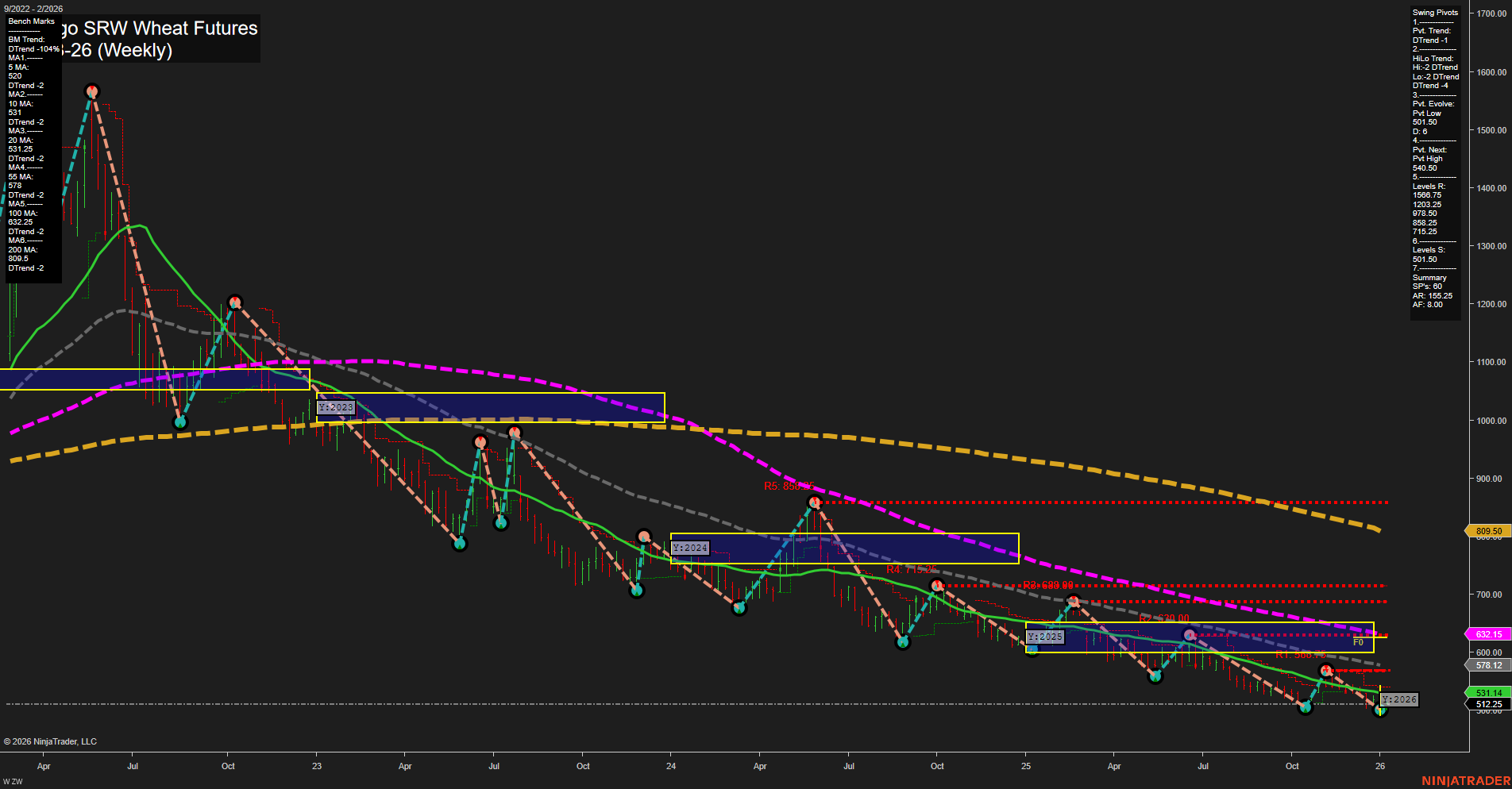

The ZW Chicago SRW Wheat Futures weekly chart shows a market that has been in a persistent long-term downtrend, as evidenced by all major moving averages (20, 55, 100, 200 week) trending lower and price trading below these benchmarks. The yearly session fib grid (YSFG) trend remains down, with price below the yearly NTZ center, reinforcing the bearish long-term structure. However, both the weekly and monthly session fib grids (WSFG, MSFG) are showing short- and intermediate-term uptrends, with price currently above their respective NTZ centers, suggesting a potential for a counter-trend rally or at least a pause in the broader decline. Swing pivot analysis confirms the dominant downtrend, with both short-term and intermediate-term trends marked as down, and the most recent pivot low at 501.50 acting as key support. The next significant resistance is at the pivot high of 540.50, with multiple higher resistance levels far above current price, reflecting the depth of the prior selloff. Recent trade signals show a mix of short and long entries, with the latest signals favoring the long side, indicating some short-term bullish attempts within the context of a larger bearish trend. Overall, the market is in a transitional phase: while the long-term trend remains bearish, there are early signs of short-term stabilization and possible mean reversion. Price action is characterized by medium bars and slow momentum, suggesting a lack of strong conviction in either direction. The market may be entering a consolidation or basing phase, with potential for a technical bounce, but the dominant trend remains down until proven otherwise by a sustained move above key resistance and long-term moving averages.