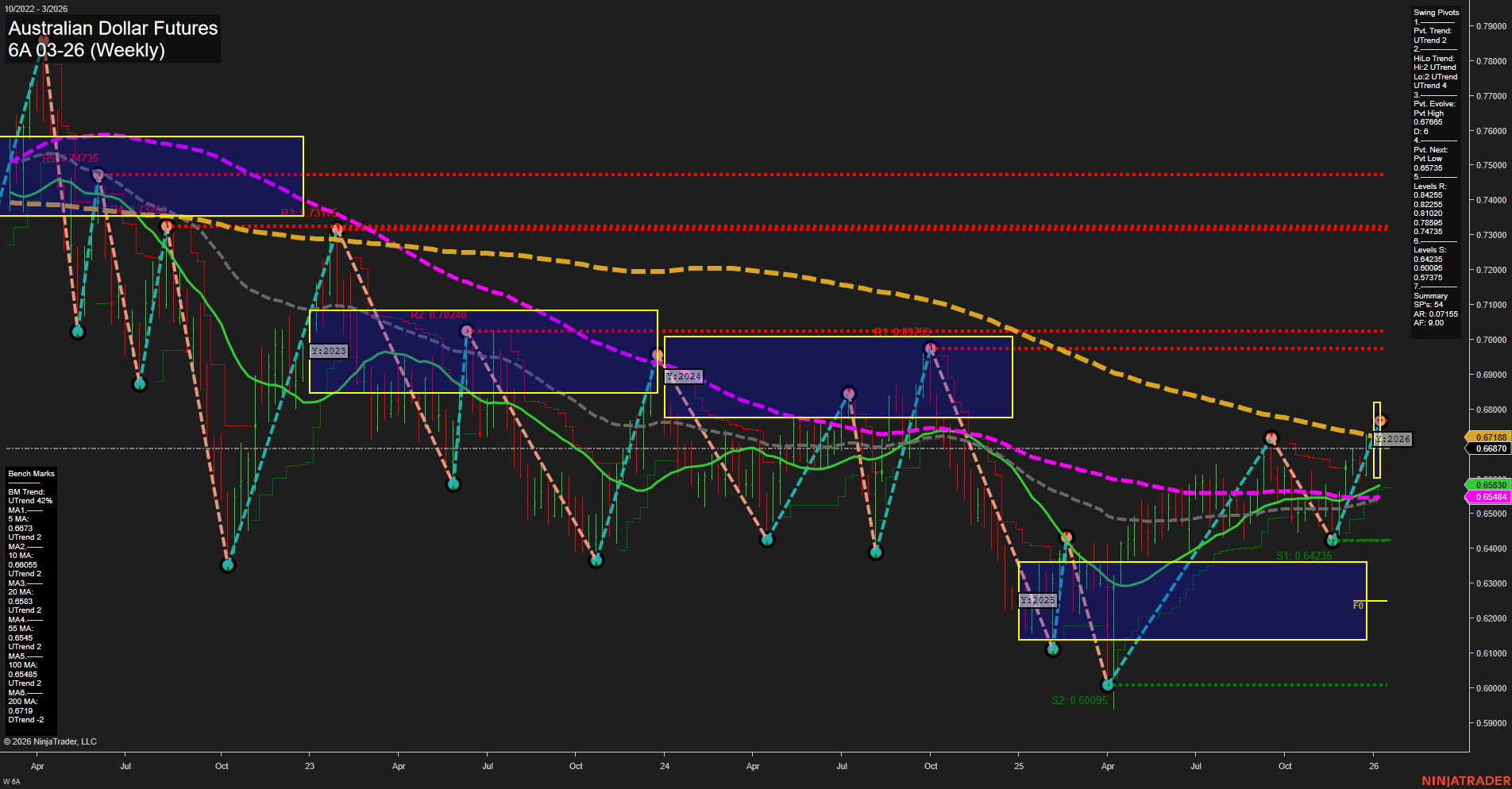

The 6A Australian Dollar Futures weekly chart shows a notable shift in momentum, with price action currently supported by a series of higher swing lows and a recent push to a new swing high at 0.67188. The short- and intermediate-term moving averages (5, 10, 20, and 55 week) are all trending upward, confirming the bullish momentum in these timeframes. However, the longer-term 100 and 200 week moving averages remain in a downtrend, indicating that the broader trend is still neutral and that price is approaching significant resistance zones. Swing pivot analysis highlights a current uptrend in both short- and intermediate-term pivots, with resistance levels clustered near the recent highs and support established at 0.65005 and below. The price is currently testing the upper boundary of the yearly session fib grid, suggesting a potential inflection point. The overall structure suggests a market in recovery mode, with a possible transition from consolidation to a more sustained uptrend if resistance is decisively broken. Volatility appears moderate, and the market is not exhibiting extreme frothiness or choppiness, but rather a steady grind higher. The key to watch will be whether price can maintain above the 0.6700-0.6720 resistance area and convert it into support, which could open the door for further upside in the coming weeks.