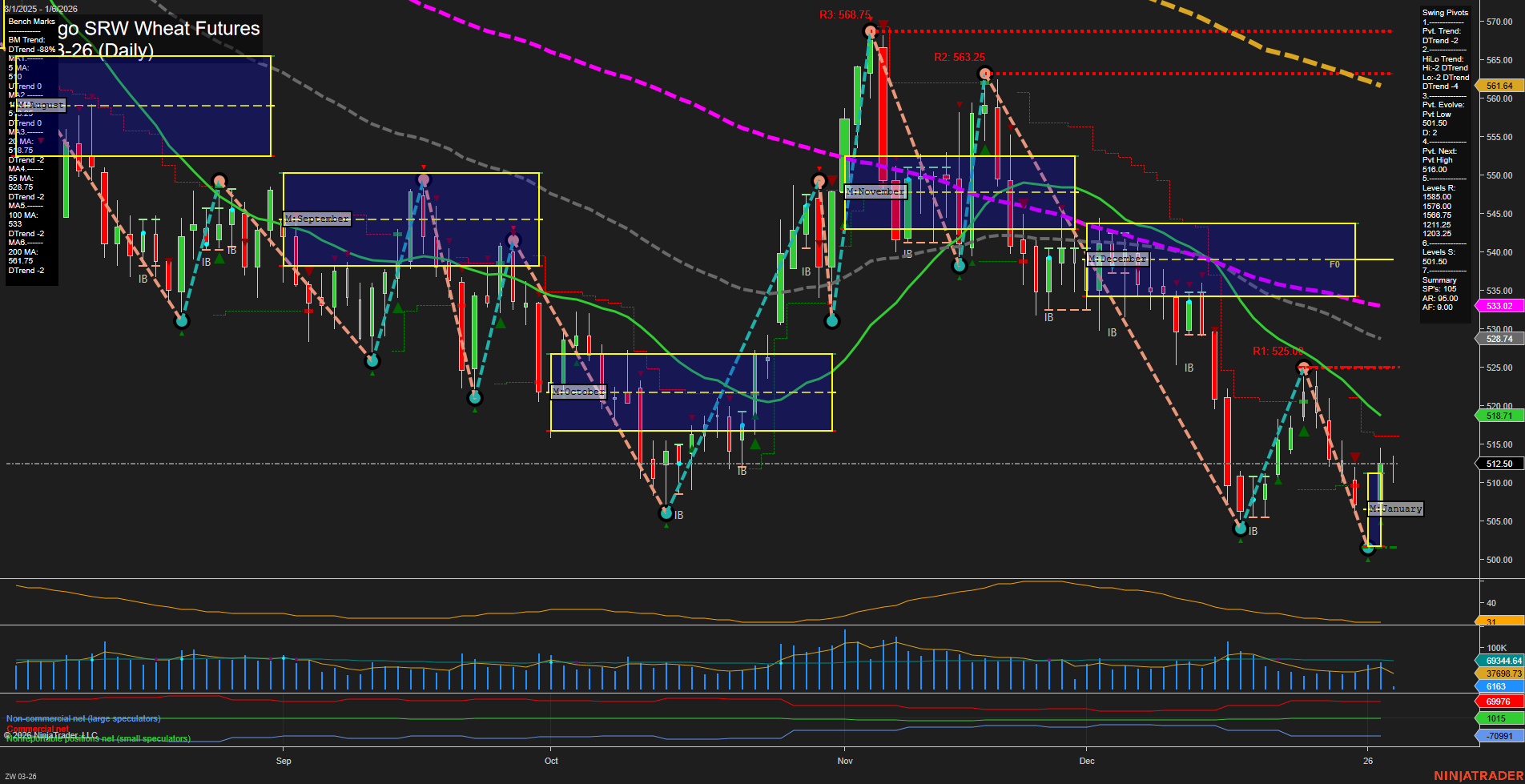

The ZW Chicago SRW Wheat Futures daily chart shows a market in transition. Price action is consolidating near the 512.50 level, with medium-sized bars and slow momentum, indicating a pause after recent volatility. The short-term and intermediate-term Weekly and Monthly Session Fib Grids (WSFG/MSFG) both show price above their respective NTZ/F0% levels and are trending up, suggesting some underlying bullish bias for the near term. However, swing pivot analysis reveals a short-term and intermediate-term downtrend, with the most recent pivot low at 510.00 and resistance at 525.00 and 561.64, highlighting overhead supply. All benchmark moving averages from short to long term are trending down, reinforcing the broader bearish structure, especially as price remains below these key averages. The long-term YSFG trend is down, with price below the yearly NTZ, confirming persistent bearish pressure. Recent trade signals show a mix of long entries at support and a prior short, reflecting the choppy, range-bound nature of the current market. ATR and volume metrics indicate moderate volatility and steady participation. Overall, the market is in a consolidation phase with short-term attempts to rally, but the dominant long-term trend remains bearish. Swing traders should note the potential for short-term bounces within a larger downtrend, with key levels at 510.00 (support) and 525.00 (resistance) likely to define the next directional move.