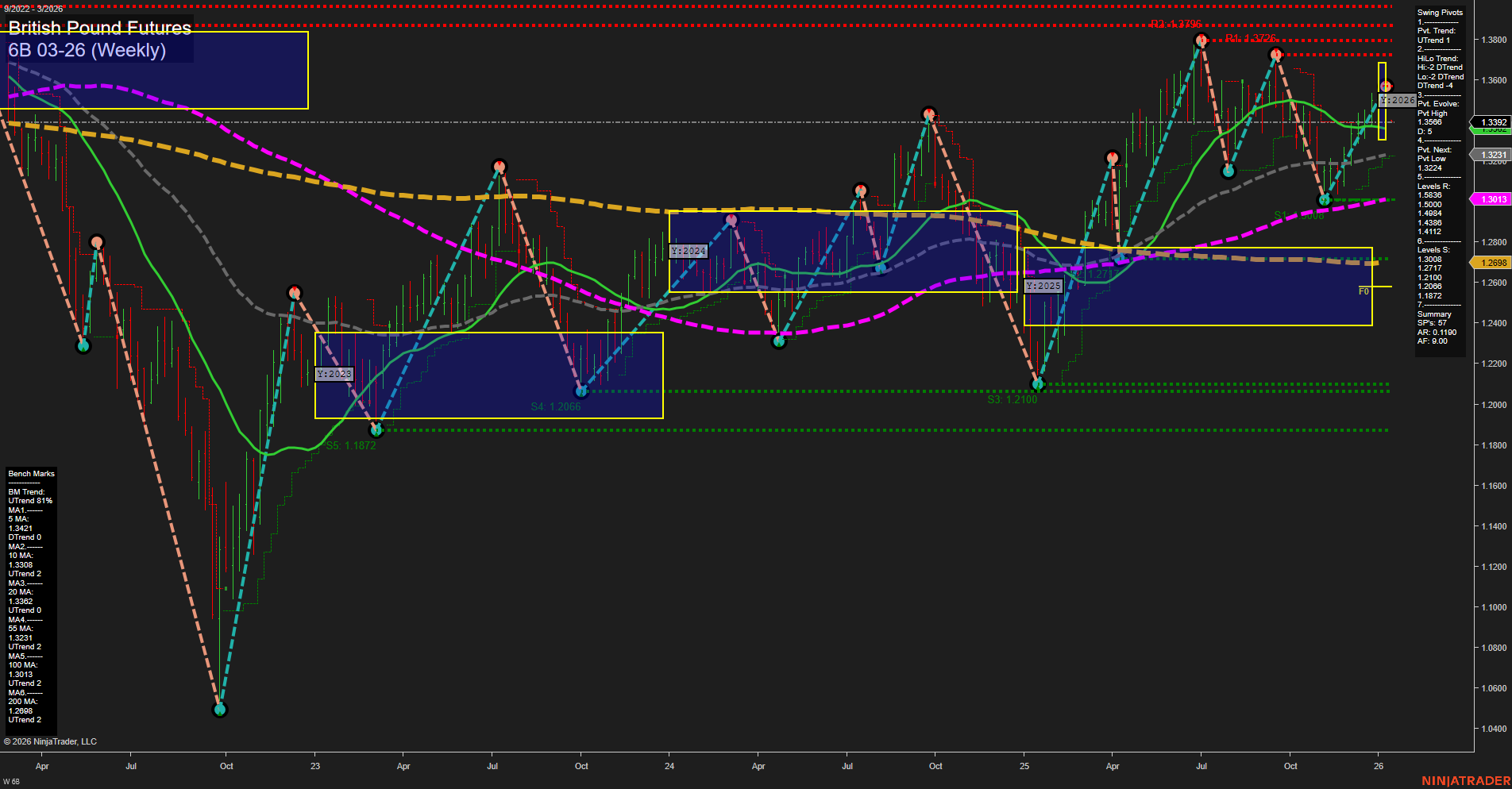

6B British Pound Futures Weekly Chart Analysis: 2026-Jan-11 18:01 CT

Price Action

- Last: 1.3392,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: -53%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: -19%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2026

- Long-Term

- YSFG Current: -5%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt high 1.3725,

- 4. Pvt. Next: Pvt low 1.3221,

- 5. Levels R: 1.3725, 1.3706, 1.3496, 1.3425,

- 6. Levels S: 1.3221, 1.3066, 1.2872, 1.2100.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1.3421 Down Trend,

- (Intermediate-Term) 10 Week: 1.3392 Down Trend,

- (Long-Term) 20 Week: 1.3231 Up Trend,

- (Long-Term) 55 Week: 1.3013 Up Trend,

- (Long-Term) 100 Week: 1.3063 Up Trend,

- (Long-Term) 200 Week: 1.2608 Up Trend.

Recent Trade Signals

- 09 Jan 2026: Short 6B 03-26 @ 1.3427 Signals.USAR-MSFG

- 07 Jan 2026: Short 6B 03-26 @ 1.3489 Signals.USAR.TR120

- 05 Jan 2026: Short 6B 03-26 @ 1.3435 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Neutral.

Key Insights Summary

The British Pound Futures (6B) weekly chart is showing a clear bearish bias in both the short- and intermediate-term outlooks, with price action below all key session fib grid centers (WSFG, MSFG, YSFG) and recent swing pivots confirming a downward trend. The most recent pivots highlight resistance at 1.3725 and 1.3706, with support levels at 1.3221 and 1.3066, suggesting the market is currently testing lower support zones after failing to break above resistance. All recent trade signals are short, aligning with the prevailing downtrend. However, long-term moving averages (20, 55, 100, 200 week) remain in uptrends, indicating that the broader structure is still neutral to slightly positive, but under pressure from the current pullback. The market appears to be in a corrective phase within a larger uptrend, with momentum average and medium-sized bars reflecting a controlled, but persistent, sell-off rather than a panic-driven move. This environment is typical of a market digesting previous gains, with potential for further downside if support levels fail, or a base-building scenario if buyers step in at key long-term averages.

Chart Analysis ATS AI Generated: 2026-01-11 18:01 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.